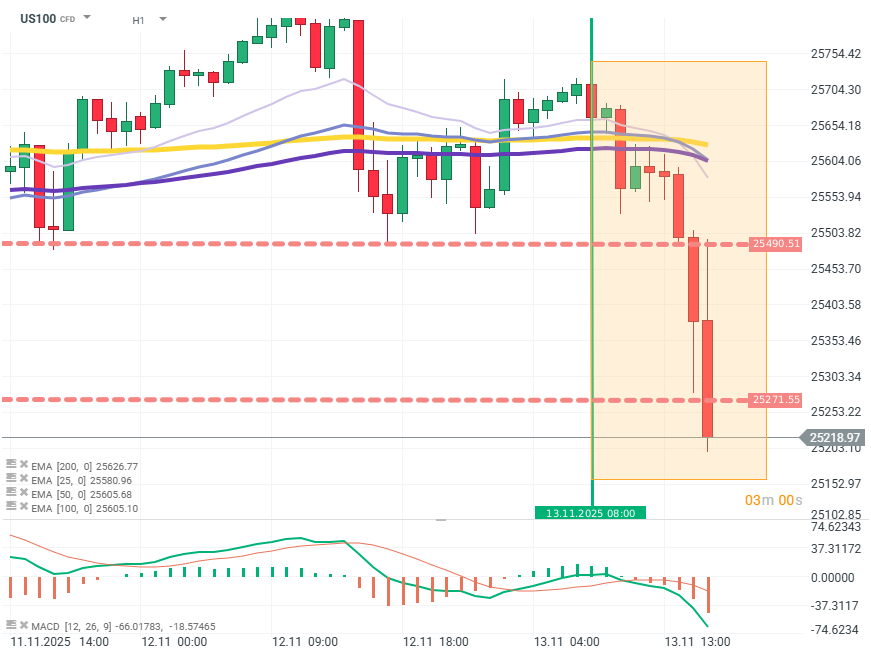

Despite the government's reopening, the markets are not showing optimism in today's session. NASDAQ100 futures are losing as much as 1.4%.

The main downward impulse on Wall Street is the change in expectations regarding the FED's interest rate path. The probability of a rate cut at the December meeting has already dropped to 50% from over 70% just a few weeks ago. Importantly, this is happening alongside the weakening of the dollar.

A secondary factor dampening investor sentiment is the EU's investigation into Google. The tech giant is losing as much as 3%, which is enough to exert downward pressure on the index single-handedly.

US100 (H1)

Source: xStation5

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

🚨 EURUSD deepens decline, falls to key support zone

Morning wrap (03.03.2026)