Major Wall Street indexes continue to move lower on Wednesday as higher than expected German CPI and hawkish comments from FED members bolstered the case for further rate increases which overshadowed initial optimism surrounding robust Chinese manufacturing data. Fed's Bostic still believes that the US central bank"s policy rate should be raised to the 5.00%-5.25% range and stay at that level well into 2024.Earlier Fed's Kashkari said he is not sure if FED will be able to achieve a soft landing. Following these comments US short-term interest-rate futures fall, pricing in Fed policy rate rising to 5.5%-5.75% range by September.

Domestically, the latest ISM report showed that the US manufacturing sector contracted for a fourth consecutive month in February. Today's sell-off is accompanied by an uptick in Treasury yields. The 1-year yield broke above 5%, while benchmark 10-year yield oscillates slightly below 4.0%, a level not seen since November which additionally weighs on tech and other high-growth stocks.

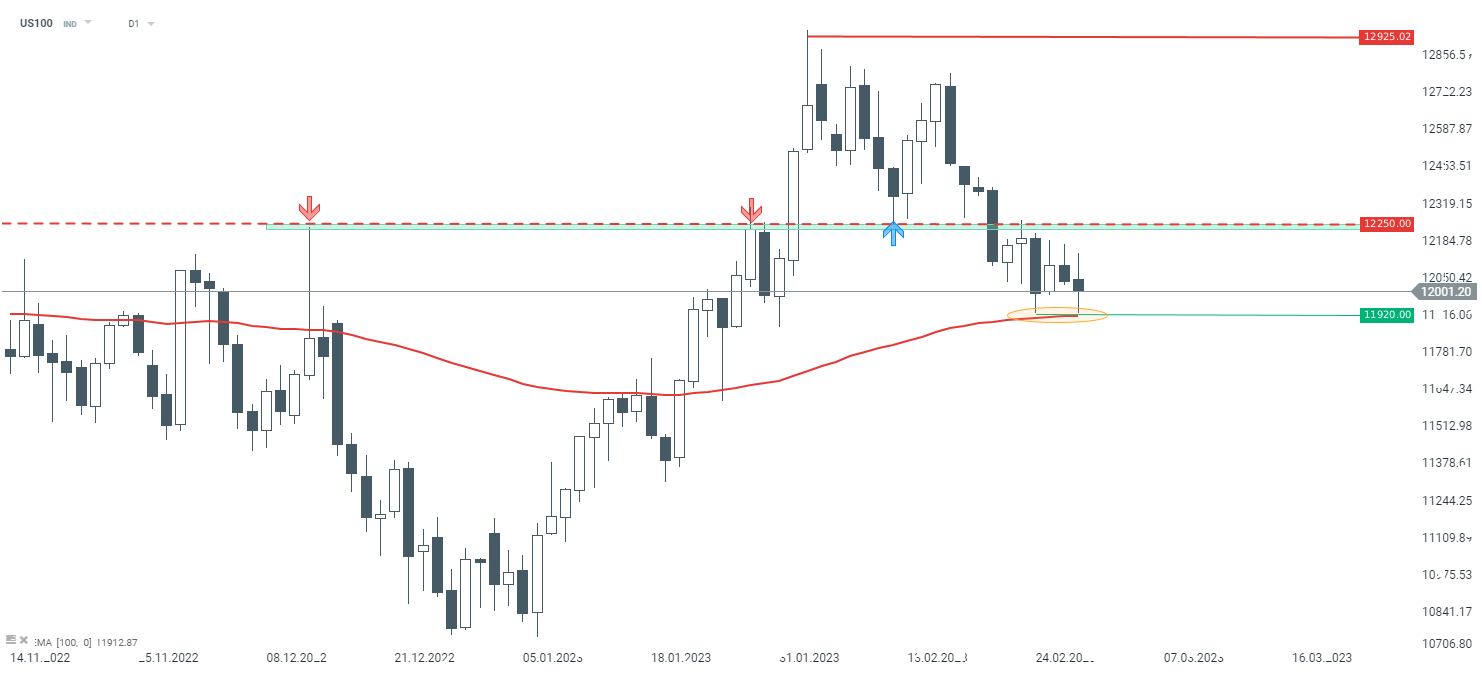

US100 started today's session with a move lower. Nevertheless, looking at the D1 interval, the downward impulse was halted at the EMA100 average, which acts as key short-term support. Should a break lower occur, the downward movement may gain steam. Otherwise, if the price stays above the aforementioned EMA, another upward impulse may be launched towards resistance zone at 12,250 pts Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Daily summary: Weak US data drags markets down, precious metals under pressure again!