- Wall Street open lower

- The dollar is the strongest currency in the market

- Yields on 10-year bonds are rising again

- Virgin Galactic (SPCE.US) loses after comments from CEO, Branson

This week on Wall Street, a worse sentiment has returned despite a great start to the last month of the year last Friday. Today seems to be the beginning of a correction after recent dynamic increases. We observe a clearly gaining dollar, as well as falling bond prices. Yields today gain 100 basis points. However, they still remain at a relatively low level of around 4.27%.

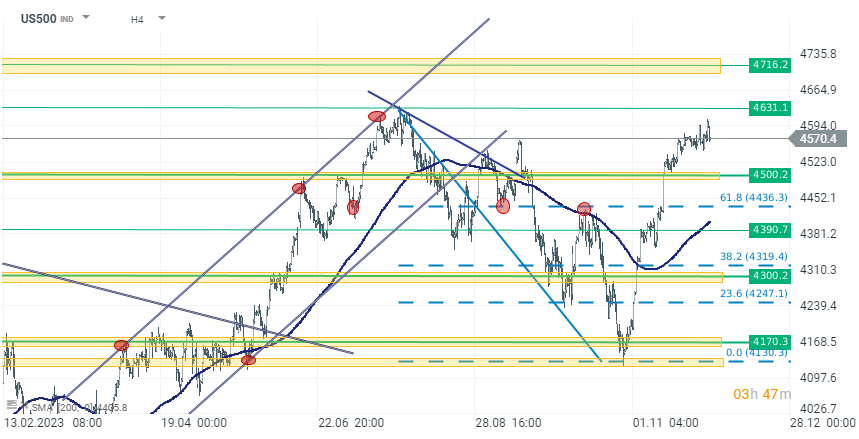

US500

The US500 index is losing 0.60% today. Despite these drops, the price remains high, above the lower support level of 4500 points. In case of continued selling pressure, this level will be the first range for the downward movement. However, it is not excluded that the bulls will manage to pull out of the current drops and again fight to test this year's peak of 4630 points.

Source: xStation 5

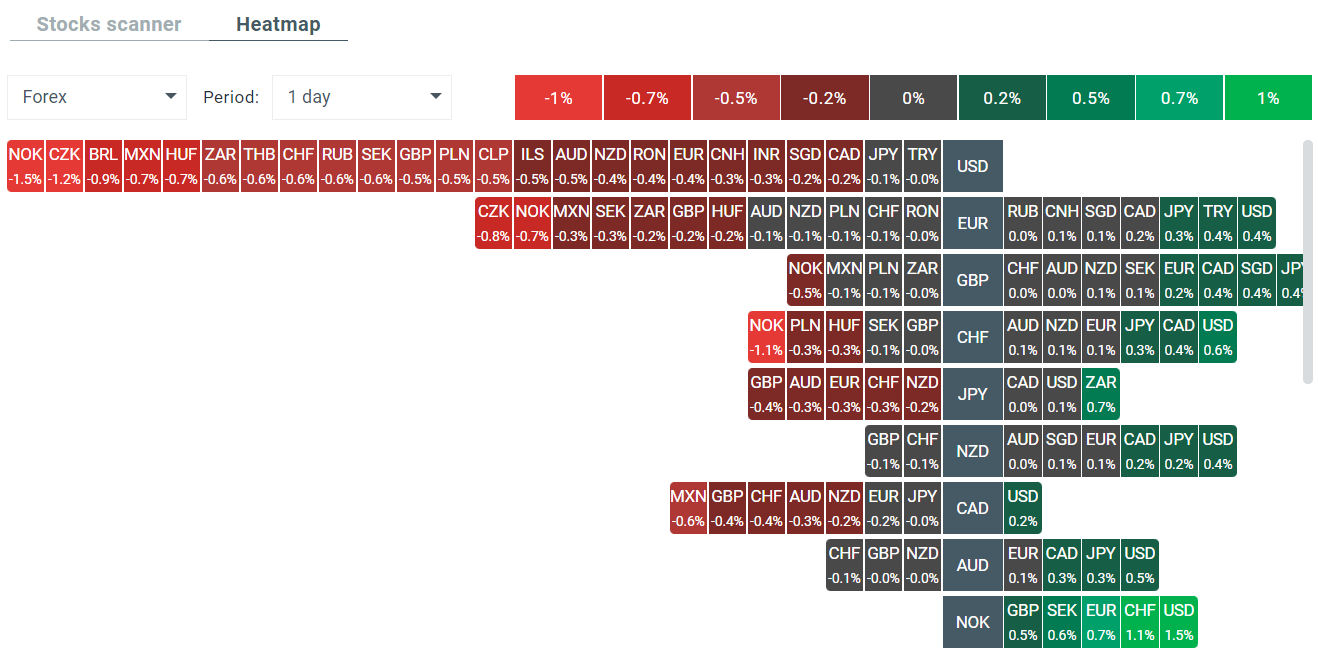

Dollar

Today's declines in the indexes are driven by the rising dollar, which at the time of publication is the strongest currency. The price on the EURUSD rate also loses after an attempt to permanently break through the 1.10 level last week.

Source: xStation 5

Company News

Carvana (CVNA.US) jumps over 14.0% after JPMorgan upgraded the online used-car dealer to neutral from underweight. The broker said the upgrade reflects improvements in “productivity, costs, and culture.”.

Virgin Galactic (SPCE.US) shares plummet by 11.60% after the company CEO, Sir Richard Branson has decided against further investing in his loss-making space travel company, Virgin Galactic, citing limited financial resources post-Covid. Despite its efforts, including job cuts and suspending commercial flights for 18 months to save cash for a new, larger spacecraft, the company faces financial challenges. Virgin Galactic, established in 2004, anticipates its new Delta vehicle to be operational by 2026 and claims to have sufficient funds until then. However, analysts speculate a possible request for additional investor funding around 2025. Branson remains passionate about the project, which has completed six commercial flights in six months, with ticket prices starting at $450,000.

Source: xStation 5

Alaska Air Group (ALK.US) dips by almost 17% after the company has announced its acquisition of Hawaiian Holdings (HA.US), the parent company of Hawaiian Airlines, for $1.9 billion, including assumed debt. Following this announcement, Hawaiian Holdings shares gain over 180%. Alaska Air is set to purchase shares at $18 each, a substantial 270% premium over HA's closing price of $4.86 on Friday. HA's stock nearly tripled on Monday morning, despite having dropped 52.6% in 2023 and reaching a 12-year low in October. Alaska Air anticipates $235 million in conservative run-rate synergies from the deal. The acquisition is expected to yield high-single-digit earnings growth within the first two years and increase to high teens thereafter. This deal is part of a broader trend of industry consolidation, similar to JetBlue Airways' (JBLU.US) agreement to purchase Spirit Airlines (SAVE.US).

Source: xStation 5

Stock of the Week: Broadcom Driven by AI Sets Records

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Economic calendar: Central banks vs global risks to inflation (05.03.2026)