The upcoming week on the financial markets promises to be extremely eventful. Investors around the world are preparing for a series of events that could determine the direction of the stock markets in the coming months. At the center of attention will be the tech giants from the Magnificent 7, whose quarterly results could decide the fate of the tech rally fueled by the artificial intelligence boom.

At the same time, all eyes are on the Federal Reserve meeting. Jerome Powell and his team will make a decision on interest rates, with a press conference on Thursday evening that could set the tone for the entire week. While the market expects rates to remain stable, any comments from Powell regarding inflation or future rate cuts could shake bond yields, the dollar, and equity markets.

Adding to the mix is a political element. President Donald Trump may announce his preferred candidate to succeed Powell this week, further intensifying the atmosphere. Names such as Rick Rieder and Kevin Warsh are reportedly in the running. Any hints in this regard could increase uncertainty, fueling debate about the Fed’s independence and the future direction of monetary policy.

This week brings together two key worlds: the earnings of the largest tech companies and decisions with the highest impact on monetary policy. Positive surprises from tech giants combined with a hawkish Fed signal could strengthen market optimism, while any disappointments or political uncertainty could trigger sharp volatility. For investors, the coming days will be a real test of nerves, and the unfolding events could set the tone for the start of the year.

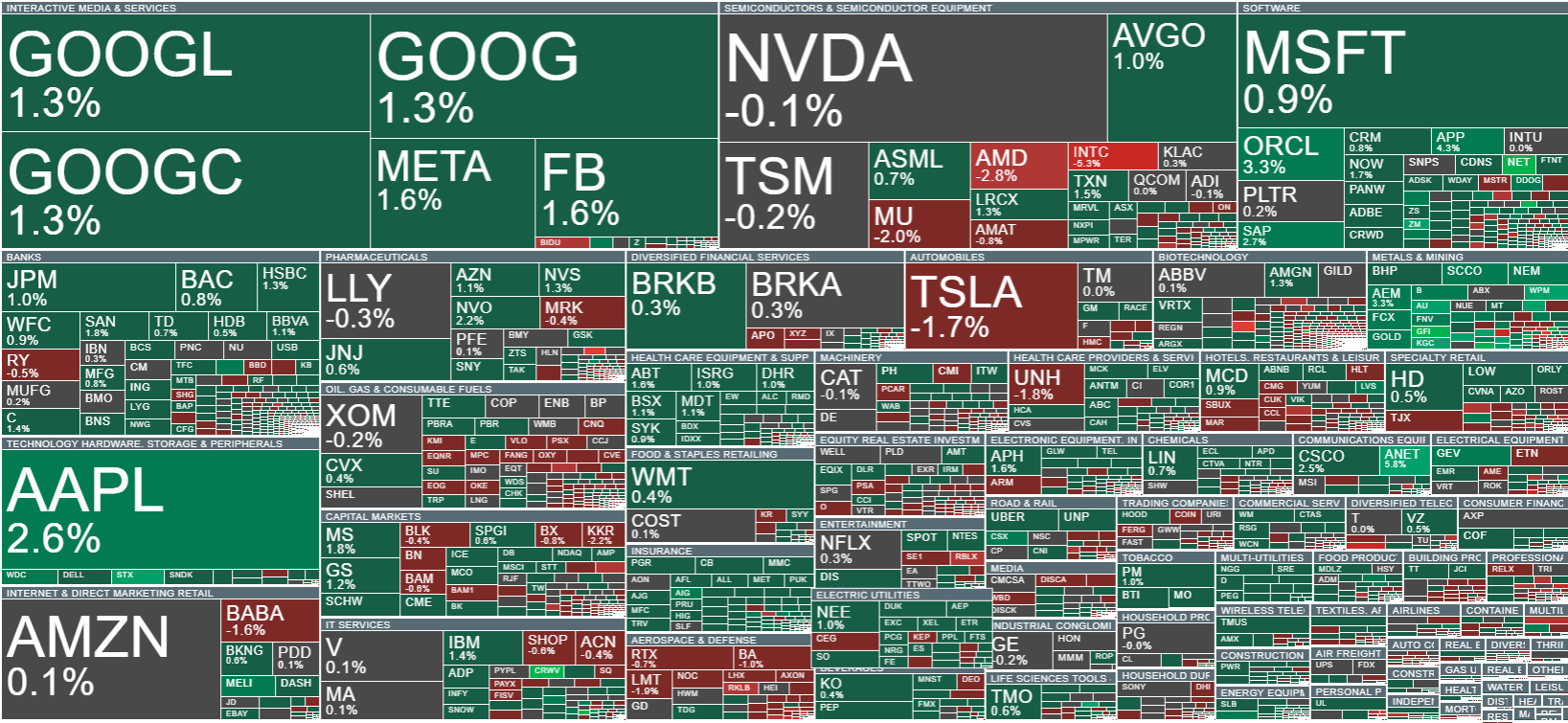

Source: xStation5

US500 (S&P 500) futures are rising during today’s session, driven mainly by optimism ahead of the quarterly reports from the Magnificent 7. The exponential moving averages are forming a classic bullish pattern, further supporting positive market sentiment.

Source: xStation5

Company News:

-

CoreWeave (CRWV.US) announced that Nvidia will invest $2 billion to accelerate the development of AI infrastructure. With Nvidia’s support, CoreWeave plans to build over 5 GW of computing capacity in its data centers by 2030.

-

USA Rare Earth (USAR.US) confirmed that the U.S. government will take an equity stake in the company, providing approximately $1.6 billion in funding under the critical rare earth metals support program. In exchange, the government will receive shares and stock options, giving it a significant stake in the company. Following the announcement, USA Rare Earth shares surged.

-

Revolution Medicines (RVMD.US) shares fell by about 20% after reports that Merck (MRK) is no longer in acquisition talks with the company.

-

AppLovin (APP.US) shares rose 5% after receiving a “Buy” recommendation, reflecting investor optimism about the company’s prospects in the mobile app and advertising sector.

Morning Wrap - Oil price is still elevated (07.03.2026)

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

Stock of the Week: Broadcom Driven by AI Sets Records