-

Wall Street opens slightly lower

-

Semiconductor shares drop after WSJ report

-

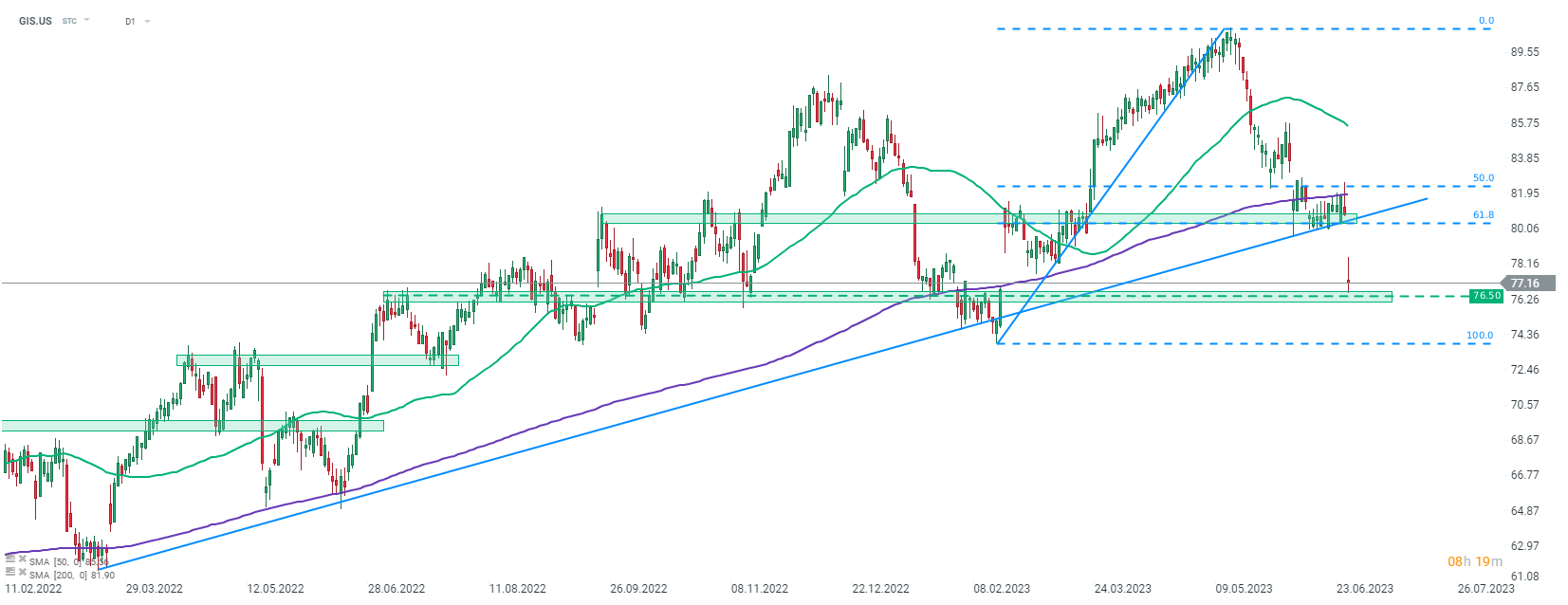

General Mills drops after fiscal-Q4 2023 earnings

Wall Street indices launched today's trading slightly lower. Nasdaq was almost 0.4% lower at the opening while Dow Jones and S&P 500 dropped 0.2-0.3%. Semiconductor stocks a driving tech sector lower amid reports that the US may be considering additional restrictions on chip exports to China.

Source: xStation5

Source: xStation5

Nasdaq-100 (US100) rallied yesterday and jumped above the 15,000 pts resistance zone as well as the short-term downward trendline. However, buyers failed to maintain bullish momentum and the index failed to break above the 15,140 pts resistance zone. US100 pulled back later on and now bulls attempt to keep it above the aforementioned downward trendline. If the 15,000 pts support holds, another upward impulse may be generated with 15,140 pts being the first target. Note that the upper limit of a local market geometry can be found in the 15,140 pts area and a break above would hint at a bullish trend reversal.

Company News

General Mills (GIS.US) is trading lower today following the release of fiscal-Q4 2023 earnings. Company reported a 1% YoY increase in EPS to $1.12 (exp. $1.07) and 3% YoY increase in revenue to $5.03 billion (exp. $5.18 billion). Company expects organic net sales to increase 3-4% in full fiscal-2024. Adjusted operating profit and adjusted EPS are expected to be 4-6% higher than $3.5 billion and $4.30, respectively, reported in fiscal-2023. Forecast were seen as disappointing, leading to share price drop. Company decided on a 9% dividend increase.

US chip stocks trade lower following a Wall Street Journal report suggesting that US lawmakers are considering a new set of restrictions on chip sales to China, targeting chips used in AI. Nvidia (NVDA), Advanced Micro Devices (AMD.US) and Marvel Technology (MRVL.US) are among stocks negatively impacted by the news.

Coinbase (COIN.US) and other crypto-related stocks are pulling back as cryptocurrencies are taking a hit today.

Analysts' actions

-

Pinterest (PINS.US) upgraded to "overweight" at Wells Fargo. Price target set at $34.00

-

Carnival (CCL.US) cut to "hold" at CFRA. Price target set at $16.00

-

Coherent (COHR.US) cut to "neutral" at B Riley. Price target set at 47.00

General Mills (GIS.US) launched today's trading with a big bearish price gap. Stock slides after a disappointing guidance for fiscal-2024. A $76.50 support zone was tested at the beginning of today's trading but bears failed to deliver downside breakout. Source: xStation5

General Mills (GIS.US) launched today's trading with a big bearish price gap. Stock slides after a disappointing guidance for fiscal-2024. A $76.50 support zone was tested at the beginning of today's trading but bears failed to deliver downside breakout. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street