- Wall Street opened higher at the start of a new week

- Charles Schwab posted its quarterly results, surpassing deposit forecasts

- Fed Harker reiterated that the Fed is likely done with rate hikes

US indices edged higher on Monday. This was as US and German leaders undertook a diplomatic effort to prevent the Israel-Hamas conflict from escalating. Wall Street's rise was fueled by improved sentiment and growing hopes that the rate hike cycle might be ending. Additionally, with the onset of the earnings season, several companies have released their results, which have generally been strong. This has bolstered bullish sentiment, as investors perceive the US economy to be more resilient to tighter monetary policy.

Today, a better sentiment on Wall Street clearly prevails. Most companies are gaining, with Charles Schwab and Pfizer leading the increases, gaining 6.20% and 4.30% respectively.

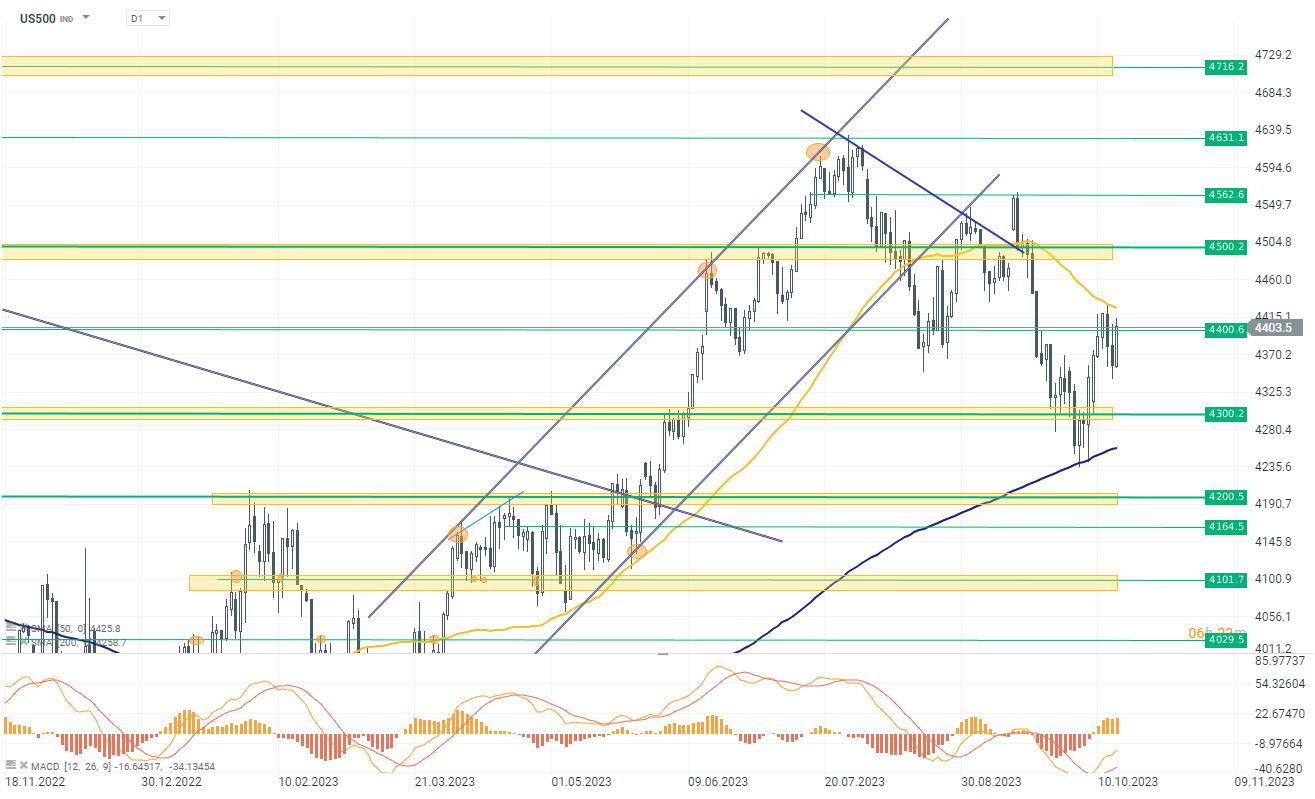

US 500 index

For the US500, the new week opened with a long bullish candle. The index price has returned above the 4400 level, which is currently a tough resistance to overcome. However, if the positive sentiment is maintained, the next level worth watching is 4500 points.

Company News:

-

Apple (AAPL.US) falls after a study from market tracker Counterpoint Research estimated sales of the company’s new iPhone 15 are down 4.5% compared with the iPhone 14 over their first 17 days after release.

-

Pfizer Inc. (PFE.US) slashed its revenue and earnings forecasts for the year after agreeing to take Paxlovid doses back from the US government amid fading demand. Wells Fargo notes that the demand weakness might have been steeper than investors expected.

-

Lululemon (LULU.US) advances over 10% putting the athletic-apparel brand on track for a seventh-straight day of gains, after S&P Dow Jones Indices announced on Friday that the company would replace Activision Blizzard on the S&P 500.

-

Charles Schwab (SCHW.US) is gaining over 10% after the company reported that its issues with clients moving money from the bank to higher-yielding products are lessening, even with elevated interest rates. CFO Peter Crawford noted a deceleration in cash realignment activity during the third quarter. Despite a 28% drop in deposits to $284.4 billion from the previous year, the firm surpassed analysts' average estimate of $268.8 billion. The company's net interest revenue decreased by 24% to $2.2 billion as clients shifted to higher-yielding products. Schwab's net revenues fell 16% to $4.6 billion, slightly missing analysts' expectations, but the firm remains optimistic about benefiting from high rates due to its variable-rate products.

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales