- Indices maintain lower volatility in anticipation of tomorrow's CPI report

- Etsy (ETSY.US) loses after a recommendation from Goldman Sachs

- Smart Global (SGH.US) gains after quarterly results

Today, we do not observe greater volatility in the markets, except for the cryptocurrency market. The dollar is slightly strengthening, but it has still been in a narrow consolidation channel for several days. Meanwhile, the indices on Wall Street are traded around the levels of yesterday's session closing. Due to the small number of macroeconomic publications today, the markets are more focused on tomorrow's CPI report for the USA. Inflation data is currently the most influential report that can both change the trend in the markets and expectations regarding the Fed's interest rate cut path. However, for this to happen, data significantly deviating from market expectations will be necessary. Considering the current picture, the chances of a big surprise are rather small.

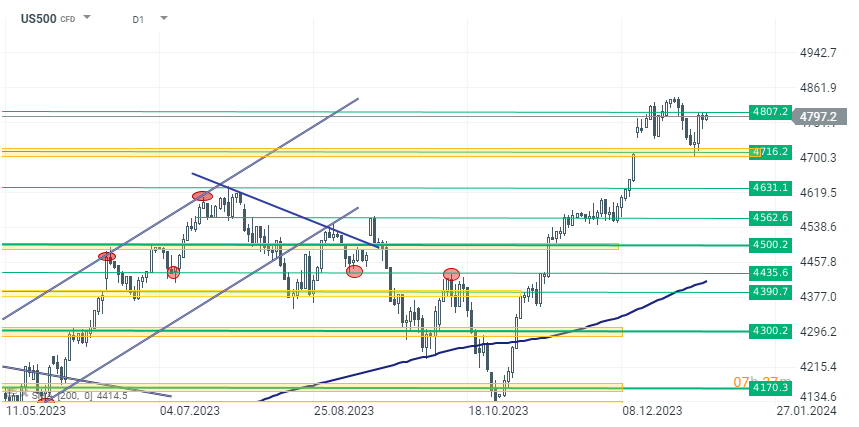

US500 gains 0.15% today and is heading back towards the 4800 point area. The index gains after a model test of the support levels at 4700 points three sessions ago. The 4700 point level was a key consolidation zone around the peaks at the end of 2021. Volatility on the index will likely be limited, and the price will fluctuate between the range of 4720-4830 until the publication of the CPI report tomorrow. Only the report can decide the direction in the coming weeks.

Source: xStation 5

Company news

Etsy (ETSY.US) declined over 1.5% following a downgrade by Goldman Sachs analysts from "buy" to "neutral." This downgrade was based on their assessment that Wall Street's forecasts already reflect Etsy's future growth potential. The downgrade coincides with Etsy's recent announcement of an 11% reduction in its workforce and a leadership reshuffle, including the departure of its Chief Marketing Officer, Ryan Scott. This restructuring is expected to affect about 225 employees and result in $25-$30 million in charges. Etsy anticipates that these changes, which should be mostly completed by the end of the first quarter of 2024.

SMART Global Holdings (SGH.US) reported its first quarter fiscal 2024 results, revealing a significant 30% drop in net sales to $274.2 million, largely due to strategic changes including the divestiture of its SMART Brazil operations. Despite the sales decline, the company achieved record gross margins, with GAAP gross margin at 30.2% and Non-GAAP gross margin at 33.3%, reflecting a strategic shift towards high-value enterprise solutions. The company's financial position remains strong with $553 million in cash and short-term investments, supporting ongoing investments in AI, advanced memory technologies, and the CreeLED portfolio.

Intuitive Surgical (ISRG.US) gains up to 7.0% following the announcement of its preliminary fourth-quarter results, which exceeded analysts' expectations. The company, known for its robotic products, anticipates a revenue of $1.93 billion for the quarter ending December 31, surpassing the consensus estimate of $1.87 billion. This increase is largely attributed to a more than 20% surge in revenue from its key instruments and accessories division, primarily due to higher pricing and robust procedure volumes of its da Vinci surgical robot. The full fourth-quarter earnings report is scheduled for January 23.

Source: xStation 5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report