- Panic on global markets continues

- Fed moves were not enough to calm investors' nerves

- Fitch downgrades Boeing's (BA.US) rating

Over the weekend FED decided to lower interest rates again by 75 basis points and announced further quantative easing programme to offset the economic impact of the coronavirus outbreak. The decision caused panic in the markets. US futures contracts plunged and hit the lower trading limit. Negative sentiment could also be seen in Asia, where main indexes also suffered significant losses. European indices are also trading in red during today’s session. Dax dropped almost 10%%, CAC 40 went down 10.87%, FTSE 100 is trading 7.58% lower. Today's main event will be the G7 conference scheduled for 2:00 pm GMT. If joint action is agreed between countries, then market sentiment may improve.

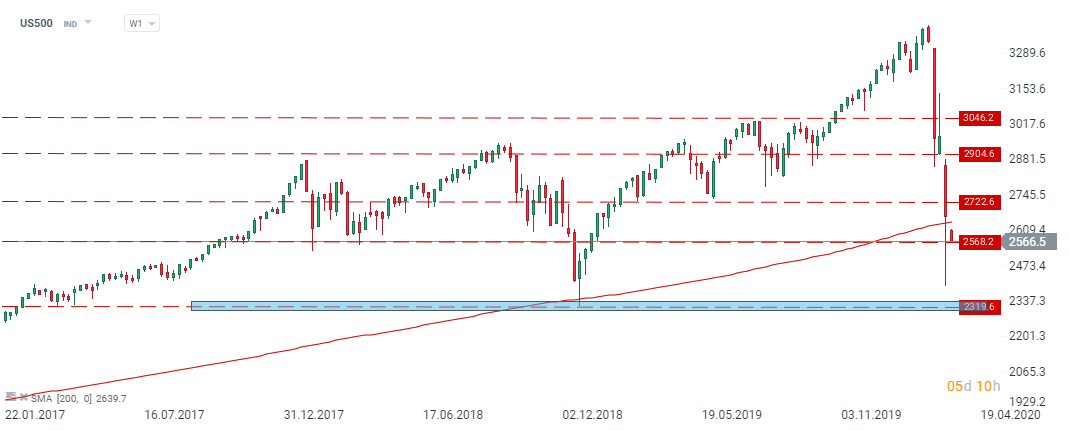

S&P 500 (US500) found some support at 2568.2 pts level which we have previously defined. However, if the outcome of the conference will be disappointing then, this level of support can break very quickly and index could re-test the level of 2319.6 pts. Source: xStation5

S&P 500 (US500) found some support at 2568.2 pts level which we have previously defined. However, if the outcome of the conference will be disappointing then, this level of support can break very quickly and index could re-test the level of 2319.6 pts. Source: xStation5

Lincoln National Corporation (LNC.US) is a holding company, which operates insurance and retirement businesses through subsidiary companies. The Company sells a range of wealth protection, accumulation and retirement income products and solutions, through its business segments. The company’s share price went down almost 5% during pre-market trading.

Lincoln National Corporation (LNC.US) share price is testing key support at $24.78. If negative sentiment remain in the markets, then the price may test next support level located at $13.84. Source: xStation5

Lincoln National Corporation (LNC.US) share price is testing key support at $24.78. If negative sentiment remain in the markets, then the price may test next support level located at $13.84. Source: xStation5

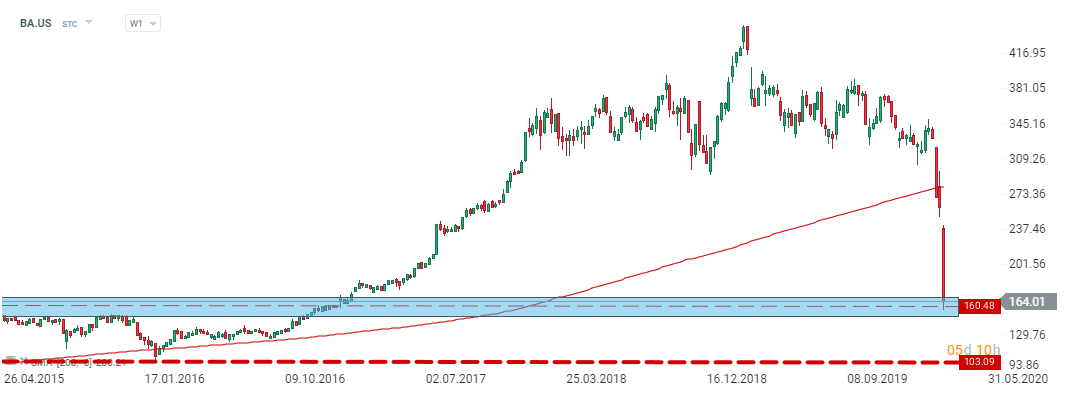

Boeing (BA.US) – shares plunged over 13% after the aircraft producer was placed on “credit watch – negative” by Fitch, reflecting the impact of the coronavirus on the aviation sector.

Boeing (BA.US) – share price sank last week and is currently testing strong support at $160.48. If the price makes a move below this level then it may continue downward move towards next support level at $103.09. Source:xStation5

Boeing (BA.US) – share price sank last week and is currently testing strong support at $160.48. If the price makes a move below this level then it may continue downward move towards next support level at $103.09. Source:xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?