- Indices gain after market opens

- The US Dollar dips after ISM data

- Yields on 10-year US Treasury bonds rise to 4.27%

The final day of the week is set to continue the positive mood seen throughout the week. Contracts on major US indices are gaining after the cash session opening. The US500 is up 0.40% to 5120 points, and the US100 gains 0.60% reaching 18180 points. The US Dollar Index (USDIDX) decreases following the weak ISM report, while yields on 10-year US Treasury bonds slightly rise to 4.27%.

US500

SP500 index futures gain nearly 0.35% today to 5120 points. The index continues in a strong upward trend that began earlier this year. On the daily interval, there has been practically no correction since the end of October last year, with the index rising by nearly 22%, indicating exceptional optimism in the market. In this case, a correction would be understandable, especially considering the divergence on the MACD indicator.

Source: xStation 5

Company News

Dell Technologies (DELL.US) experienced a significant surge of over 27% following its impressive Q4 report, largely attributed to the strong demand for its AI servers. The company is optimistic about its growth prospects, projecting a return to growth from FY2025 onwards.

Autodesk (ADSK.US) gains over 2% rise following robust Q4 results and an upbeat revenue outlook for FY2025. The company expects its EPS for FQ1 2025 to be in the range of $1.73 to $1.78, aligning with the consensus estimate. Its projected revenue is between $1.385B and $1.4B, which is slightly below the analysts' expectation of $1.389B.

NetApp (NTAP.US) shares soared almost 25% following the release of their FQ3 results and a raised annual profit forecast, driven by strong demand for its all-flash storage products. The company has increased its FY2024 adjusted EPS guidance to $6.40–$6.50, up from the previous estimate of $6.05–$6.25, thereby exceeding the consensus estimate.

New York Community Bancorp (NYCB.US) plummeted over 20% following the disclosure of significant internal accounting weaknesses and subsequent leadership changes. The bank identified these weaknesses as stemming from poor oversight, risk assessment, and monitoring.

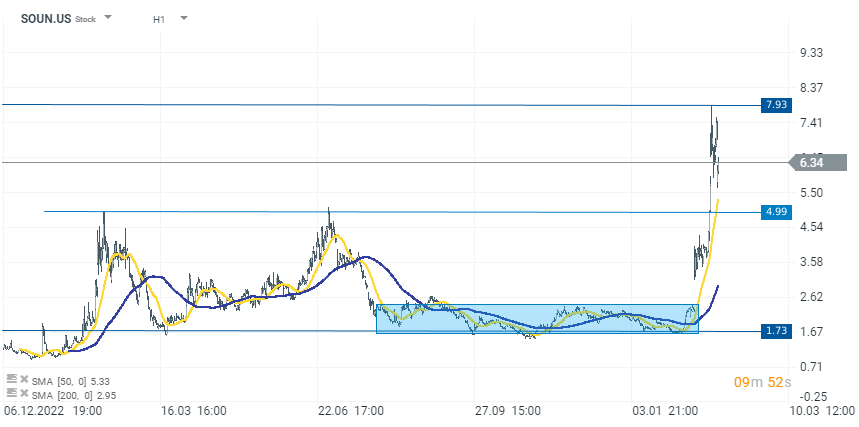

SoundHound AI (SOUN.US) dips over 12% after the company reported earnings below expectations for Q4. Despite securing partnerships with notable brands like Jersey Mike's and Krispy Kreme to implement its voice AI technology in their outlets, SoundHound's forecast for FY2024 sales ranges between $63M and $77M, which is below the consensus estimate of $69.73M.

Source: xStation 5

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report