- US stocks opened higher

- S&P500 and Dow Jones both hit new records

- Ford (F.US) plans to nearly double production of its electric pickup

US indices launched today's session higher, with both the Dow Jones and the S&P 500 extending record highs as optimism on global economic recovery overshadowed the rising number of COVID-19 cases. Later in the session, investors will focus on December’s ISM manufacturing PMI and November’s Job Openings and Labor Turnover Survey.

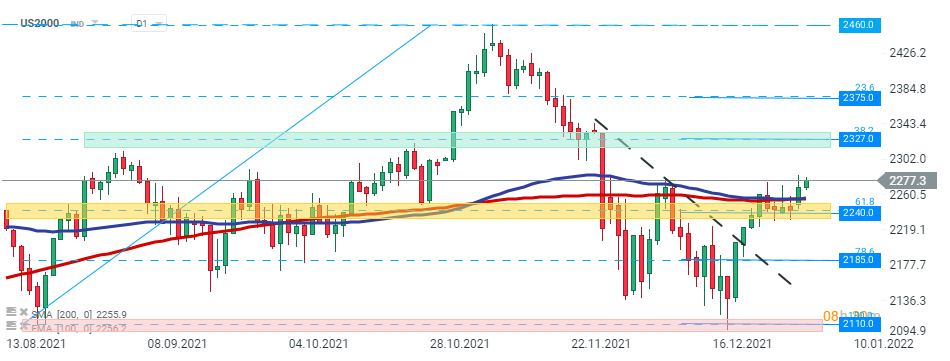

US2000 - despite several attempts sellers failed to break below major support at 2240 pts which is strengthened by 61.8% Fibonacci retracement of the upward wave launched in August 2021 and index jumped above the 200 SMA (red line ) and 100 EMA (purple line). Next target for bulls is located at 2327 pts. On the other hand, if sellers regain control and manage to break below the aforementioned support, downward move may accelerate towards 2185 pts level. Source: xStation5

US2000 - despite several attempts sellers failed to break below major support at 2240 pts which is strengthened by 61.8% Fibonacci retracement of the upward wave launched in August 2021 and index jumped above the 200 SMA (red line ) and 100 EMA (purple line). Next target for bulls is located at 2327 pts. On the other hand, if sellers regain control and manage to break below the aforementioned support, downward move may accelerate towards 2185 pts level. Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appCompany news:

Ford (F.US) stock rose over 1.0% higher in premarket after the car producer announced plans to nearly double the output of its all-electric pickup F-150 Lightning. The company is aiming to produce 150,000 units of the vehicle every year at its Dearborn factory in Michigan due to increasing customer demand.

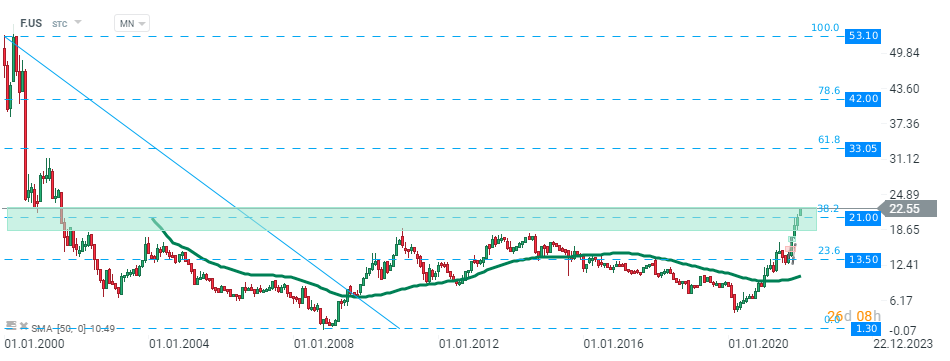

Ford (F.US) stock price rose sharply in recent months and managed to break above the major resistance zone around $21.00 which coincides with 38.2% Fibonacci retracement of the large downward move from 2001. At the moment price is trading at its highest level since August 2001, however if current sentiment prevails, upward move may accelerate towards resistance at $33.05. Source: xStation5

Ford (F.US) stock price rose sharply in recent months and managed to break above the major resistance zone around $21.00 which coincides with 38.2% Fibonacci retracement of the large downward move from 2001. At the moment price is trading at its highest level since August 2001, however if current sentiment prevails, upward move may accelerate towards resistance at $33.05. Source: xStation5

Under Armour (UAA.US) stock jumped more than 2.0% in premarket after Baird upgraded the athletic apparel maker stock to “outperform” from “neutral” as it should benefit from a cyclical recovery in earnings.

Coca-Cola (KO.US) stock added 1% in the premarket after Guggenheim upgraded the beverage behemoth’s stock to “buy” from “neutral,” due to several factors including strong emerging market performance and a faster-than-expected recovery in on-premises sales.

Apple (AAPL.US) stock rose slightly in premarket 0.4% after becoming the first US company to briefly exceed $3 trillion market cap, reaching that milestone on Monday. Apple needed over one year to climb from $2 trillion.

Warner Music (WMG.US) stock plunged over 4.0% after the entertainment conglomerate announced an 8.6 million share sale by affiliates of stakeholder Access Industries.

Tesla (TSLA.US) stock rose 0.3% in premarket following yesterday's strong fourth-quarter deliveries number despite controversy over the opening of a showroom in the Chinese region of Xinjiang.