-

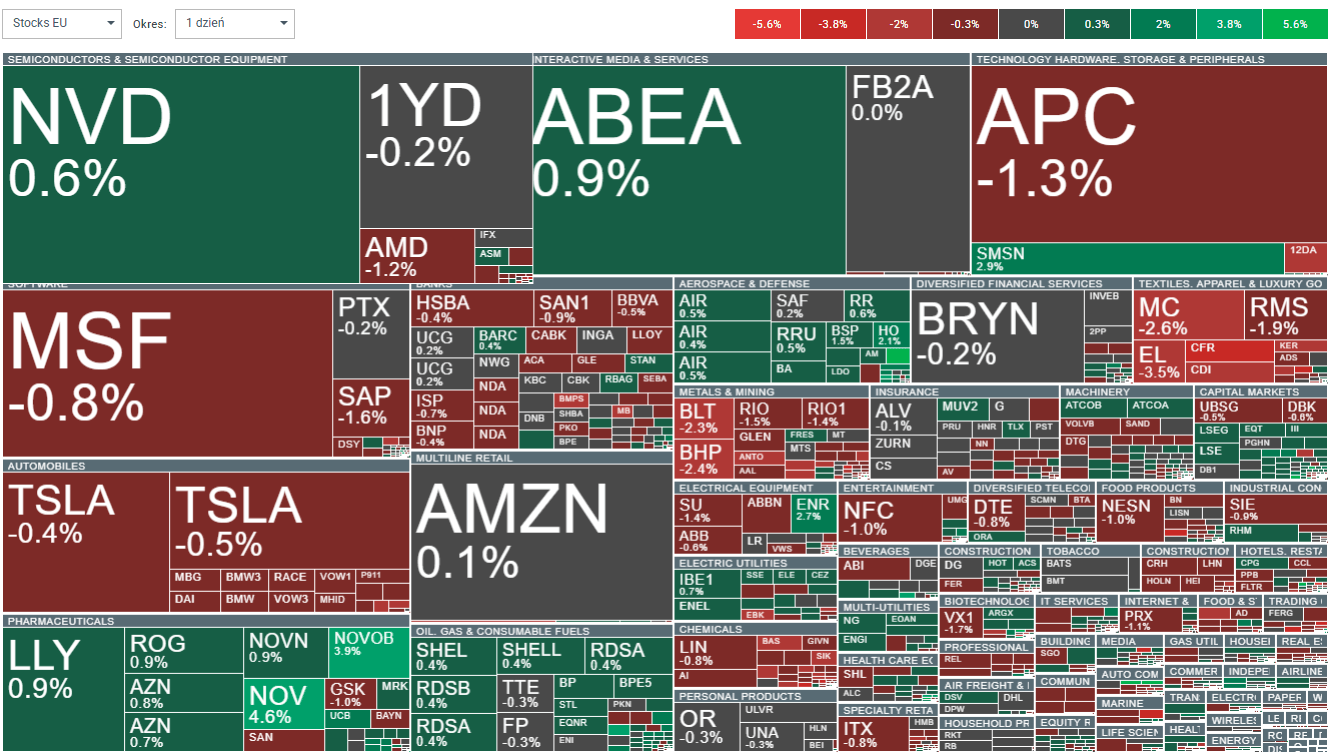

Sentiment in European equity markets remains mixed toward the end of the week. The Euro Stoxx 50 is down 0.40%, Germany’s DAX is up 0.10%, and overall moves are contained within a ±0.40% range.

-

Market mood in Europe is increasingly shaped by the technology sector, which is up 11.8% YTD. This makes it the second-best performing sector after basic resources and clearly stronger than US technology stocks, which are currently consolidating.

-

Companies such as ASML, ASM International, and BE Semiconductor account for nearly 40% of the Stoxx 600 Technology Index and have generated almost 90% of the sector’s gains this year.

-

Optimism was further reinforced by TSMC, which delivered very strong capital expenditure guidance, supporting expectations of a sustained upswing among its supply-chain partners. The world’s largest contract chipmaker forecasts capex growth of around 30% in 2026, along with a significant increase in spending over the following three years.

-

Confirmation of strong demand in TSMC’s results is clearly positive for European suppliers of data-center and semiconductor manufacturing equipment. Demand for production tools is expected to remain strong beyond 2026, especially as new fabs come online and physical capacity constraints gradually ease.

-

Morgan Stanley raised its price target for ASML to EUR 1,400 (from around EUR 1,165 currently, implying roughly 20% upside). This is among the highest valuations on the market. The bank expects strong order inflows over the next two to three quarters, with improved growth prospects likely to persist at least through 2027.

-

The current rally marks a reversal of earlier weakness among European semiconductor equipment makers, which had lagged US peers at the start of the AI boom.

-

Valuations of European tech companies are gradually catching up with their US counterparts. ASML trades at around 43x forward earnings, compared with its 10-year average of roughly 29–31x. The Stoxx 600 Technology Index is valued at about 27x forward earnings, broadly in line with US levels.

-

Global markets show mixed sentiment: US100 and US500 futures are slightly higher, while Asian equities have reached record levels following TSMC’s results.

-

In commodities, oil has edged higher to around USD 59.80 per barrel, while precious metals such as gold and silver are seeing modest declines.

-

Investor attention may also turn to European clean-energy stocks after a US court allowed Equinor to resume construction of a large offshore wind farm near New York.

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉