US stock index futures are trading higher but trim gains after the opening bell. Sentiments are supported by improving risk sentiment after President Donald Trump signaled a reversal in his latest tariff rhetoric tied to tensions around Greenland. The shift has helped markets stabilize after a sharp bout of volatility. After the US macro data, US100 is trying to hold above EMA50 (the red line) on D1 interval, while RSI remains mixed.

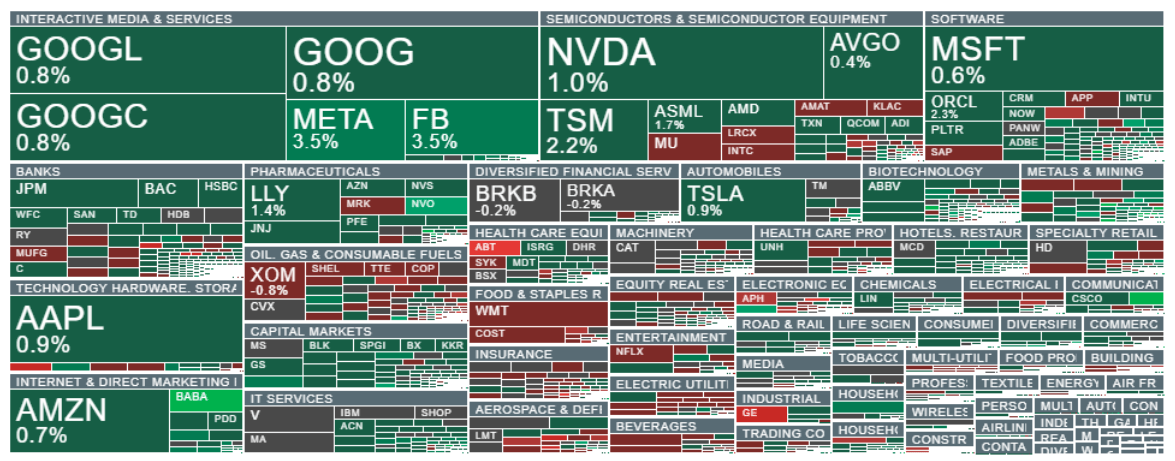

Several major names including Microsoft, Nvidia, and Tesla remain well below their recent highs, which keeps the “valuation reset” narrative alive. Meta Platforms is one of the strongest US stocks on Wall Street today, shares of the company are rebounding from local lows driven by Jefferies analysts take to 'buy the dip' after the 20% correction.

Source: xStation5

Meta Platforms (META.US) and Alibaba's ADR (BABA.US) are the strongest stocks on Wall Street today. Source: xStation5

What’s driving the rebound?

Markets appear to be responding positively to what traders describe as another “TACO” episode — a pattern where aggressive trade threats are followed by walk-backs or delays. This time, the focus is on Trump stepping back from imposing tariffs on multiple European nations, which would have been tied to Greenland-related negotiations.

At the same time, investors are preparing for delayed US inflation data (PCE), which could heavily influence expectations around Federal Reserve policy over the coming months.

-

S&P 500 is higher, extending the rebound from Wednesday’s close

-

Nasdaq leads gains, with a stronger “risk-on” tone in tech

-

Treasury yields slightly lower early in the session

-

Oil down modestly, gold slightly weaker, and bitcoin marginally lower

While the market mood is clearly improving, the bigger picture is still fragile. Investors are watching whether tariff-driven inflation pressures are fading, which could give the Fed more room to cut rates later this year. Even though markets are reacting positively to the tariff reversal, the geopolitical theme remains unresolved. Greenland has become a headline risk again, and traders are increasing. The early part of earnings season has been solid. Most reporting companies have beaten expectations, but investors remain focused on forward guidance rather than backward-looking results.

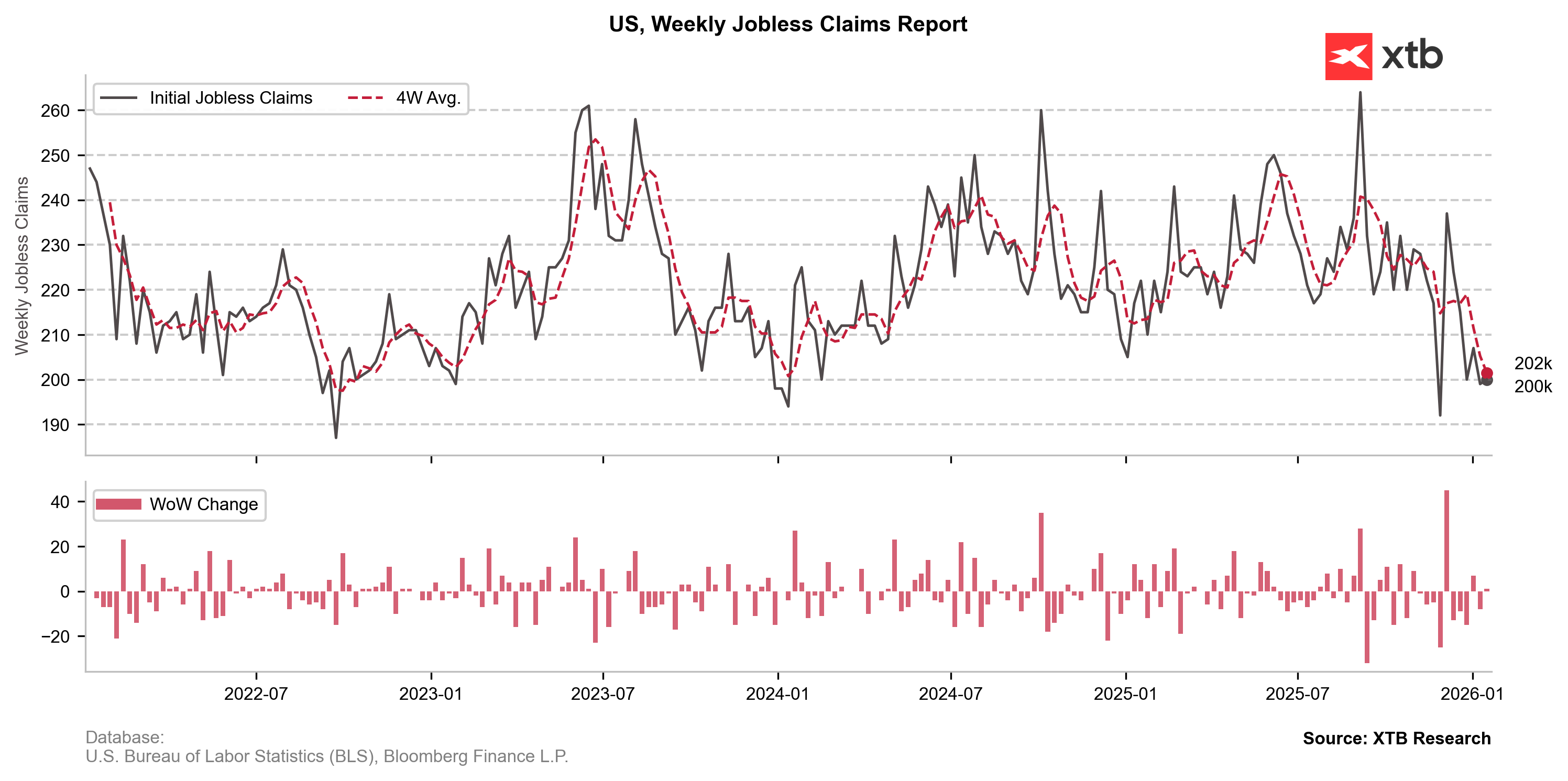

- US Jobless claims: 200k vs 209k exp. and 198k previously with slightly lower than expected continued claims

- US GDP QoQ Final: 4.4% vs 4.3% exp. and 4.3% previously (Price Index at. 3.8% YoY, in line with expectations); PCE at 2.8% YoY, in line with expecations.

Source: XTB Research, BLS, Bloomberg Finance L.P.

Stocks in focus

-

AMD (AMD.US) surged in after-hours trading after beating expectations

-

Lululemon (LULU.US) gained after announcing a stock repurchase plan

-

Abbott (ABT) falls 4% after posting fourth-quarter results.

-

Axogen (AXGN) down 7% after announcing an $85M common stock offering.

-

Knight-Swift (KNX) drops 2% after Q4 earnings missed expectations.

-

Mobileye (MBLY) jumps 6% after revenue guidance was raised.

-

Procter & Gamble (PG) slips 1.6% as organic sales growth stalled and volume fell.

-

Rocket Lab (RKLB) rises 2% after the company said a qualification test triggered a rupture during a hydrostatic pressure test.

-

Sphere Entertainment (SPHR) gains 3% after BTIG upgraded the stock to “Buy.”

-

Venture Global (VG) up 10% after winning a dispute with Spain’s Repsol over LNG shipments from its Louisiana export plant.

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China