-

Wall Street set to open significantly lower

-

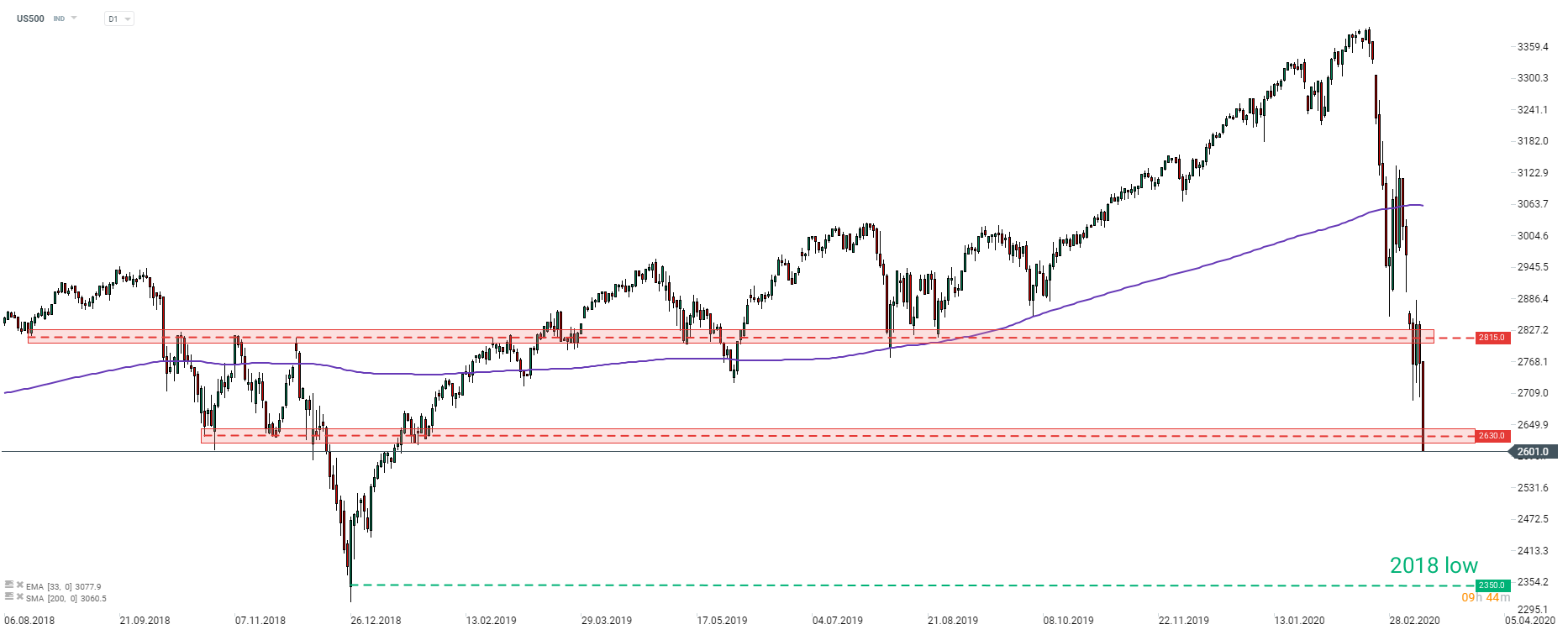

US500 tests 2,600 pts

-

Uber and Lyft trade lower on weaker demand

Markets remain nervous after Donald Trump banned European from travelling to the United States. Travel sector is taking the biggest hit in premarket trade. On the other hand, Mallinckrodt (MKN.US) surges on Covid-19 drug hopes.

S&P 500 (US500) is trading over 20% lower against its all-time high, meaning that the index is now in bear market territory. Futures hit lower trading limit in premarket trade, what prevented more losses. However, traders should be aware that some additional pressure is likely to surface at the cash session open (1:30 pm GMT). Unless an action is taken, the index may continue to freefall with 2018 low (2350 pts area) being the nearest major support. Source: xStation5

S&P 500 (US500) is trading over 20% lower against its all-time high, meaning that the index is now in bear market territory. Futures hit lower trading limit in premarket trade, what prevented more losses. However, traders should be aware that some additional pressure is likely to surface at the cash session open (1:30 pm GMT). Unless an action is taken, the index may continue to freefall with 2018 low (2350 pts area) being the nearest major support. Source: xStation5

Donald Trump’s decision to ban Europeans from travelling to the United States sent a shockwave across European markets. What should not come as a surprise is the fact that airlines were among the worst impacted companies. Also one should not expect situations to look different in the United States. Airlines and travel agencies are companies suffering the biggest premarket drops. Alaska Air Group (ALK.US), American Airlines Group (AAL.US), Delta Air Lines (DAL.US), United Airlines Holdings (UAL.US) and Southwest Airlines (LUV.US) are US airlines to watch today.

Southwest Airlines (LUV.US) broke below the upward trendline earlier this month. The stock tested $42 support zone yesterday but is likely to smash through it today. In such a scenario, the next major support can be found at $36 or 15% below yesterday’s close. Source: xStation5

Southwest Airlines (LUV.US) broke below the upward trendline earlier this month. The stock tested $42 support zone yesterday but is likely to smash through it today. In such a scenario, the next major support can be found at $36 or 15% below yesterday’s close. Source: xStation5

Mallinckrodt (MKN.US), the pharmaceutical company, is evaluating whether nitric oxide has a potential to help fighting lung issues that arise in Covid-19 patients. The company has held early talks with FDA on the matter. Share price rises over 10% in premarket trades

Ride-hailing companies Lyft (LYFT.US) and Uber Technologies (UBER.US) are trading significantly lower in premarket. Both companies suffer lower travel volumes due to coronavirus scare. Drop in demand may crush hopes of any bigger improvement in business and companies may once again fail to show profit in 2020.

Uber (UBER.US) pulled back to the support zone at $26 yesterday and threatened to break to the lowest level on the record. Bulls managed to push the stock off the daily lows yesterday but taking into account premarket’s decline, Uber is likely to open at an all-time low. As long as the coronavirus spreads, the company may remain under pressure. Source: xStation5

Uber (UBER.US) pulled back to the support zone at $26 yesterday and threatened to break to the lowest level on the record. Bulls managed to push the stock off the daily lows yesterday but taking into account premarket’s decline, Uber is likely to open at an all-time low. As long as the coronavirus spreads, the company may remain under pressure. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street