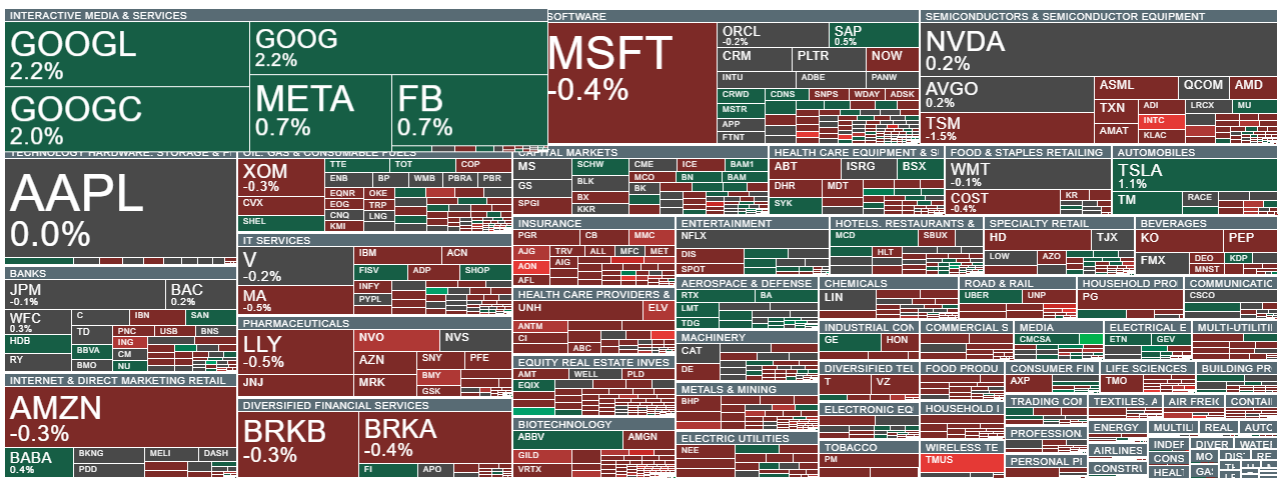

Sentiments among U.S. stock indexes are mixed today. The US100 is struggling to return to gains, while the US30 is down over 0.4%. Among Big Tech companies, Alphabet (GOOGL.US) and Tesla (TSLA.US) shares are recording the strongest gains.

- China has announced it will lower tariffs on some American goods currently subject to 125% duties.

- Final UoM sentiments came in higher than expected; 1 year inflation expectations slightly higher but still at very high 6.5% level

- Shares of UnitedHealth (UNH.US), a DJIA giant, are falling another 2.5%, hitting multi-year lows.

- Intel shares are down over 8% after disappointing financial results. Strong results from Alphabet (GOOGL.US) were not enough to lift broad market sentiment.

Among large U.S. companies, the biggest decliners include Intel, AON, Novo Nordisk, and T-Mobile US. Gains in the tech sector are being driven primarily by Alphabet (GOOGL.US).

Source: xStation5

Company News

• Schlumberger NV:

SLB missed analysts' profit estimates for the first quarter, as a slowdown in demand for oilfield equipment and services in Latin America weighed on its international business.

- "The industry may experience a shift in priorities driven by changes in the global economy, fluctuating commodity prices, and evolving tariffs — all of which could impact upstream investment and demand for our products and services," said SLB CEO Olivier Le Peuch.

- International revenue fell 5% to $6.73 billion in Q1. The company, formerly known as Schlumberger, reported adjusted earnings of 72 cents per share, slightly below analysts' estimates of 74 cents.

• Skechers USA Inc:

The footwear maker withdrew its full-year forecast on Thursday amid economic uncertainty caused by the Trump administration's unpredictable trade policies, sending shares lower in after-hours trading.

- Production in China accounts for nearly 38% of Skechers' U.S. sales, according to a Bank of America note dated April 9.

- Skechers also missed first-quarter sales expectations, reporting a 7.1% rise compared to the 7.9% growth expected.

- Sales in China fell about 16% in the quarter ending March 31, a steeper decline than the 11.5% drop in the previous three-month period.

• T-Mobile US Inc:

The U.S. telecom carrier added fewer new wireless subscribers in Q1 2025 than the market expected, as competitors ramped up promotions in an increasingly saturated U.S. market, leading to a drop in the company's shares after hours.

- The report highlighted intensifying competition, where operators attract customers with price locks and bundled offers while economic uncertainty grows due to tariffs.

- T-Mobile added 495,000 monthly bill-paying subscribers in the first three months of 2025 — more than AT&T — while Verizon lost subscribers during the period after warning about the impact of "off-season promotions."

- Still, the result fell short of FactSet’s estimate of 506,400 additions.

- The company raised its 2025 adjusted EBITDA guidance to a range of $33.2 billion to $33.7 billion, up from the previous forecast of $33.1 billion to $33.6 billion.

- T-Mobile's revenue in Q1 rose 6.6% to $20.89 billion, beating expectations of $20.62 billion, according to LSEG data.

• Verisign Inc:

The internet services company reported a 4.7% rise in first-quarter revenue on Thursday, driven by continued demand for domain registrations as businesses expanded their online presence. Warren Buffett increased his stake in Verisign in Q4 2024.

- Verisign reported revenue of $402.3 million compared to $384.3 million a year earlier.

- It manages the domain-name registries for two of the world's most valuable domains — .com and .net — and operates two of the 13 global internet root servers.

- Net income rose to $199.3 million, or $2.10 per share, from $194.1 million, or $1.92 per share, a year earlier.

- Verisign processed 10.1 million new .com and .net domain registrations in Q1, up from 9.5 million a year earlier.

Intel extends losses

The chipmaker forecast second-quarter revenue and profit below Wall Street estimates, casting a shadow over the first financial results under the leadership of new CEO Lip-Bu Tan amid an ongoing trade war.

- In efforts to restructure and cut costs, Intel also announced it is lowering its adjusted operating expense target to approximately $17 billion in 2025, down from the previously stated goal of $17.5 billion, and is targeting $16 billion in 2026.

- The company expects revenue between $11.2 billion and $12.4 billion for the quarter ending in June, compared with analysts' average estimate of $12.82 billion.

- Intel's first-quarter revenue remained flat at $12.67 billion, exceeding the $12.30 billion estimate.

- The company projects that second-quarter adjusted earnings per share will be near zero, compared to prior expectations of 6 cents per share.

Intel Stock Chart (INTC.US)

Intel shares are falling below $20 today, marking an 8% sell-off. The stock failed to break above the 23.6% Fibonacci retracement of the last downward wave and twice failed to hold above the 200-day EMA, signaling a return to a downward trend. Strong support is seen between $18 and $19.50.

Source: xStation5

Changes in Analysts' Recommendations

• Alphabet Inc: Wells Fargo raises the target price to $175 from $167 after impressive first-quarter results driven by advertising growth.

• Comcast Corp: Oppenheimer lowers the target price to $38 from $55, as the cable provider reported weak broadband subscriber performance due to high prices.

• Intel Corp: JPMorgan lowers the target price to $20 from $23 after the chipmaker downgraded its second-quarter revenue outlook.

• PepsiCo Inc: Piper Sandler lowers the target price to $160 from $167, citing potential tariff pressures on North American beverage concentrate imports and the Frito-Lay North America division.

• Procter & Gamble Co: TD Cowen lowers the target price to $175 from $189 after the consumer goods company cut its sales and EPS forecasts for FY25 amid uncertainty about consumer spending and tariff-related costs.

Economic calendar: Fed, BoC and Mag 7 companies to fight for investors' attention (29.10.2025)

BREAKING: SPA35 ticks down on lower-than-expected GDP in Spain 🇪🇸 📉

BREAKING: USDSEK dip 0.15% on above-estimates GDP data in Sweden 🇸🇪

Morning wrap (29.10.2025)