- US indices launched today's cash trading slightly lower

- US retail sales well above expectations

- Target (TGT.US) stock plunges on weak financial outlook

Three major Wall Street indices launched today's session mixed, with Dow Jones trading around the flatline while the S&P 500 and Nasdaq fell 0.4% and 0.9% respectively, following grim sales outlook from major retailer Target, while US retail sales rose 1.3% MoM in October which suggests that US consumers continued to spend despite the weakening economy. Among other economic releases, industrial production unexpectedly declined.

S&P 500 index stocks categorized by sectors and industries. Size represents market cap. Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app

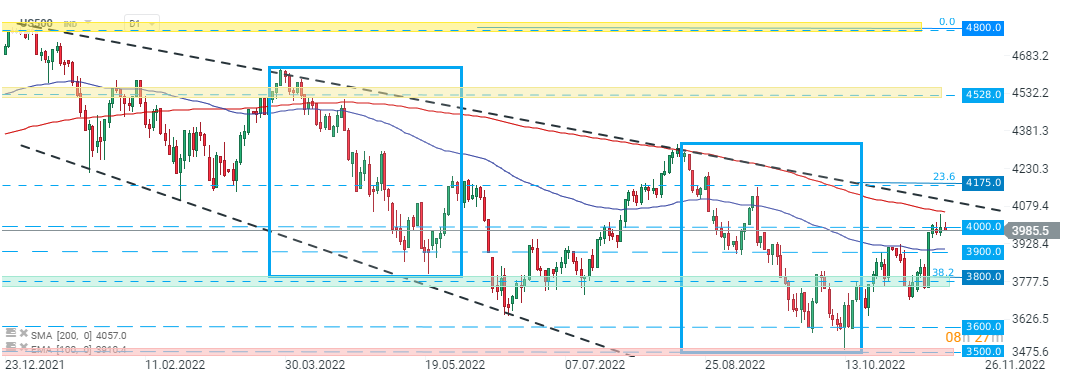

US500 again fell below 4000 pts following the release of retail sales and industrial production data. As long as the index sits below, downward move may accelerate towards short-term support at 3900 pts.. Source: xStation5

Company news:

Etsy (ETSY.US) stock dropped over 3.5% after Evercore put the online crafts marketplace on its “Tactical Underperform” list, however uphold its outperform rating. Evercore expects a 3-month trend of slower sales and a shift in spending toward lower-priced items.

Etsy (ETSY.US) stock jumped nearly 40.0% since the beginning of November, however buyers failed to stay above resistance at $123.50, which coincides with 23.6% Fibonacci retracement of the downward wave launched in November 2021. Nearest support to watch lies at the earlier broken upper limit of the local descending channel. Source: xStation5

Etsy (ETSY.US) stock jumped nearly 40.0% since the beginning of November, however buyers failed to stay above resistance at $123.50, which coincides with 23.6% Fibonacci retracement of the downward wave launched in November 2021. Nearest support to watch lies at the earlier broken upper limit of the local descending channel. Source: xStation5

Target (TGT.US) shares fell over 14% in premarket after a major retailer reported lower profit in Q3 and expects weaker sales in holiday-quarter, citing surging inflation and "dramatic changes" in consumer spending.

Lowe’s (LOW.US) stock rose over 2.4% before the opening bell after the home improvement retailer posted upbeat quarterly results and reported better-than-expected comparable store sales. Company lifted its annual financial outlook, thanks to higher prices and robust demand for its products.

Grab (GRAB.US) stock rose 15% in premarket after the ride-hailing platform lifted its revenue guidance thanks to solid demand in Southeast Asia.