- US indices open lower amid spike in US yields

- US500 drops to 1-week low

- Profit warning from American Airlines pressures US airline stocks

- Marathon Oil rallies after agreeing to be acquired by ConocoPhillips

Wall Street indices launched today's cash trading lower - S&P 500, Dow Jones and Nasdaq traded around 0.7% lower at session open while small-cap Russell was down over 1.6%.

A pullback was triggered by hawkish comments from Fed speakers delivered yesterday and overnight, that triggered a spike in US yields. 10-year US Treasury yield is up 2 basis points on the day, near 4.57%, following an around 9 basis points jump yesterday. Fed Kashkari hinted yesterday that idea of rate hikes has not been abandoned altogether and it led markets to believe that interest rates in the US may stay higher-for-longer. Money markets are now seeing just a single Fed rate cut this year at December 2024 meeting. Economic calendar for the US session today is empty but speech from Fed Williams at 6:45 pm BST may trigger some volatility.

Source: xStation5

Source: xStation5

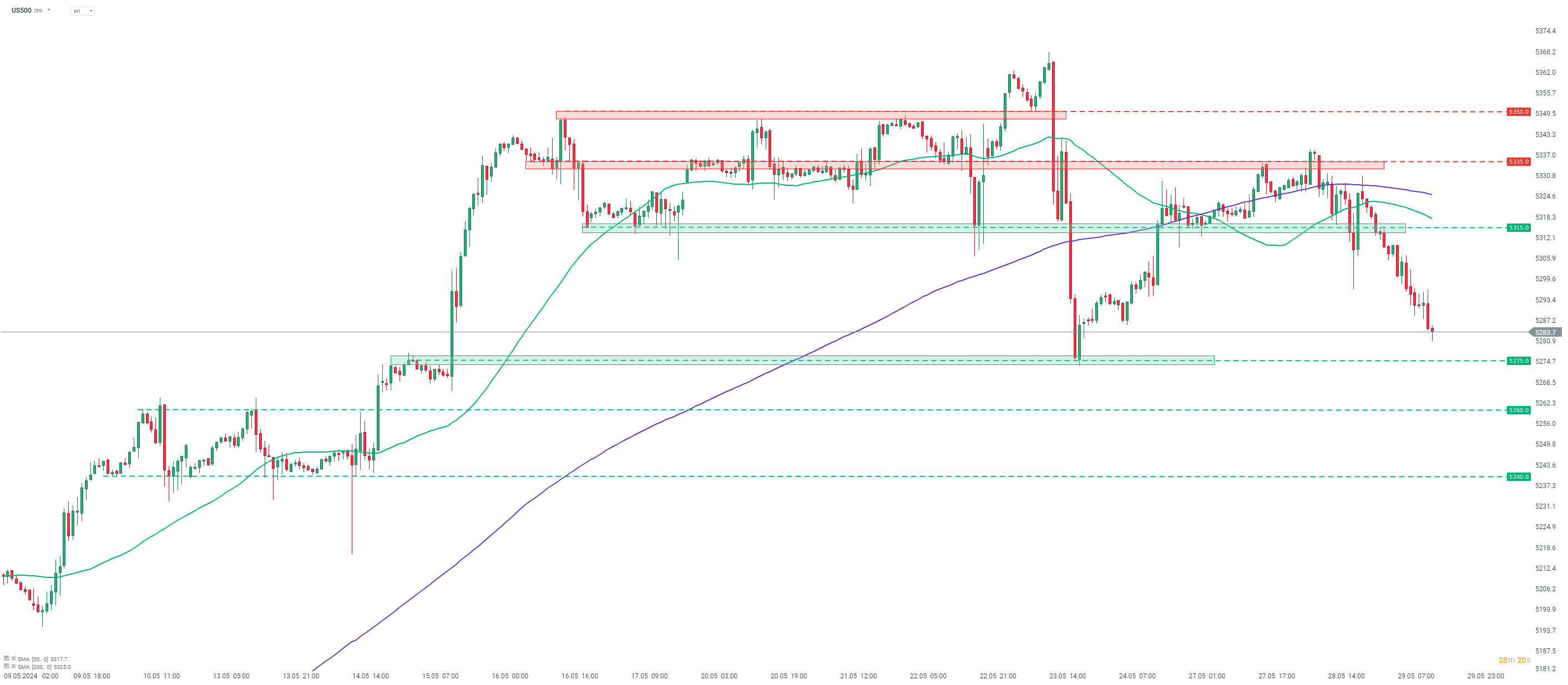

S&P 500 futures (US500) have been sliding since midday yesterday. Taking a look at US500 chart at H1 interval, we can see that the index failed to break above the 5,335 pts resistance zone yesterday and dropped below 200-hour moving average (purple line). A few attempts were made to climb back above this moving average later on, but all of them failed, and the downward move accelerated overnight. The near-term support zone to watch can be found in the 5,275 pts area. Should we see a break below, the next two potential levels that may offer some short-term support will be 5,260 and 5,240 pts.

Company News

Airline stocks are trading under pressure after American Airlines (AAL.US) issued a profit warning. American Airlines said that it now expects total revenue per available seat mile to be 5-6% YoY lower in Q2 2024, while it earlier expected 1-3% YoY drop. Operating margin is now seen in the 8.5-10.5% range, down from previous guidance of 9.5-11.5%. Adjusted EPS guidance was also lowered from $1.15-1.45 to $1.00-1.15.

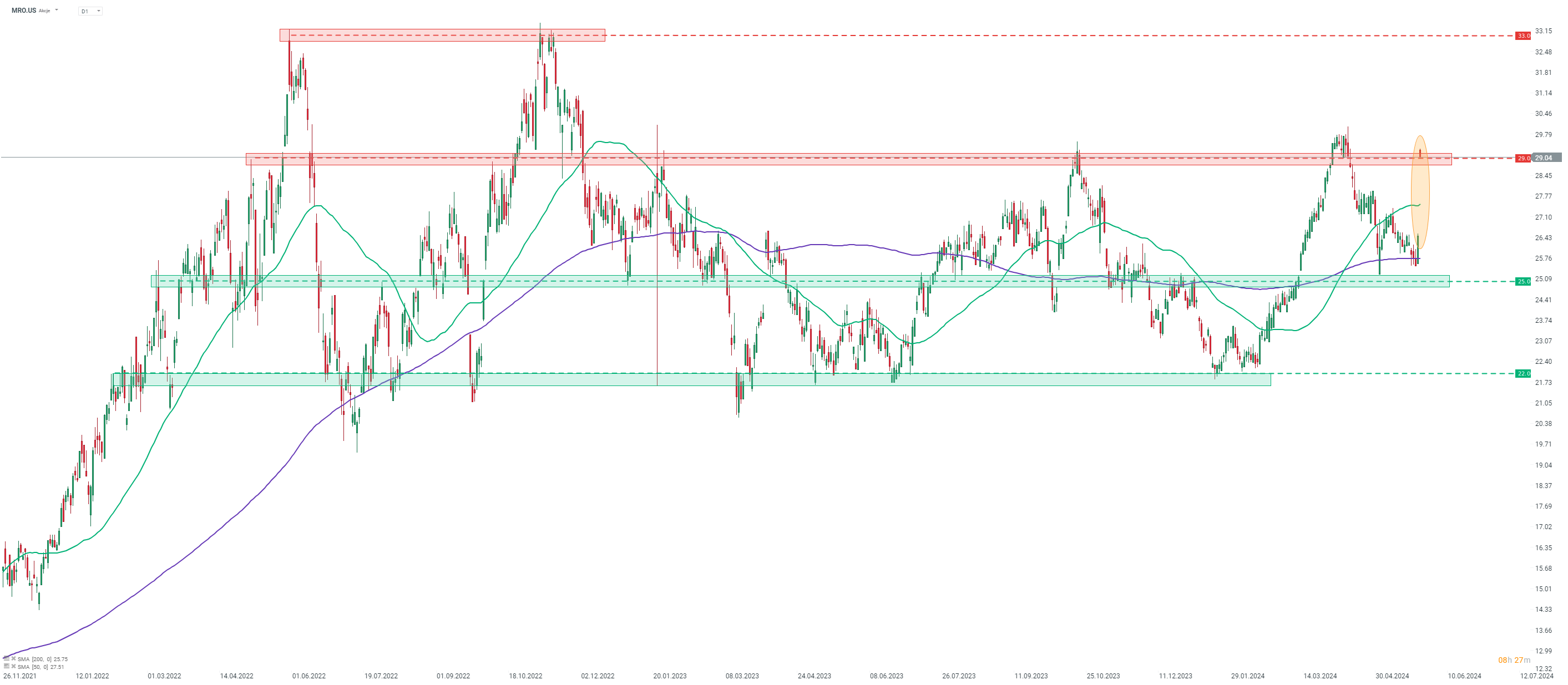

Marathon Oil (MRO.US) gains after takeover news. Company will be acquired by ConocoPhillips (COP.US) in an all-stock deal valuing Marathon Oil at about $17 billion, or around $33.03 per share. Deal terms also put Marathon's enterprise value at around $22.5 billion. This was reported earlier today by Financial Times and was confirmed by the two companies before Wall Street session open. However, FT report signalled that the deal may value Marathon Oil at around $15 billion, so the actual valuation is a positive surprise.

Robinhood Markets (HOOD.US) trades higher after company's board of directors approved a $1 billion share buyback programme. Management expects repurchases to be conducted over period of 2-3 years, starting in the third quarter of 2024.

Marathon Oil (MRO.US) launched today's trading with a big bullish price gap, following news of takeover by ConocoPhillips (COP.US). Stock opened above the $29.00 resistance zone, but has trimmed part of the gains in first minutes of trade. Source: xStation5

Marathon Oil (MRO.US) launched today's trading with a big bullish price gap, following news of takeover by ConocoPhillips (COP.US). Stock opened above the $29.00 resistance zone, but has trimmed part of the gains in first minutes of trade. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war