- Improved market sentiment at the start of the week

- Tech companies climb on positive news

- Gold and silver support mining companies

- Improved market sentiment at the start of the week

- Tech companies climb on positive news

- Gold and silver support mining companies

The beginning of the week starts optimistically on the American stock exchange. Investor sentiment is clearly better, and the absence of macroeconomic readings allows investors to focus on positive company announcements.

The leader of growth among American indices is Russell2000, whose contracts are rising by about 0.8%. Smaller, yet still noticeable increases are recorded by US100, US500, and US30, where growth is limited to 0.4%.

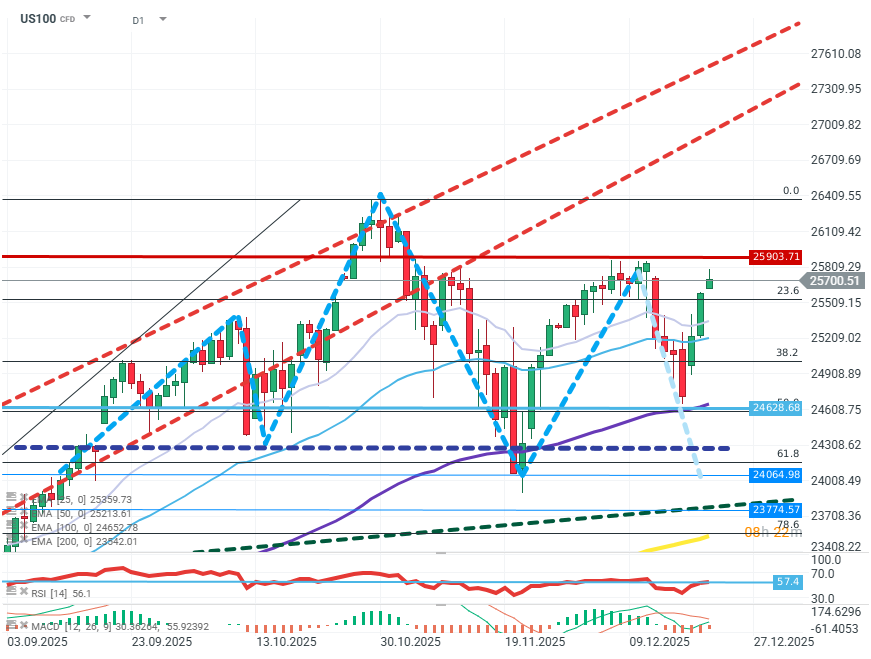

US100 (D1)

Source: xStation5

Buyers managed to break the RGR formation, defending the FIBO 50 level and the EMA100 average. The next target is around 25,900, which must be exceeded to attempt testing all-time highs on the chart. If the supply wants to regain initiative, a quick return below FIBO 38.2 is necessary, from where an attempt could be made to pass through the EMA100 average to deepen the correction.

Company News:

Clearwater Analytics (CWAN.US) - The company's valuations are rising by over 8% after it was announced that a private equity group will purchase the software producer for $8.5 billion.

Rocketlab (RKLB.US) - The orbital and rocket technology company is rising by over 4% at the opening after announcing it won a contract to build 18 satellites. This is the company's largest single contract to date.

Anglogold (AU.US) - The rise in precious metals is driving up valuations of mining and jewelry companies. Increases exceed 4%.

Warner Bros Discovery (WBD.US) - The company is rising by over 3% at the opening after information that Netflix will receive a $59 billion loan to purchase the company.

Nvidia (NVDA.US) - The chip and AI giant announces that the first batch of export H200 processors will reach China before the end of February 2026. The company is rising by about 1.5%.

Carnival (CCL.US) - The cruise ship operator published results significantly above expectations, with EPS at the end of the year amounting to $0.34 compared to the expected ~ $0.25. This simultaneously allowed for a series of positive recommendations from investment banks. The company is rising by about 8% at the opening of trading.

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?