- Apple CEO buys Nike shares

- US sanctions EU officials

- Donald Trump comments on his FED president choices

- Intel suffers setbacks with Nvidia

- Another probe into Tesla

- Apple CEO buys Nike shares

- US sanctions EU officials

- Donald Trump comments on his FED president choices

- Intel suffers setbacks with Nvidia

- Another probe into Tesla

The American session begins trading with limited volatility following the ongoing holiday season. Noticeable decline can be observed on Russel2000, US2000 slips by 0,2%. Trading on Wall Street will be shortened today to 1:00 PM local time.

Despite the ongoing holidays, there have been several significant market-related political developments:

- One of the advisors to the US Treasury Secretary, Joe Lavorgna, stated in an interview that "the FED should lower interest rates even if the economy is growing." This narrative was confirmed by the President himself, who wrote on his social media that "he wants his FED chairman to lower interest rates" and that "no one who doesn't want to do this will become the FED chairman."

- The USA has taken an unprecedented step by imposing visa sanctions on 5 European officials involved in designing legislation regulating the digital services market. This is a response to a series of fines imposed in recent quarters on American companies for monopolistic practices, anti-consumer behaviour, and illegal processing of user data. The American side, despite exhaustive explanations from the European Commission, maintains that the fines are political in nature and have signs of censorship.

- At the same time, the US administration announces another delay in tariffs on Chinese chips and semiconductors until July 2027.

Macroeconomic Data:

The Department of Labor published data on unemployment benefit claims, which turned out to be better than expected on a weekly basis, with a decrease to 214,000. However, concerns may arise from a significant increase in repeat claims (1,92 million).

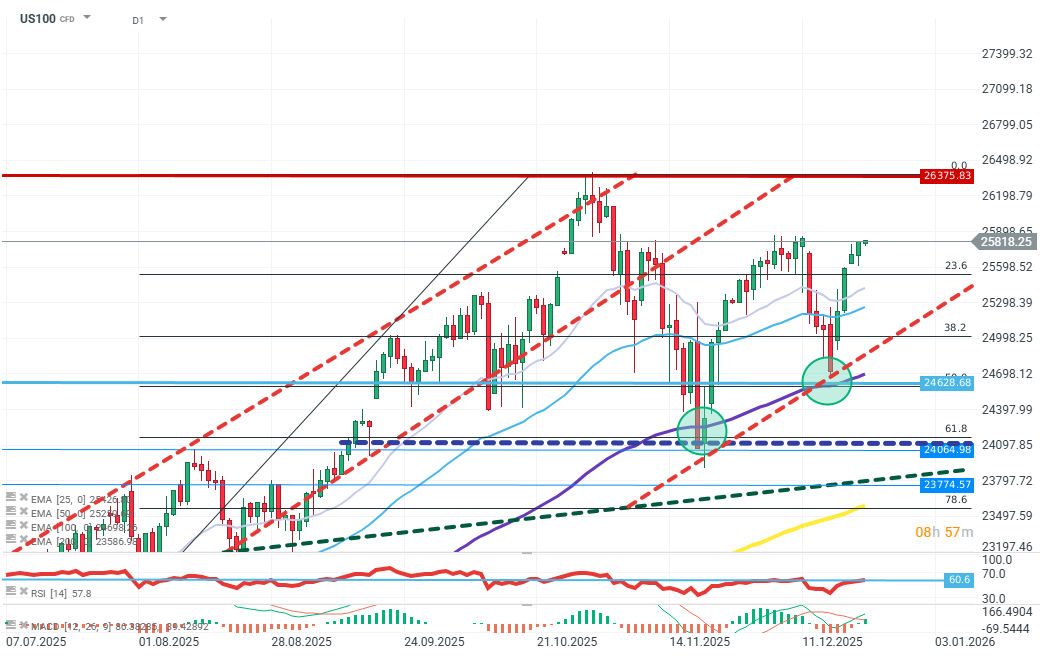

US100 (D1)

Source: xStation5

Buyers managed to defend the FIBO 50 level, where the support zone was further strengthened by the EMA100 average. Currently, the price is in another resistance zone at the height of local peaks. The momentum of the EMA averages indicates a continuation of the upward trend, and the MACD also signals growth as the average has moved above the signal line. At the same time, RSI(14) is starting to reach elevated levels, and another failed attempt to reach the last maximum may signal weakness among buyers. Currently, the demand target is to test the last ATH, while the supply must break the price out of the upward trend channel and bring the price down to the FIBO 38.2 level, which will open the way for further correction.

Company News:

- Nike (NKE.US) - The clothing company is up over 2% after revealing that Apple's CEO purchased shares worth $2.95 million.

- Dynavax (DVAX.US) - The vaccine research and production company has been acquired by French Sanofi. The company was purchased at a price of $15.5 per share, which represents a significant premium over the market valuation.

- UiPath (PATH.US) - The company's shares are up over 8% after joining the S&P500 index.

- Intel (INTC.US) - The chip manufacturer is down about 3% due to information about failed production process tests of 18A by Nvidia.

- Tesla (TSLA.US) - The "Defect Investigation Office" has launched an investigation into the door locking mechanism in the Tesla Model 3. The investigation will cover 179,071 vehicles from the year 2022. The regulator suspects that the mechanism is not easily accessible, posing a threat to individuals in the vehicle.

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

US OPEN: War in Iran hits the markets