Summary:

-

US indices remain near record highs

-

NYSE and NASDAQ closed

-

Quiet trade due to Thanksgiving holiday

There was a gap lower in US indices overnight and news that president Trump had signed the Hong Kong bill caused a quick spate of selling. The move was fairly measured however and only amounted to around 15 points from high to low but it still represented a relatively rare occurrence of late.

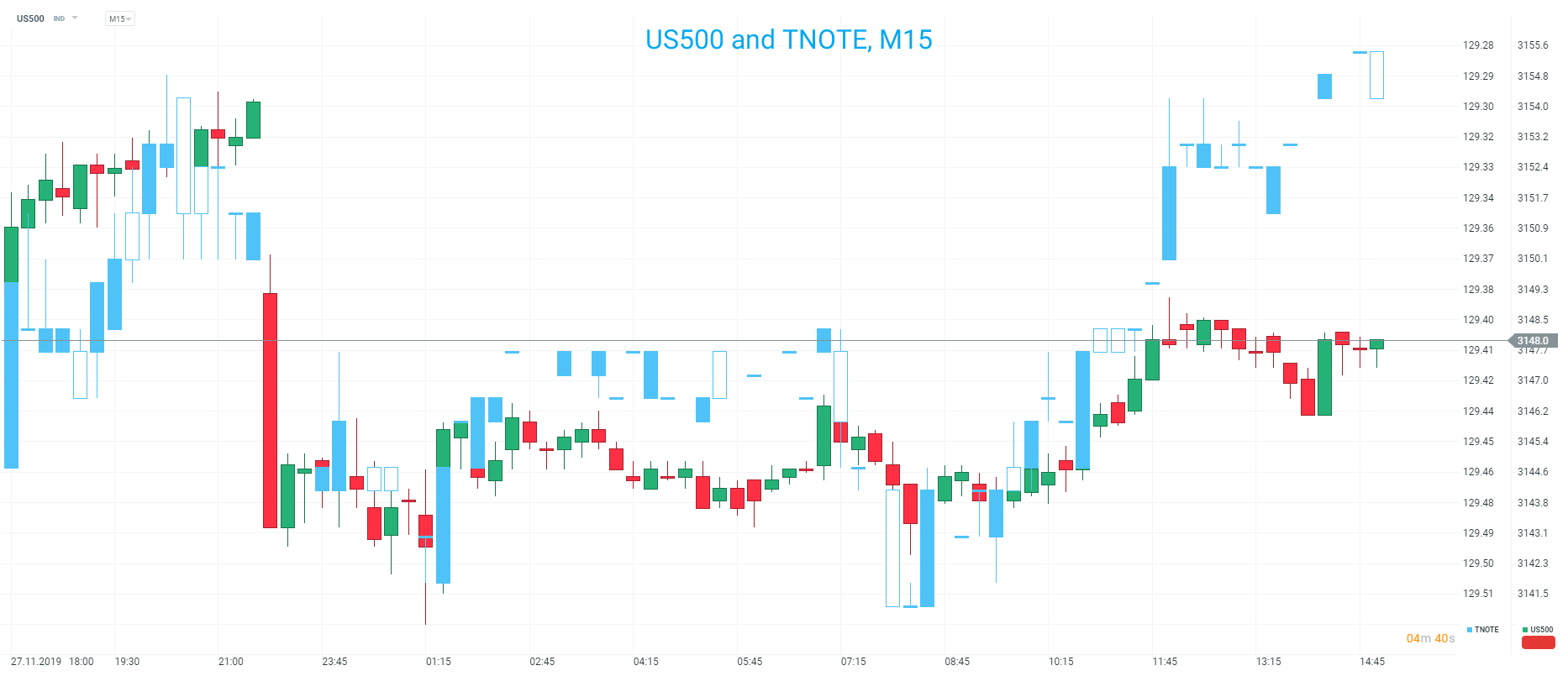

US stocks dipped lower overnight with a gap but have since recovered and trade around 7 points from their all-time high. The US session is expected to be a quiet affair with the Thanksgiving holiday meaning that the stock exchanges are closed and futures will trade with shortened hours. Source: xStation

Since then the markets have ground back higher in a steady fashion and with both the New York Stock Exchange and NASDAQ closed for the Thanksgiving holiday the current price action has a fairly sleepy feel. One this to possibly note is the move in the US 10-year bond which while not dramatic has been pretty clear. The government bond market trades inversely to stocks around periods of risk-off flows, such as that seen on the Hong Kong news, and there was a gap higher seen overnight.

US500 and TNOTE can show inverse correlations around risk-related news. Notice that the TNOTE (axis inverted) has closed its gap from the overnight news and made new lows for the day in the past 15 minutes whilst the US500 is yet to do so. Source: xStation

US500 and TNOTE can show inverse correlations around risk-related news. Notice that the TNOTE (axis inverted) has closed its gap from the overnight news and made new lows for the day in the past 15 minutes whilst the US500 is yet to do so. Source: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes