At the start of a new week — and the first trading day of September — U.S. index futures remain calm, with moves limited to around ±0.05%. U.S. cash markets will stay closed today for the Labor Day holiday.

Investors are also weighing the impact of a recent U.S. Court of Appeals ruling on Trump-era tariffs. On Friday, the court voted 7–4 that most tariffs imposed by former President Donald Trump were not fully consistent with the law. Experts argue this could weaken the U.S. negotiating position in trade. The decision is suspended until October 14 to allow for further appeals. The case is expected to reach the Supreme Court, but for now, odds favor overturning the bulk of the tariffs while keeping only those targeted at specific sectors. That could potentially bring relief for many companies and improve economic growth prospects.

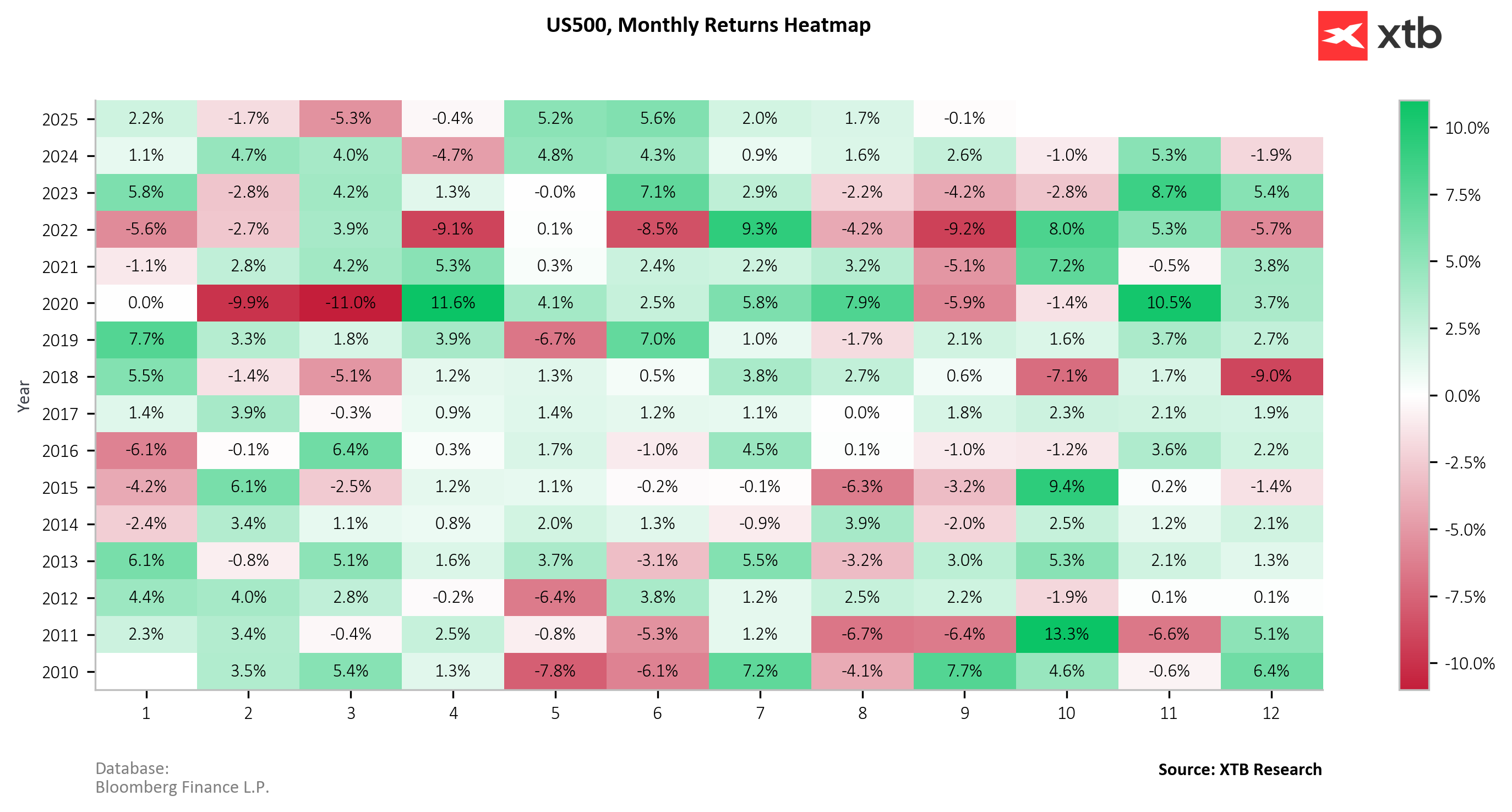

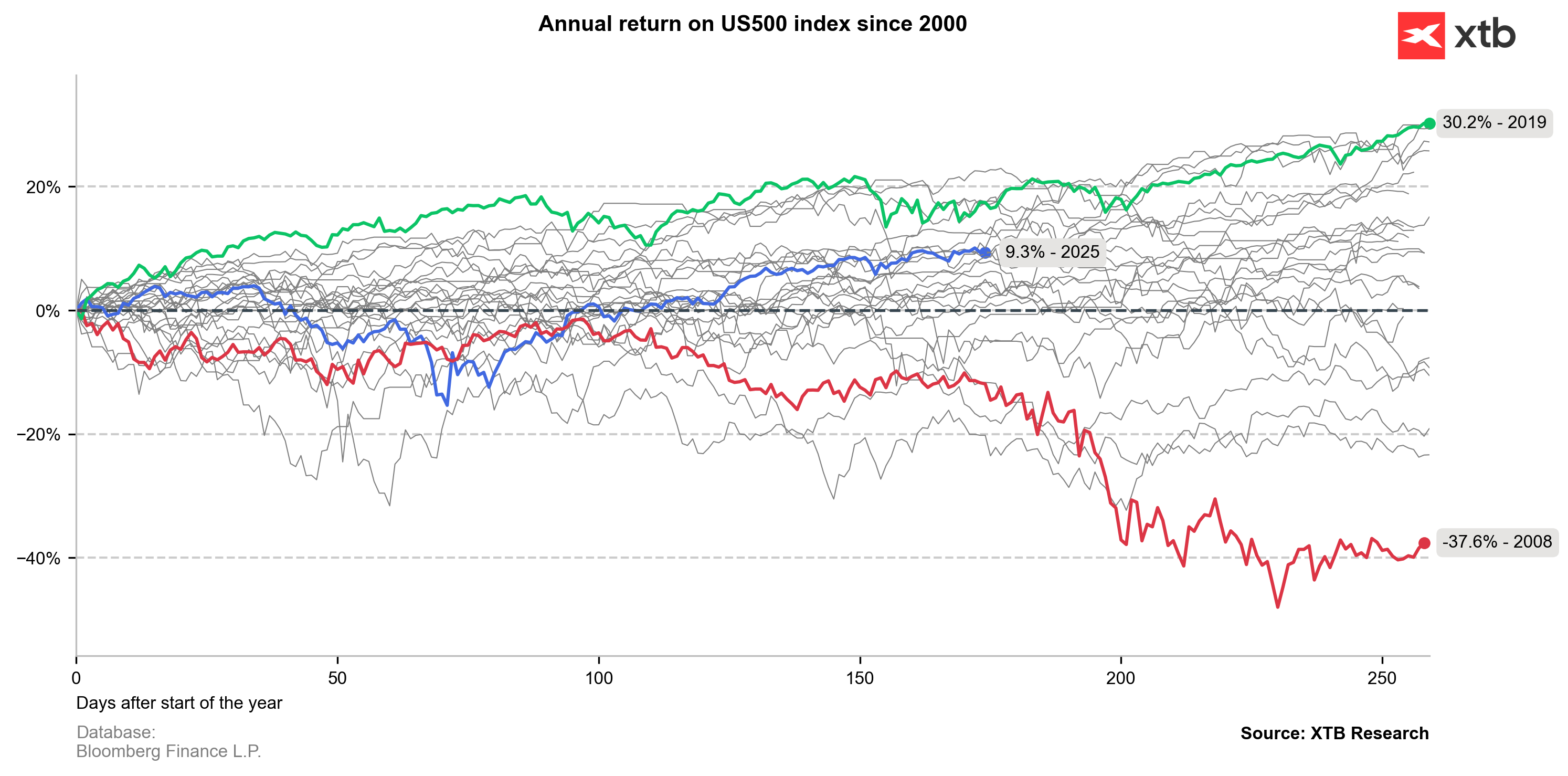

Seasonally, September is often the weakest month for U.S. equities, historically carrying the heaviest selling pressure of the year.

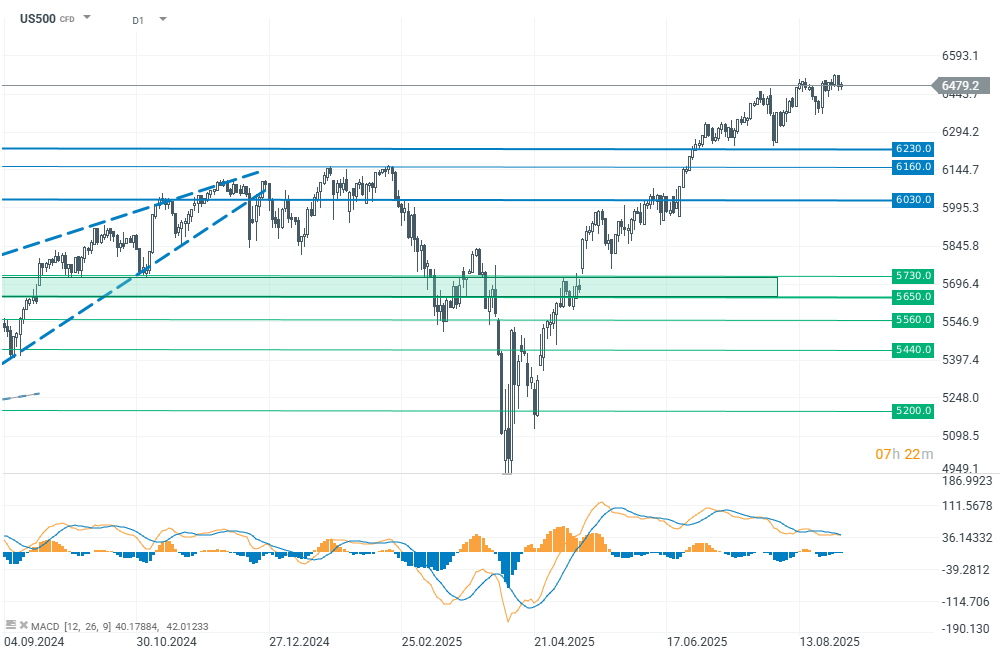

So far, however, the US500 has held up relatively well — gaining 9.3% year-to-date, on top of a strong 2024 performance.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report