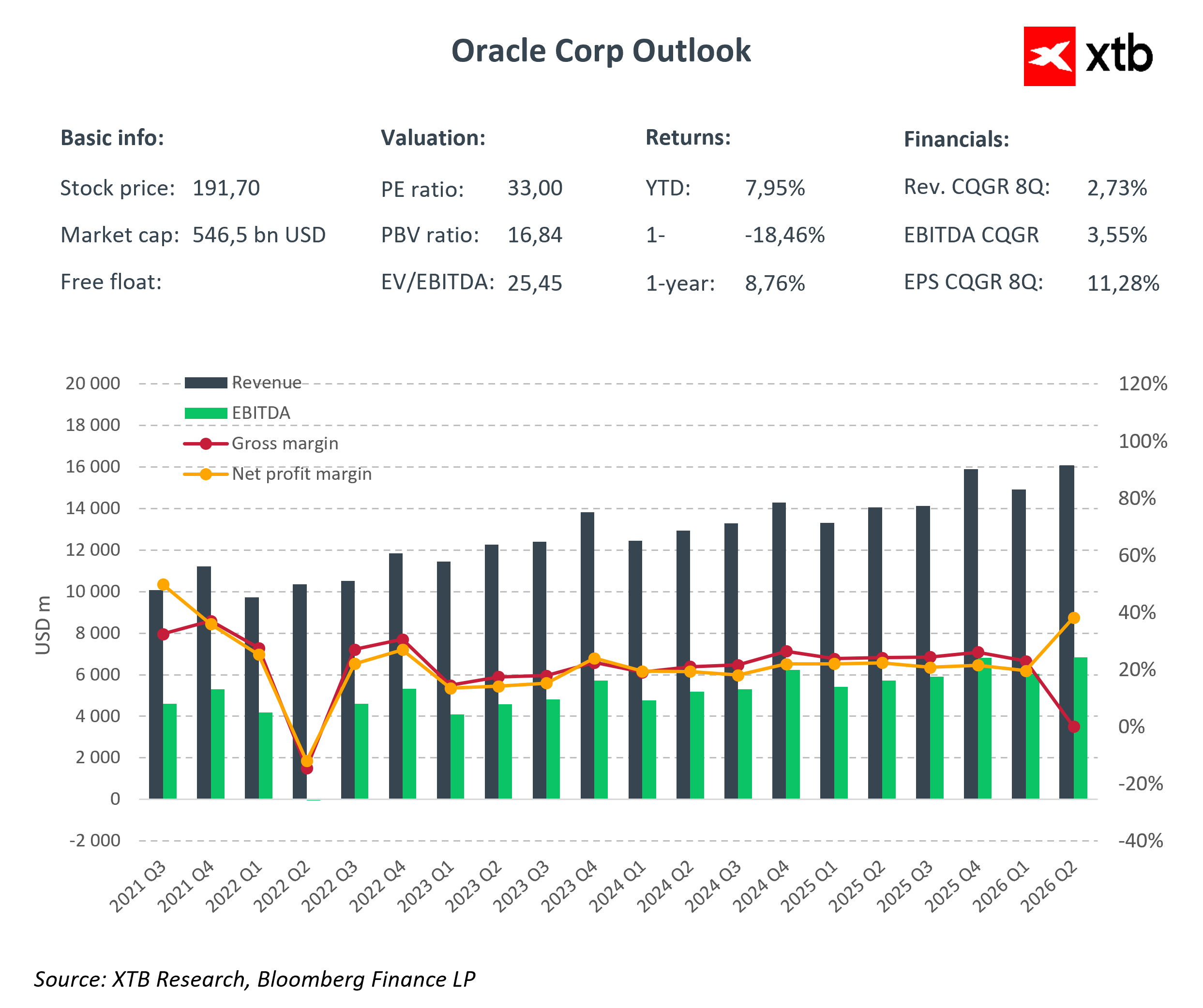

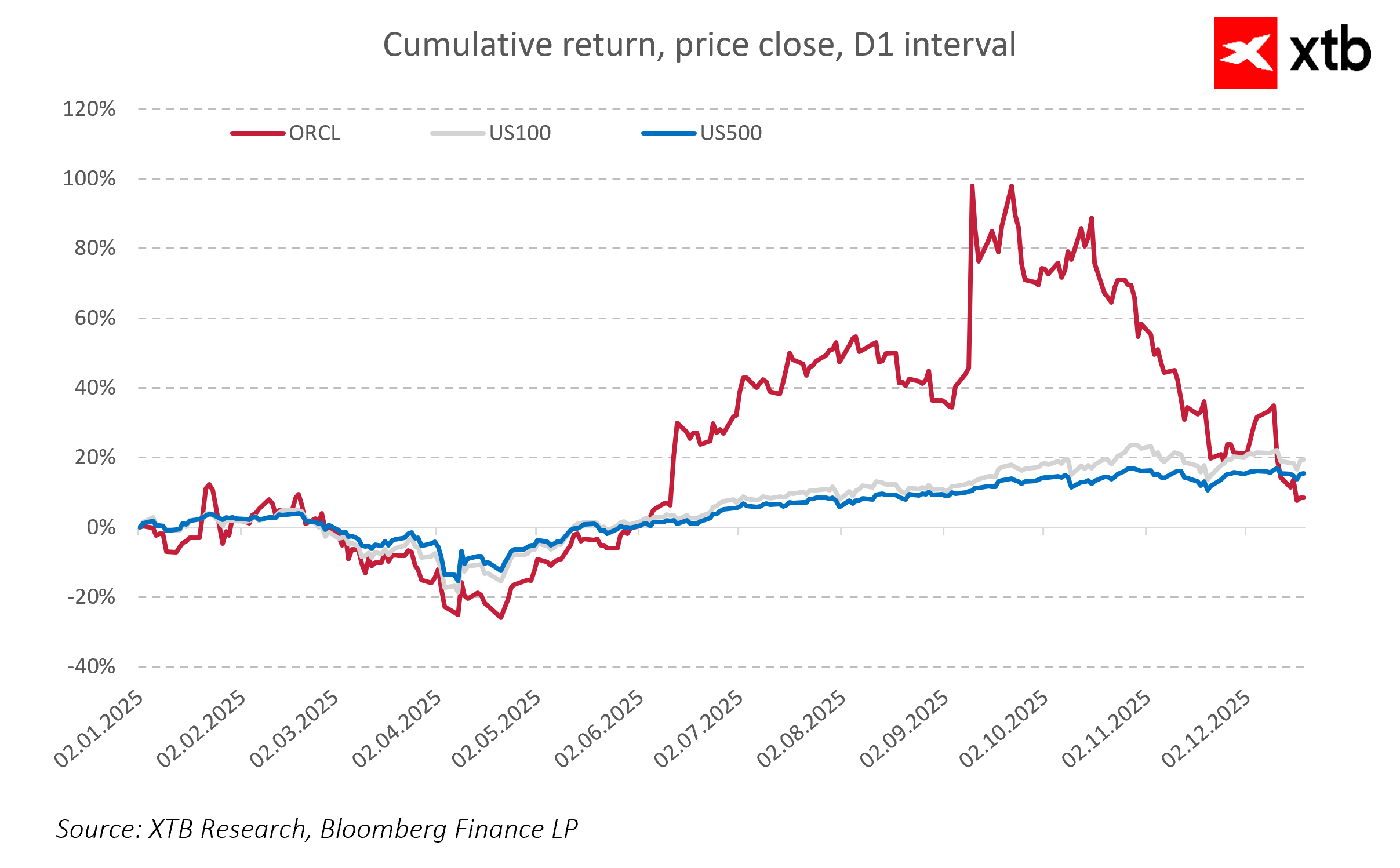

Oracle (ORCL) shares experienced a dynamic increase following reports on progress in the TikTok transaction in the U.S. and fundraising discussions with OpenAI, highlighting the company's strategic strengthening in the cloud computing and artificial intelligence sectors.

ByteDance has agreed to sell over 80% of TikTok’s U.S. operations to a consortium including Oracle, Silver Lake, and MGX from Abu Dhabi. The transaction aims to meet national security requirements and avoid a potential ban on the app in the United States. Oracle and its partners will acquire a majority stake in the newly formed TikTok US with the deal expected to close by the end of January. This will position Oracle to manage the algorithm, user data, and Oracle Cloud Infrastructure (OCI), potentially driving significant growth in cloud revenues.

Simultaneously, OpenAI is conducting preliminary negotiations to raise up to USD 100 billion at a valuation of USD 750 billion, signaling strong investor appetite for AI and easing Oracle’s cost pressure related to its cloud partnership with the company.

The TikTok US transaction strengthens Oracle’s position in a key segment of the technology market, enhances the company’s role in data security and cloud infrastructure, and creates potential for further stock value growth in the coming quarters.

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment