Futures on Nasdaq100 (US100) soars more than 1.4% today and stronger than expected macro readings from US didn't stop Wall Street bulls, as Taiwan Semiconductors improved sentiments among chip producers.

- US jobless claims as well as housing starts and buildings permits came in stronger than expected but Wall Street looks closely into Taiwan Semiconductor (TSM.US) strong earnings and optimistic remarks over chips and AI

- Strong macro data from US supported dollar and 10-year yields but from the 2 PM GMT we can see the US dollar index futures (USDIDX) declines from 103.4 to 103.2

- According to Mark Liu, the Chairman of TSM, the largest chip producer in the world, AI is still in a nascent stage and 'we are only seeing the tip of the iceberg'

- The company expects 20% revenue growth in 2024, AI and high performance computing will be it the biggest growth drivers in current year

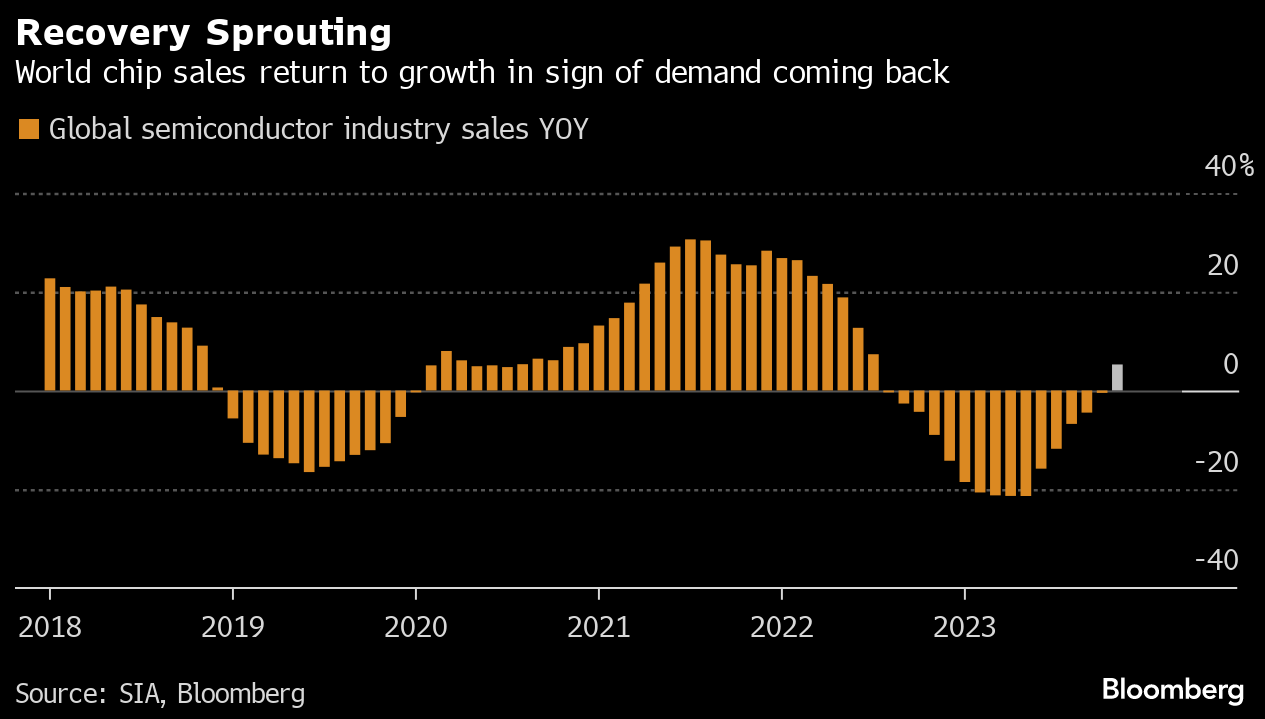

- Markets expect that not only AI but also cyclicality may support semiconductor producers in a new year. We can see huge gains among AMD (AMD.US), Nvidia (NVDA.US) or Marvell Technology (MRVL.US) but the strongest gainer today is TSM with stocks rising more than 8%

- Today, gains are also supported by Apple (AAPL.US) as company shares soars by 3.2%. Bank of America analysts raised the company to 'buy' from a previously 'neutral' rating. Analysts highlighted a new revenue stream for Apple, from VR and AR. On the other hand, iPhone prices are being slashed in China ahead of the Lunar New Year holiday, with major online retailers offering competing discounts as the device faces flagging sales amid competition from Huawei and other Chinese brands.

Source: Bloomberg Finance LP, SIA

Source: Bloomberg Finance LP, SIA

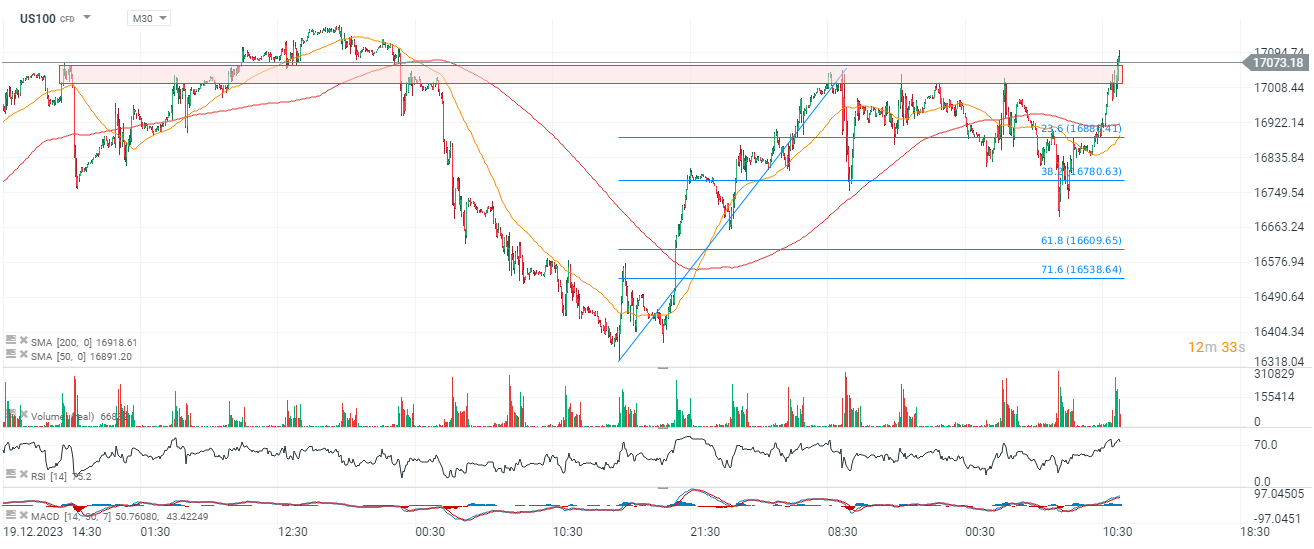

US100 and TSM.US charts (M30, D1)

US100 gains today on strong, buyers volume and is only 130 points below all-time-highs.

Source: xStation5

Source: xStation5

Shares of Taiwan Semiconductors (TSM.US) opened today session with huge, bullish gap, breaking out above levels of local highs from June 2023. Price has approached record level from February 2022 as company expects stronger demand on phones and AI chips solutions, in 2024.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?