- Wall Street struggles for direction

- Debt-ceiling discussion in the mainstream

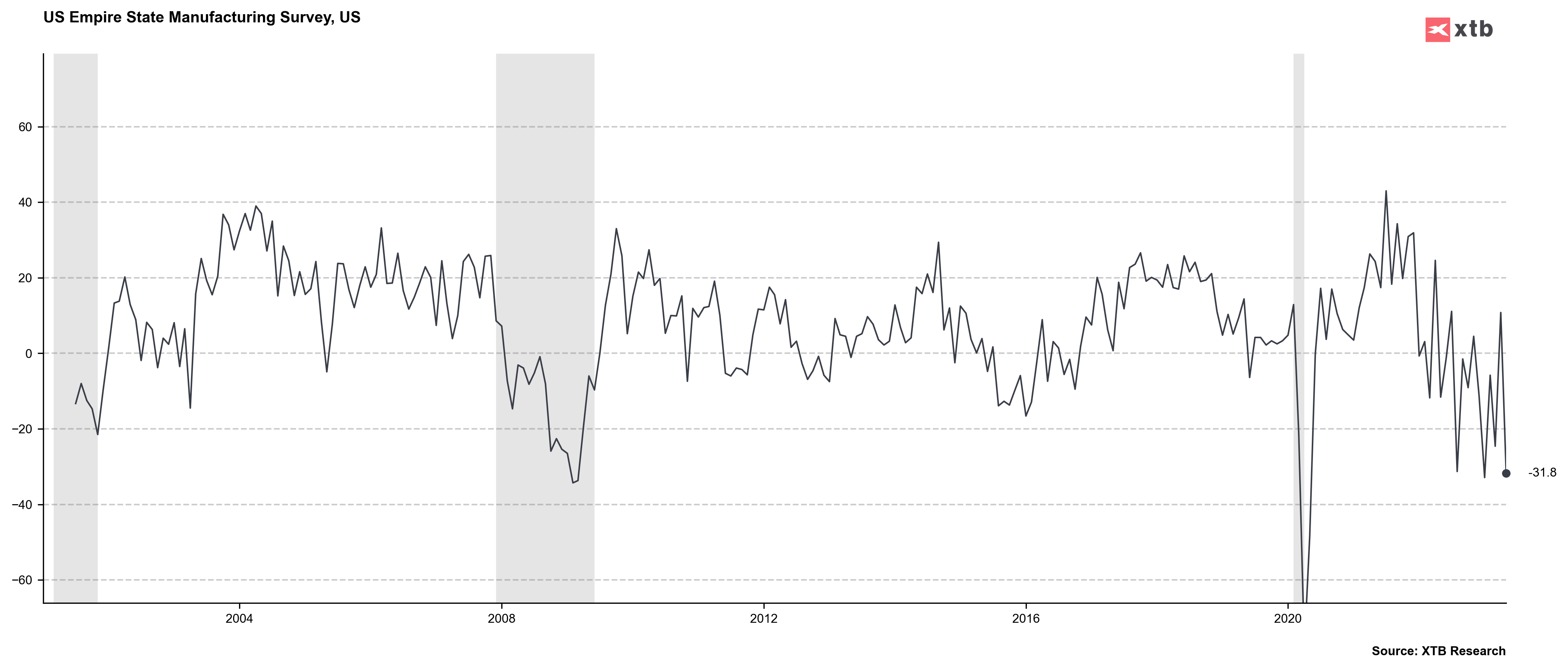

- New York Fed index slumps

Wall Street struggles for direction at the start of a busy week as investors evaluate the progress of debt-ceiling discussions and the Federal Reserve's monetary policy.

The S&P 500 (US500) Index declines 0.15% to 4,133 points, while the Nasdaq 100 (US100) Index drops 0.17% to 13,370 points. The yield on the 10-year Treasury note climbed to 3.50% and the Cboe VIX Index inched up to approximately 18.

The debt-ceiling issue is a significant concern for investors, with analysts cautioning that failure to raise the government's borrowing limit of $31.4 trillion could lead to market turmoil and economic catastrophe. President Biden, House Speaker Kevin McCarthy and other congressional leaders plan to hold further discussions on Tuesday.

Raphael Bostic, the President of the Federal Reserve Bank of Atlanta, opposed market expectations of interest rate cuts this year and advised against ruling out further rate hikes if inflation persists. The subdued market response to the fiscal standoff implies that investors anticipate a negotiated solution, particularly after President Biden expressed optimism about reaching an agreement.

The New York Fed manufacturing index for May was released today at 1:30 pm BST. Release was closely watched as this index surprised with a big jump last month and clearly stood out among other regional indices. Market expected report to show -2.5 after 10.8 reported for April. However, actual data showed a massive slump to -31.8! This was the lowest reading since January 2023 and the largest single month drop since April 2020.

US500, currently trading at 4,133 points, has experienced a slight decline of 0.15% today. The price action suggests a period of consolidation, as it remains within the range of 4,100 and 4,200 points. Particularly interesting level is at 4,200 points, which serves as both a resistance line and zone where the upper boundary of a bear market channel is approaching.

Investors should closely monitor this key level, as a breakthrough above 4,200 points could signal a potential bullish breakout and a shift in market sentiment. Conversely, a failure and further sentiment deterioration could indicate a continuation of the bearish trend.

Company News

-

Meta Platforms (META.US) climbs 1.2% after Loop Capital upgraded the social media giant’s stock to buy from hold saying that the company’s revenue picture looks increasingly positive.

-

Schwab (SCHW.US) rises 3.4% after the brokerage firm was upgraded to outperform from market perform at Raymond James, which says headwinds from cash sorting are easing.

-

C3.ai (AI.US) rises as much as 11% after the company posted preliminary 4Q revenue that beat the average analyst estimate

-

H&R Block (HRB.US) slips 9% and TurboTax owner Intuit (INTU.US) falls 4% after the Wall Street Journal reports that the IRS is considering creating a government-run alternative to the two tax-prep firms.

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Daily summary: Weak US data drags markets down, precious metals under pressure again!