Banks are one of the best performing groups of stocks during today's Wall Street session. Improved sentiment towards the sector is a result of yesterday's Fed announcement. Federal Reserve published results of stress tests for 23 US banks that showed banks being capable of coping with global recession. To be more precise, results showed that banks combined are able to withstand losses of up to $474 billion. It is not a surprise that US banks managed to clear Fed's stress tests. However, this time it was a bit more important. Why? Fed has imposed limits on US banks in the aftermath of the coronavirus pandemic, barring them from paying out dividends and conducting buyback programmes. As the sector's performance in stress tests showed strong resilience, Fed said that limits on dividend and buybacks can end after June 30. Today's solid performance of the banking sector can be therefore reasoned with investors' anticipation of resuming capital distributions to shareholders.

Wells Fargo (WFC.US) continues to recover from the latest sell-off. Stock trades almost 3% higher today following results of Fed stress tests. Share price approaches the resistance zone ranging between $47 mark and 78.6% retracement of the downward move launched in late-2019. This area is also marked with post-pandemic highs. Source: xStation5

Wells Fargo (WFC.US) continues to recover from the latest sell-off. Stock trades almost 3% higher today following results of Fed stress tests. Share price approaches the resistance zone ranging between $47 mark and 78.6% retracement of the downward move launched in late-2019. This area is also marked with post-pandemic highs. Source: xStation5

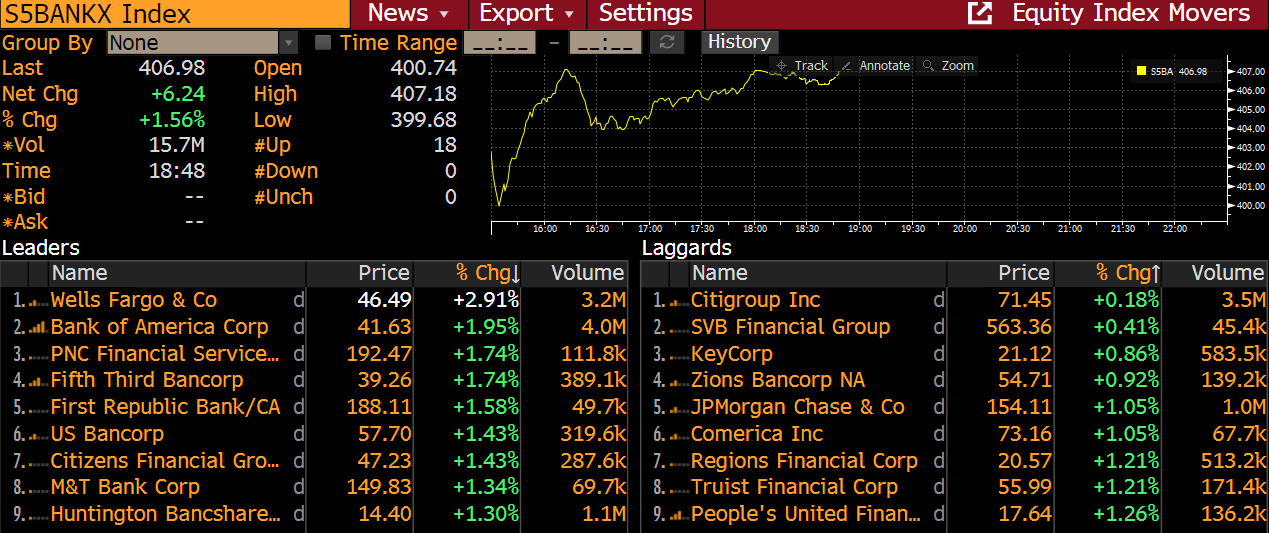

Banking stocks are performing very well today after the Fed signalled an end to temporary limits on dividend payments and buyback schemes. Source: Bloomberg

Banking stocks are performing very well today after the Fed signalled an end to temporary limits on dividend payments and buyback schemes. Source: Bloomberg

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street