- U.S. markets open slightly in the red

- Dollar relatively strong at the beginning of the session

- Yields on 10-year U.S. bonds gain to 4.27%

The end of this week looks tense. Markets are witnessing a slight return to safe assets, with both the dollar (USD) and yields on 10-year U.S. bonds gaining significantly. Next week is scheduled for the Fed's interest rate decision and Chairman Jerome Powell's conference. Although leaving interest rates at their current level is almost certain, markets will closely watch Powell's statements regarding the next cuts. In the past few weeks, markets were dominated by euphoria, with capital flowing into risky assets like stocks and Bitcoin. Today's strong dollar might be a precursor to an impending correction in the stock markets, which have been moving in an upward trend almost nonstop since the beginning of this year.

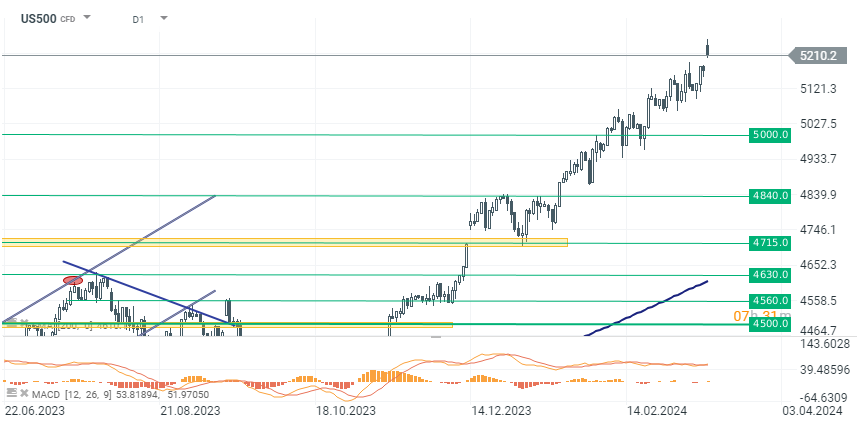

US500

Today we observe much higher levels in contracts, due to the rollover that took place between yesterday and today. Nonetheless, the scale of increases in the indices in recent weeks has been large, and there hasn't been any significant correction along the way. At the time of publication in the U.S. market, we are witnessing slight declines and a strong rise in the dollar's value, which could be a sign of the first breathlessness in a long time. In such a scenario, the next support level to watch is 5000 points.

Source: xStation 5

Company News

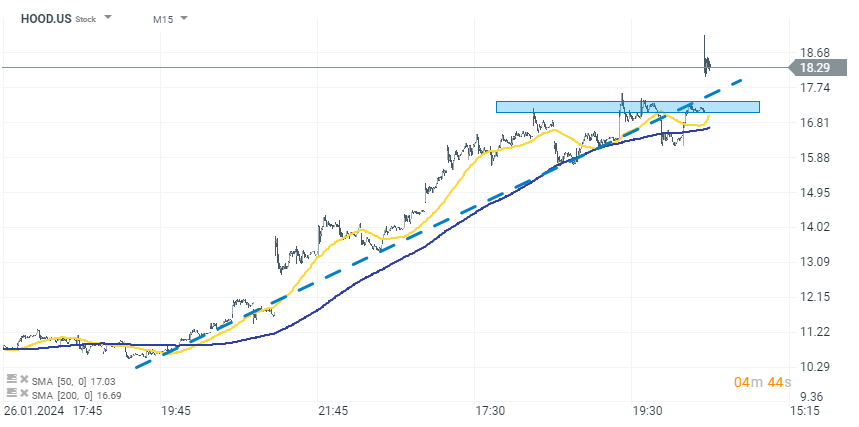

Robinhood's (HOOD.US) stock soared over 7.40% after the release of its impressive February performance data, which showed significant increases in assets under custody, trading volumes, and daily average revenue trades (DARTs) across equities, options, and crypto. The strong user engagement and platform growth are reflected in these figures.

Source: xStation 5

Dollar General (DG.US) saw a 6% rise in shares after announcing Q4 results that surpassed expectations. The company forecasts sales growth and diluted EPS for FY2024 within market estimates, but anticipates a lower-than-expected diluted EPS for Q1.

Conversely, Fisker (FSR.US) experienced a drastic 4.5% drop in shares amid reports of possible bankruptcy, primarily due to issues with its Ocean SUV and financial struggles.

FUTU Holdings (FUTU.US) also saw an 11% decline following lower-than-expected Q4 earnings and a year-over-year decrease in trading volume and daily average revenue trades (DARTs).

Hello Group (MOMO.US) shares fell by around 21% after mixed Q4 earnings, with a notable decline in active and paying users on its Tantan and Momo apps. The company expects a decrease in total net revenues for 1Q24.

MicroStrategy's (MSTR.US) stock dipped over 1.8% following its plan to raise $500M for bitcoin acquisition and general corporate use.

Under Armour (UA.US) experienced an 11.5% drop after announcing Kevin Plank's return as CEO and changes in leadership, leading to downgrades in ratings and price targets from market analysts due to strategy concerns.

Super Micro Computer: the quiet winner of the current earnings season?

Morning wrap (05.02.2026)

Alphabet Results: Record Revenues and Investments Showcase the Company’s Dominance!

Daily summary: Nasdaq hits nearly two-month low, USD gains momentum, crypto deep in red (04.02.2026)