US index futures trade slightly higher on the day with market attention moving to the US Q4 GDP report release, scheduled for 1:30 pm GMT today. Market is expecting annualized pace of growth to slow from 3.2 to 2.6% in Q4 2022 and core PCE inflation to drop from 4.7 to 4.0% QoQ in Q4 2022. Apart from US Q4 GDP release, December's durable goods orders data will also be released at 1:30 pm GMT, as well as weekly jobless claims print. Attention today will be mostly on GDP growth figures as monthly PCE reading for December, which is more timely than quarterly reading and draws more attention, will be released tomorrow at 1:30 pm GMT. Today's GDP report combined with tomorrow's PCE data may be key for determining the Fed's move at a meeting next Wednesday. So far, markets and economists are inching towards a 25 bp rate hike.

Nasdaq-100 futures (US100) outperform other Wall Street indices more than an hour ahead of the release. Improved sentiment towards the tech sector can be reasoned with solid performance of Tesla, following Q4 2022 earnings release yesterday after close of the market. Meanwhile, EURUSD is trading a touch lower on the day as the US dollar struggles to find direction.

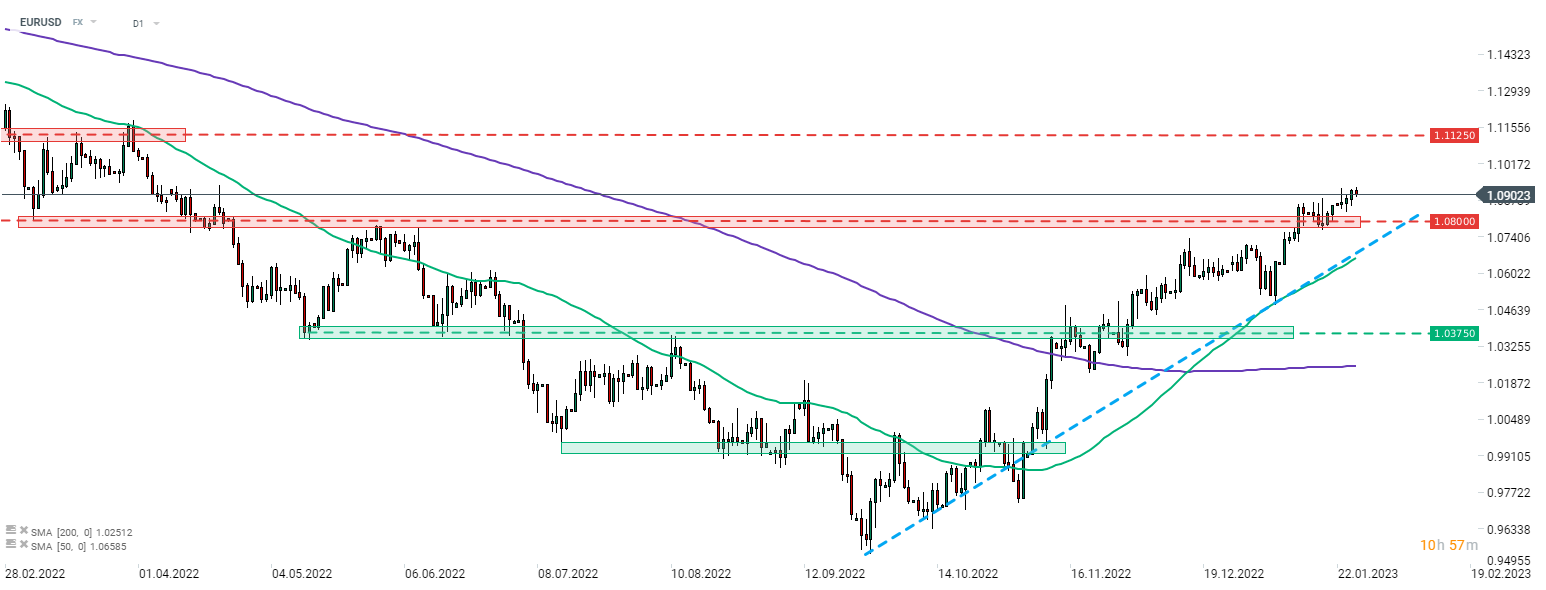

EURUSD is trading little changed on the day near 1.09 handle as investors await hints from the US Q4 GDP report (1:30 pm GMT). Source: xStation5

EURUSD is trading little changed on the day near 1.09 handle as investors await hints from the US Q4 GDP report (1:30 pm GMT). Source: xStation5

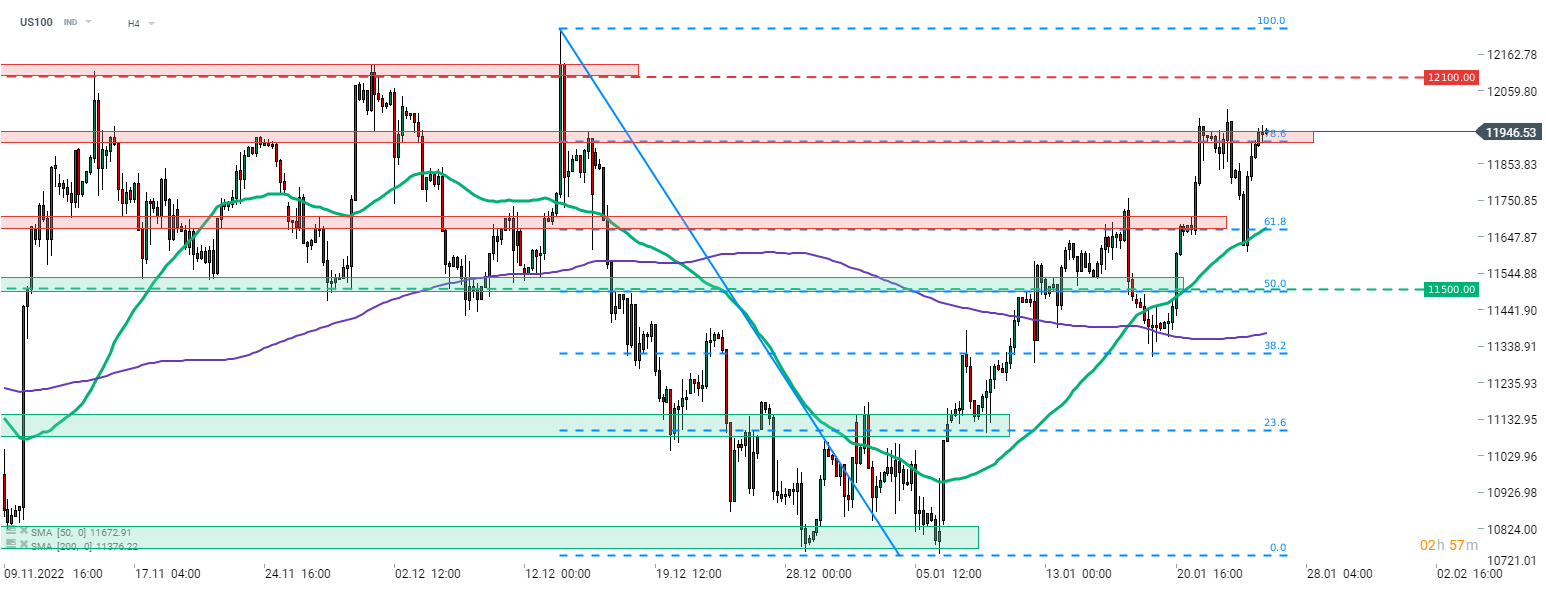

Nasdaq-100 (US100) is trading slightly higher today and is making another attempt at breaking above the resistance zone ranging above 78.6% retracement of the downward move launched in mid-December 2022 (11,900 pts). Source: xStation5

Nasdaq-100 (US100) is trading slightly higher today and is making another attempt at breaking above the resistance zone ranging above 78.6% retracement of the downward move launched in mid-December 2022 (11,900 pts). Source: xStation5

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Three Markets to Watch Next Week (16.01.2026)

US OPEN: Bank and fund earnings support valuations.

MIDDAY WRAP: Capital flows into European technology stocks 💸🔎