-

Wall Street opens higher on Wednesday

-

Major U.S. banks release their third-quarter results

-

Apple (AAPL.US) unveiled iPhone 12

Wall Street opened higher on Wednesday as more and more companies release their Q3 earnings reports. Today investors’ attention was mostly focused on major U.S. banks reports. Goldman Sachs managed to strongly beat market expectations while provisions for credit losses of both Bank of America and Wells Fargo came in below forecasts. Meanwhile Fed Vice Chairman Claride said that the U.S. economy would need another year or maybe more until it gets back to its pre-pandemic levels.  Following the September’s slump, US2000 rose over 15% and climbed to fresh post-pandemic highs. While the index has remained in a tight range in the past few days, the 1,600 pts area should serve as a support level in case sellers regain control. Pre-pandemic highs are located as high as 1,714.8 pts. Source: xStation5

Following the September’s slump, US2000 rose over 15% and climbed to fresh post-pandemic highs. While the index has remained in a tight range in the past few days, the 1,600 pts area should serve as a support level in case sellers regain control. Pre-pandemic highs are located as high as 1,714.8 pts. Source: xStation5

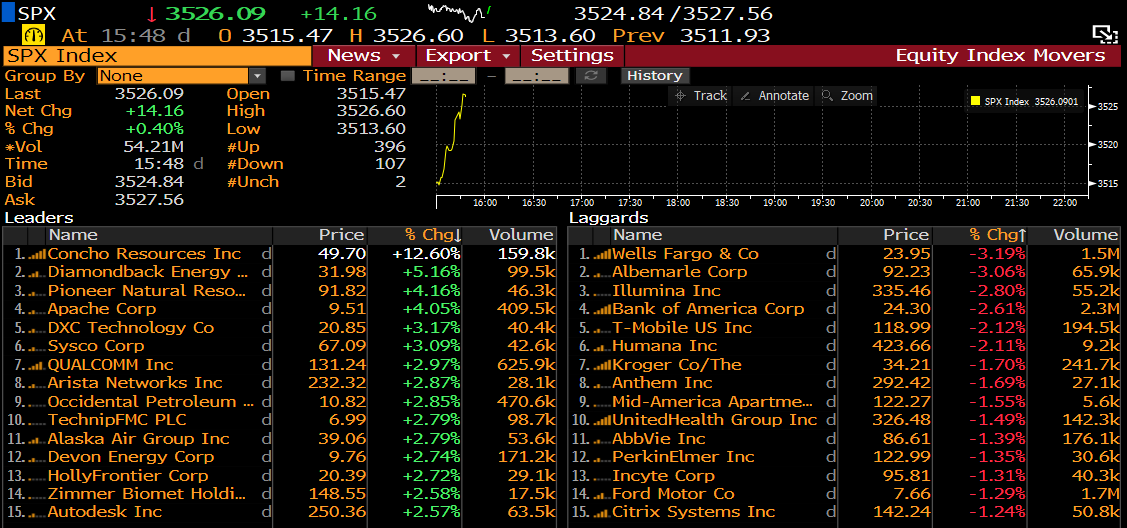

S&P 500 top movers at 2:48 pm BST. Source: Bloomberg

Apple (AAPL.US) unveiled four different iPhone models during yesterday’s event. The cheapest one, iPhone 12 mini, will cost $699 while 6.7-inch pro model will start at $1,099. Tim Cook, Apple CEO, confirmed that 5G support was coming to the full lineup of new iPhones.

United Health (UNH.US) reported an adjusted EPS of $3.30, beating the consensus estimate of $3.10. Revenue rose 7.9% y/y to $65.12 billion, above expectations as well. The company raised its full-year outlook and sees FY adjusted EPS at $16.50 to $16.75 (previously: $16.25 to $16.55)

Walmart (WMT.US) plans to spread out its Black Friday deals over three days in November as the world’s largest retailer intends to reduce crowds during the pandemic. Walmart will also encourage customers to shop via their computers or smartphones.

Walmart (WMT.US) stock has been moving in an upward channel following February-March sell-off. While the $133 area remains key support for now, recently shares have been marching towards recent all-time highs at $151. Source: xStation5

PNC Financial Services (PNC.US) posted Q3 net income attributable to the company of $1.52 billion, or $3.39 a share, compared with $1.38 billion, or $2.94 a share in the same period last year. The firm set aside merely $52 million to cover potential loan losses (as much as $2.45 billion in Q2).

Alibaba sell-off extends amid White House national security concerns📌

US Earnings Season Summary 🗽What the Latest FactSet Data Shows

3 markets to watch next week (14.11.2025)

US Open: US100 initiates rebound attempt 🗽Micron shares near ATH📈