-

Revenue Shift Confirmed: Q1 miss was offset by a $10–$11B Q2 revenue guide, signaling a timing deferral and strong sequential growth.

-

Margin Headwinds Persist: Q2 EPS guidance came in low, confirming investor concerns about profitability and margin pressure.

-

FY Outlook Raised: SMCI increased its full-year guidance to $36B, underscoring confidence in long-term AI execution.

-

Revenue Shift Confirmed: Q1 miss was offset by a $10–$11B Q2 revenue guide, signaling a timing deferral and strong sequential growth.

-

Margin Headwinds Persist: Q2 EPS guidance came in low, confirming investor concerns about profitability and margin pressure.

-

FY Outlook Raised: SMCI increased its full-year guidance to $36B, underscoring confidence in long-term AI execution.

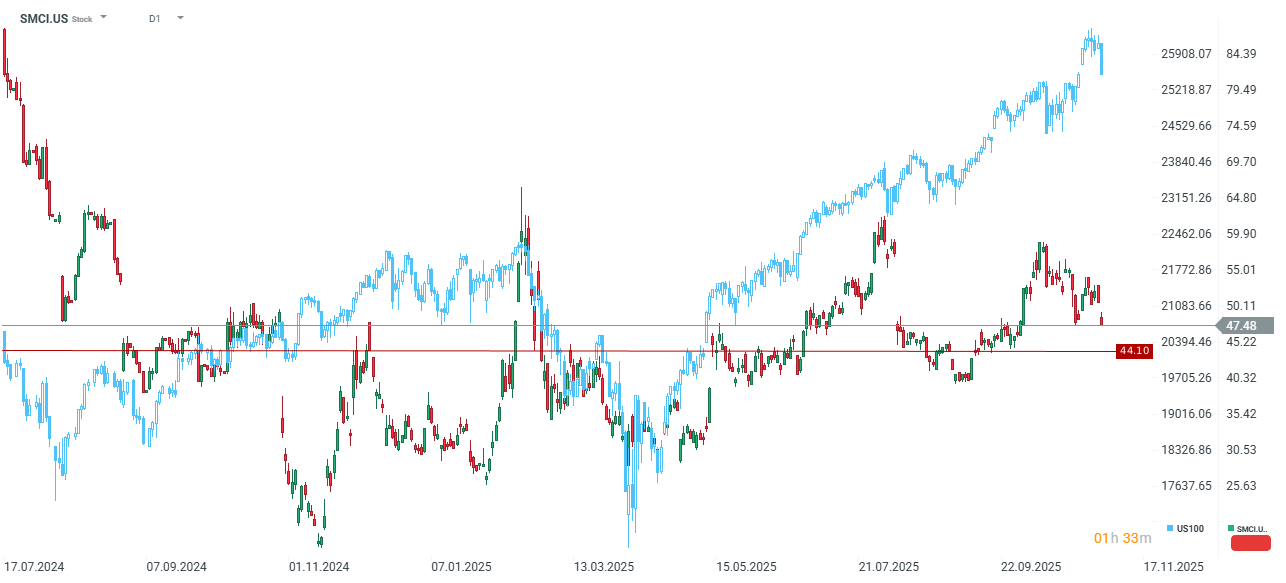

Super Micro Computer (SMCI) reported significantly disappointing results for Q1 FY2026, though forward guidance points to a robust recovery and sequential growth surge.

Key Q1 FY2026 Misses

-

Revenue came in at $5.02 billion, falling short of the $6.09 billion consensus, representing a 17.5% miss.

-

Adjusted Earnings Per Share (EPS) was $0.35, a 14.6% disappointment against the expected $0.41.

-

The Adjusted Gross Margin was 9.5%, narrowly missing the 9.63% expectation.

Forward Guidance Signals Volatility and Margin Pressure

-

Q2 Revenue guidance was set between $10 and $11 billion, significantly exceeding the consensus of $8.05 billion and implying a substantial 24% to 37% sequential increase.

-

However, Q2 EPS guidance of $0.46–$0.54 fell well below the $0.62 consensus, suggesting continued margin compression despite the revenue acceleration.

-

SMCI raised its full-year FY2025 revenue guidance to at least $36 billion, up from the previous at least $33 billion.

Analysis: Timing Shift Over Fundamental Disappointment

-

The company's poor Q1 performance was attributed to a clear revenue deferral into Q2, caused by customers awaiting "design win upgrades" related to new NVIDIA and AMD chip generations.

-

This backlog suggests the Q1 result is primarily a timing issue rather than a fundamental demand deterioration. The Q2 revenue forecast, implying a potential 100% sequential jump, reinforces this view.

-

Crucially, the company's decision to increase its ambitious full-year target to $36 billion underpins management's confidence in execution, even as the lower-than-expected Q2 EPS guidance highlights ongoing concerns about profitability and margins.

-

The 8% drop in after-hours trading reflects typical market asymmetry, where investors prioritize the quarterly miss over the optimistic long-term revenue forecast, while also reacting to the weak profitability outlook.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records