Today's global trading session brings a number of key readings coming from the most advanced economies globally. Recent words from President Lagarde let the market know that Europe is seeing problems with inflation, which is expected to continue its upward trend. The euro rallied strongly after the ECB decision, which weakened stock markets, including Wall Street. The Nasdaq (US100) loses at the start of the session today through a plunge in Meta Platforms (FB.US) shares, which sink by 24%. The stock's valuation was weighed down by weak financial results and poor forward guidance. The BoE raised interest rates as expected to 0.5% (up 25 basis points). Applications came in at 238k against expectations of 245k and against previous level of 261k. Continuing applications remain slightly higher after the recent rise and for the period a fortnight ago came in at 1. 628 million against expectations of 1. 620 million and against previous level of 1. 672 million.

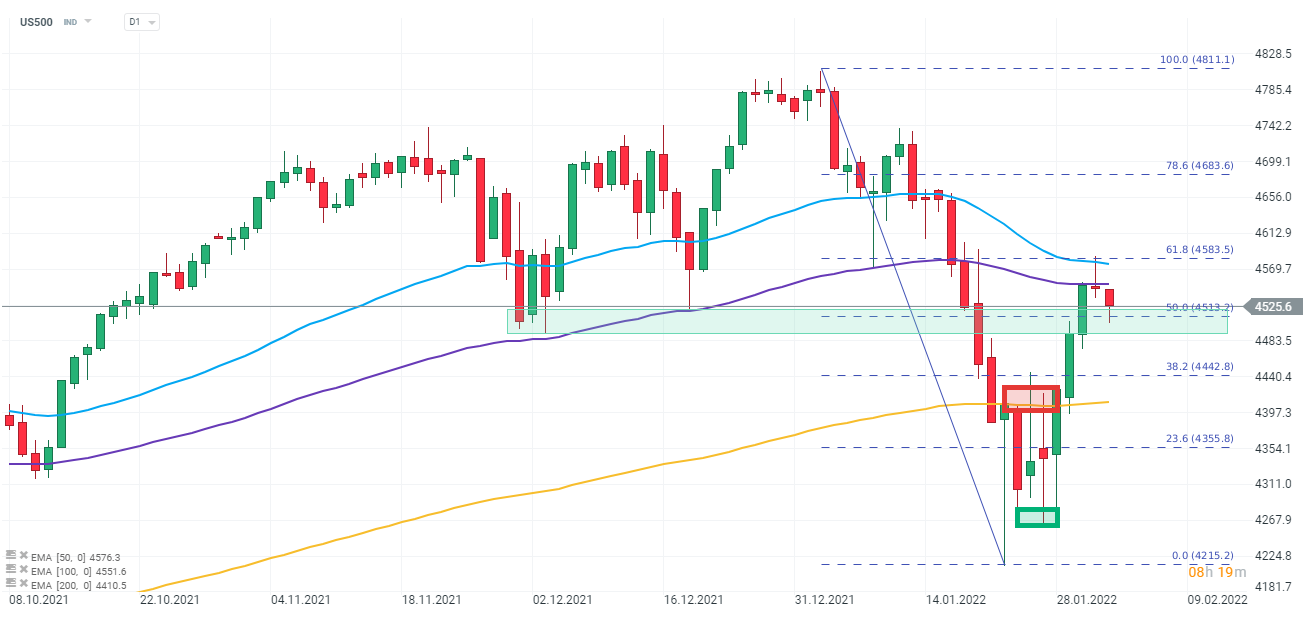

The US500 index is trying to hold the support zone near 4500 points. Source: xStation 5

News:

A strong sell-off in Meta Platforms (FB.US) shares drags down other representatives of social media companies such as Snap (SNAP.US) and Twitter (TWTR.US).

Honeywell International (HON.US) shares are losing nearly 3.5% after the company released mixed fourth quarter results, beating estimates on earnings and missing on revenue.

Spotify sinks at the open of today's session after releasing weaker-than-expected projections for future subscriber numbers.

The ISM index for services is performing slightly better than expectations. The index falls to 59.9 from 62.0 points on expectations of a fall to 59.5 points. Earlier, the PMI index rose to 51.1 from a preliminary 50.8.

The employment sub-index, however, falls sharply though to 52.3 from 54.9 points, which does not suggest a decline in employment. The Omicron and seasonal adjustments could mess with the NFP report quite a bit though. Price sub-index at a high of 82.3 points, new orders up slightly to 61.7.

Beyond that, durable goods orders fall just 0.7% m/m against a preliminary reading of -0.7% m/m. Factory orders fall 0.4% m/m as expected.

Huge sell-off in Meta Platforms (FB.US) shares, D1 interval. Source: xStation 5

DAX: DE40 loses ahead of the EBC decision 📉Volkswagen under pressure

BREAKING: Preliminary Euro Area GDP data beat expectations, pushing EUR/USD higher.

Morning wrap (30.10.2025)

US100 gains ahead of the Fed decision 🖋️