Tuesday’s session was not favourable for buyers. A sell-off in bonds, triggered by growing investor concerns, dragged stock markets worldwide lower. S&P 500 futures at times lost more than 1.5%. Today’s session opens with a correction of that nervous decline. S&P is up 0.3% and NASDAQ is up 0.7%.

The market managed to reverse most of yesterday’s losses, but the U.S. session still ended in the red. The main U.S. stock index fell about 0.6%. Key risk factors were mounting investor fears about maintaining strong results amid a weakening economy. Some also expressed concerns over the health of the current president and priced in his potential resignation. The tipping point came with a sudden sell-off in G7 bonds, as investors appear to be pricing in long-term risks and inflation.

Today, positive sentiment is being fuelled by tech companies, dovish comments of Waller and weak labor market data giving hope for sooner and deeper rate cuts.

Macroeconomic Data:

The U.S. Bureau of Labor Statistics published today’s much-anticipated employment data. Investors expected further cooling of the labor market, but readings turned out to be even worse than expected.

Job Openings:

- Published: 7181k (Expected: 7.382k, Previous: 7.437M)

Later in the day, the market will await a speech from FOMC member Kashkari as well as the release of the Beige Book.

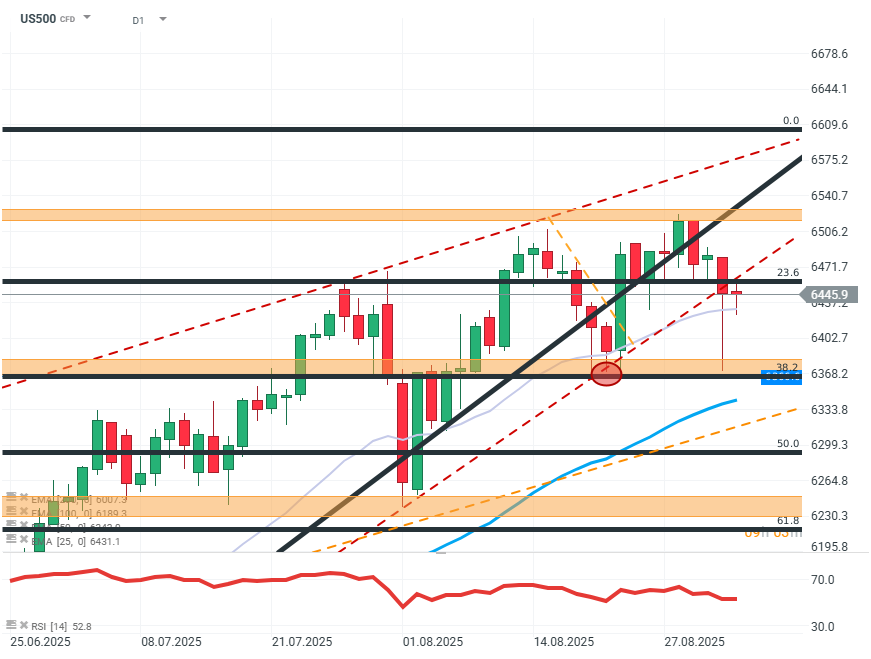

US500 (D1)

Source: Xstation

On the chart, one can observe the relative strength of buyers who, despite a sharp and sudden decline, easily defended the support level around the 38.2 FIBO retracement. The price quickly returned to the area near the lower boundary of the medium-term uptrend, but failed to move back into the rising channel. Given the current chart situation, a likely scenario is price consolidation between the last peak and the resistance zone around $6,360. On the other hand, the sharp and sudden drop may signal a shift in sentiment and a trend reversal to bearish.

Company News:

Alphabet (GOOGC.US) / Apple (AAPL.US) — Tech stocks are rallying after a key court ruling. In an antitrust lawsuit, the court decided Google would not be forced to split its business into smaller companies and will retain the ability to promote its search engine as default. In return, the company is obliged to share collected data with competitors. Alphabet shares are up over 6% and Apple is up 3%.

Kraft Heinz (KHC.US) — The food producer is recovering some of the previous session’s losses after receiving an upgraded rating from Morgan Stanley. Shares are up more than 1% in pre-market trading.

Zscaler (ZS.US) — The software maker is down more than 3% at the open despite reporting strong Q2 2025 results. The results beat investor expectations, and the company also issued an optimistic outlook.

Dollar Tree (DLRT.US) — The retailer released its results, beating analyst expectations with growth in EPS, revenue, and sales. The company also projected solid future growth. However, the results and forecasts did not please investors. Shares are down nearly 9%.

Daily summary: exceptionally low US trade deficit; dollar remains strong 📌

NY Fed Survey: higher inflation expectations, but also higher equity price expectations 📄🔎

Micron Bets Billions on AI. Here’s What’s Driving the New Semiconductor Supercycle! 📈

Cryptocurrencies sell-off 📉Ripple loses despite Amazon partnership