• US China tensions eases

• Uber Technologies (UBER.US) price soared after Q1 results

US indices opened higher today despite the fact that the recent NFP figures plunged by 20.5 million in April and the unemployment rate hit an all-time high of 14.7%. However both figures came in below analysts’ expectations. Markets sentiment improved after news that China and U.S. trade negotiators discussed their Phase 1 trade deal in a telephone call, with China agreed to improve the atmosphere for its implementation and US saying both countries expected obligations to be met.

Canadian economy shed more than 1.99 million jobs and the unemployment rate rose to 13 % in April from 7.8 percent in the previous month and came in below analysts’ expectations of 18 %.

S&P500 (US500) - publication of today's NFP report did not cause significant price movements. Index is currently testing resistance at 2912.6 pts. If bulls will manage to push higher, then next target is located at 2968.3 pts. On the other hand, once sellers regain control, the support at 2828.3 pts may be at risk. Source: xStation5

S&P500 (US500) - publication of today's NFP report did not cause significant price movements. Index is currently testing resistance at 2912.6 pts. If bulls will manage to push higher, then next target is located at 2968.3 pts. On the other hand, once sellers regain control, the support at 2828.3 pts may be at risk. Source: xStation5Motorola Solutions (MSI.US) shares sinked 9% in extended trading after the company posted its quarterly results. The cellphone maker’s said it had revenue of $1.66 billions lighlty below market expectations of $1.67 billion, according to Refinitiv. Motorola withdrew its full-year guidance due to the ongoing coronavirus pandemic. Company also provided week second-quarter guidance, expecting a 17% to 14% decline compared to last year.

Motorola Solutions (MSI.US) opened with huge bearish gap and price is heading towards local support at $123.73. Near term resistance can be found at $134.96. Source: xStation5

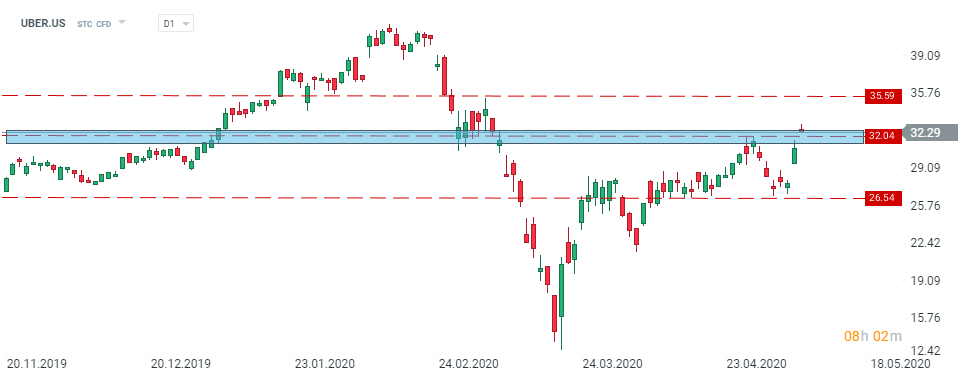

Uber Technologies (UBER.US) shares rose 6% in extended trading after the company reported its first quarter results. Company posted a net loss of $ 2.9 billion, its biggest loss in three quarters and a loss of $ 1.70 per share. Revenue of $ 3.54 billion came in slightly above analysts’ expectations. Uber announced that gross bookings for its Rides business dropped 5% compared to last year, however its gross bookings for its Eats food delivery business increased 52%. "While our Rides business has been hit hard by the ongoing pandemic, we have taken quick action to preserve the strength of our balance sheet, focus additional resources on Uber Eats, and prepare us for any recovery scenario," said CEO Dara Khosrowshahi in a statement.

Uber Technologies (UBER.US) shares gain momentum after publication of the first quarter results. In current moods prevail, price may test local resistance at $35.59 per share. Source: xStation5

Uber Technologies (UBER.US) shares gain momentum after publication of the first quarter results. In current moods prevail, price may test local resistance at $35.59 per share. Source: xStation5Macy’s (M.US)– will publications delay of its first quarter earnings report until July 1, due to coronavirus-related business disruptions which have also delayed preparation of its financial statements. In the past the company usually posted its first quarter results in mid-May.

Yelp (YELP.US) said it had a loss of 22 cents per share on revenue of $250 million, while analysts anticipated a loss of 11 cents per share on revenue of $229 million, according to Refinitiv. “While there is no way of knowing how long this pandemic will last, we are encouraged by the early signs of stabilization in the business that we witnessed in the second half of April,” said Yelp co-founder and CEO Jeremy Stoppelman in the company’s earnings release. The restaurant review website’s shares lost 4% in extended trading.

Roku (ROKU.US) stock dropped 7.9% after its net loss widened in the first quarter due to higher subscriber acquisition costs and a decrease in the advertising revenue on its free channel.

Ford (F.US) - is planning to restart date its North American operations on May 18. Company announced it would resume production with enhanced safety measures for workers.

General Motors (GM.US) priced a new $4 billion debt offering, which includes $1 billion in notes due in 2023, $2 billion in notes due in 2025, and $1 billion in notes due in 2027.

Daily summary: Sentiments on Wall Street stall at the end of the week🗽US Dollar gains

US100 loses 0.5% 📉Meta shares decline extends on AI CAPEX worries & Deutsche Bank remarks

AbbVie near 1-month low after earnings report 📉

CHN.cash under pressure despite positive Trump remarks 🚩