- Flat opening on US stock exchanges

- 10-year Treasury yields slightly down

- The US Dollar Index (USDIDX) loses 0.40%

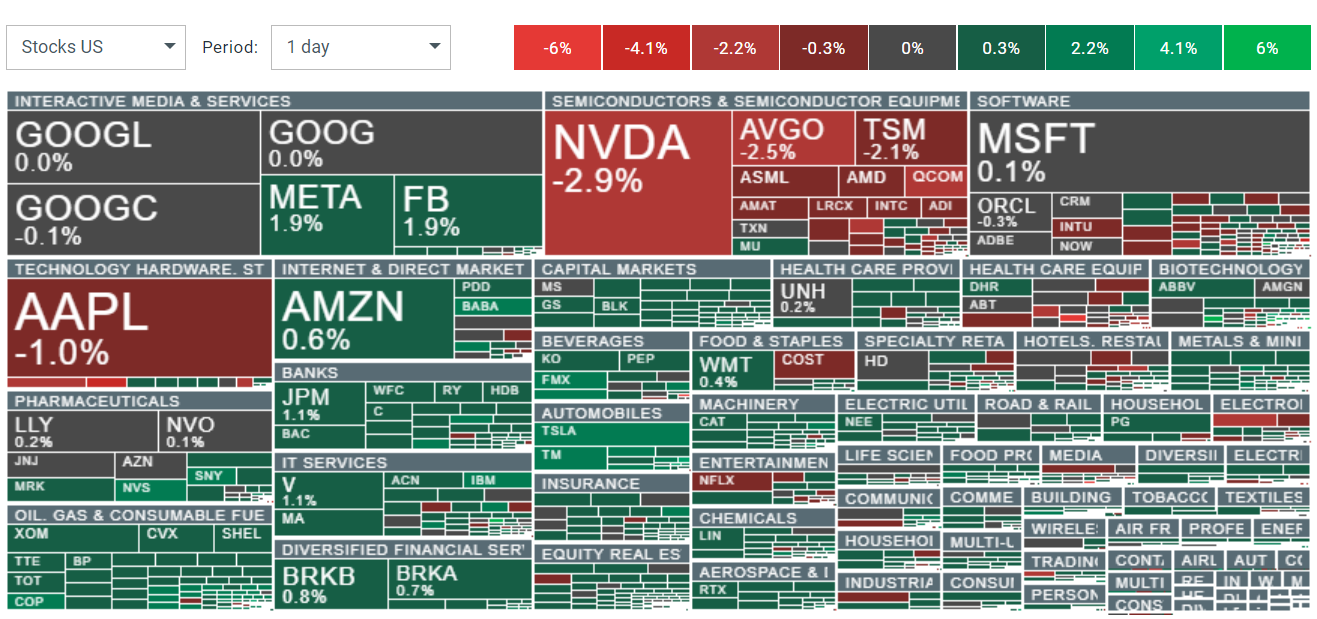

- Semiconductor sector continues to decline

The start of the new week is not the best for investors in the American stock market. Gains in major indexes on the Old Continent do not translate into better moods in the USA. Once again, for the second day in a row, companies related to the semiconductor sector are having a weaker session. At the time of publication, the US500 is up 0.40%, while the US100 is down 0.20%.

Nvidia loses an additional 3.10%, with the share price falling to $123.50. Meanwhile, Broadcom and TSM are both down by 2.60%. On the other side, among the sectors gaining the most, we can highlight Oil & Gas, and Interactive Media & Services.

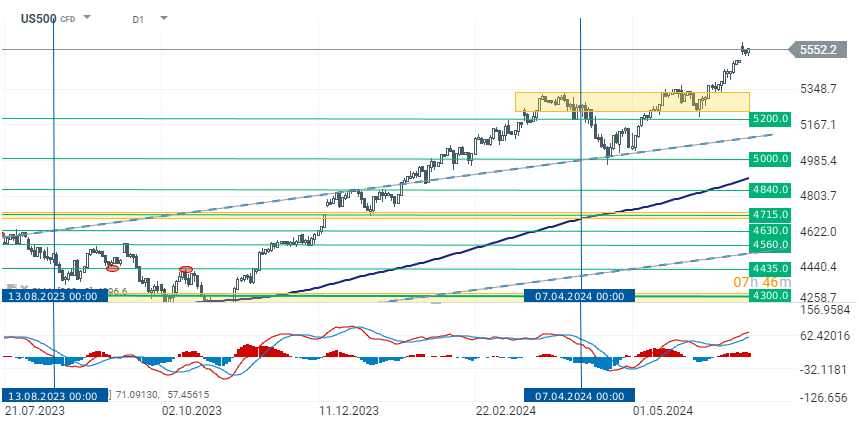

US500

The main index of companies in the USA, US500, gains 0.40% at the opening of the cash session. The quotes are consolidating around historical highs at the level of 5550 points for the third session in a row. The nearest support level in case of a deeper correction remains the 5330 points zone, which is the upper limit of the previous consolidation channel.

Source: xStation 5

Company News

Alnylam Pharmaceuticals (ALNY.US) gains 28% following successful late-stage trial results for vutrisiran, a treatment for ATTR amyloidosis with cardiomyopathy. The trial met its primary and secondary endpoints, achieving significant reductions in composite all-cause mortality and recurrent cardiovascular events, as well as notable mortality reduction in pre-specified secondary endpoints.

Altimmune (ALT.US) shares soared 26% after phase 2 trial results of pemvidutide demonstrated notable efficacy in obesity treatment, with participants losing an average of 15.6% body weight at 48 weeks. This obesity candidate not only showed significant weight loss but also better preservation of lean muscle mass compared to other treatments, highlighting its unique position in obesity management.

Affirm Holdings (AFRM.US) rose by 7.30% after Goldman Sachs began coverage with a Buy rating and set a price target of $42. Goldman Sachs commended Affirm for its groundbreaking credit solutions, excellent underwriting processes, and robust risk management strategies.

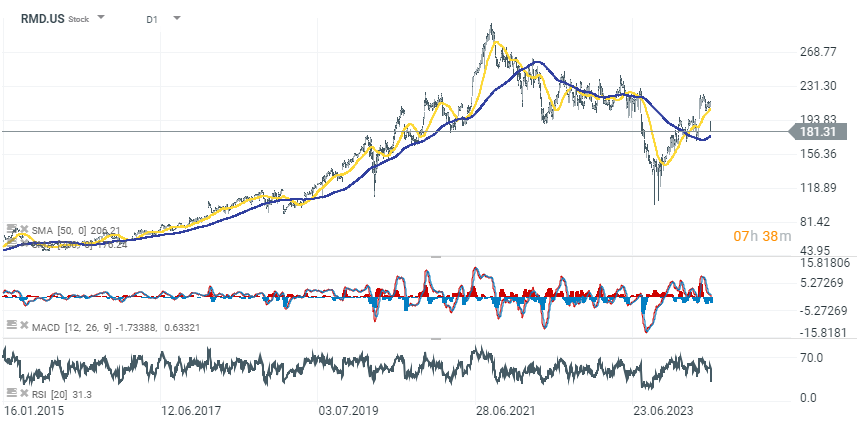

ResMed (RMD.US) saw its stock fall more than 13% following an announcement by Eli Lilly regarding an FDA decision to expand the use of its weight loss therapy, tirzepatide, to treat obstructive sleep apnea (OSA). This decision follows the successful results of the Phase 3 SURMOUNT-OSA program, potentially setting tirzepatide up as a direct competitor to ResMed’s CPAP machines for OSA treatment.

Crypto-related stocks, including Riot Platforms (RIOT.US), MicroStrategy (MSTR.US), CleanSpark (CLSK.US), and Marathon Digital (MARA.US), experienced notable losses as the prices of Bitcoin and other significant cryptocurrencies fell. This decline was influenced by reduced interest in the recently introduced spot Bitcoin ETFs and ongoing uncertainty about future interest rate decisions by the Federal Reserve, which affected the broader cryptocurrency sector stocks.

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales