Thursday started in euphoric moods on indices but ended with a panic sell-off, triggered by US tech stocks. While there was no obvious single reason, it all started with Tesla. The company first announced share sale and then we learned that a major shareholder reduced his stake – a sign that valuation could be simply too high.

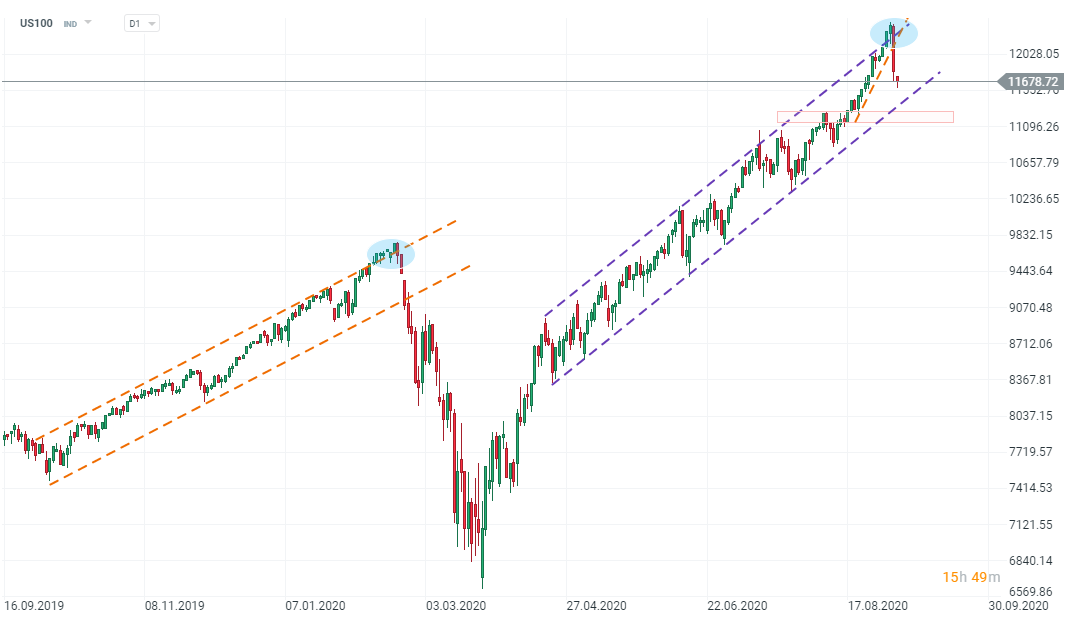

Valuation concerns are present for the whole tech sector and little wonder US100 was the biggest sell-off victim among indices. What’s next? The index is still very high and within a very steep upwards channel. A lower limit of this channel runs around 11450 points while a previous local high is around 11265 – these are support level to watch.

However, when the index made an attempt to break higher from a similar channel in February it eventually ended in a massive sell-off. This situation looks similar but obviously back in February pandemic was the main reason.

However, when the index made an attempt to break higher from a similar channel in February it eventually ended in a massive sell-off. This situation looks similar but obviously back in February pandemic was the main reason.

Traders will receive one more crucial piece of information today – the NFP report from the US (1:30pm BST). We will comment the release in the “News” section for you.

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉