Fed decision did not bring any surprises in terms of interest rates. Rates were left unchanged at previous levels as expected. However, the Bank said that it will be appropriate to hike them as soon as the economy continues to improve. The US central bank also said that it will complete the QE taper in early-March and the reduction of the balance sheet will begin after the first rate hike.

That is some strong guidance but lacks key information - when the first rate hike will come? Fed Chair Powell will surely be pressed about the issue during the press conference at 7:30 pm GMT. Markets are pricing a 90% chance of a rate hike coming as soon as in March but will Powell confirm it?

Markets reacted positively to the announcement. Indices jumped with US100 testing 14,600 pts handle. GOLD moved higher initially but gave back gains later on and is now trading little changed compared to pre-announcement levels. USD moved higher initially just like gold but has given back gains later on and now trades lower. EURUSD erased daily gain to trade little changed.

US100 tested 14,600 pts area after FOMC decision that is marked with the downward trendline. The inital downward move was partially erased. Markets' attention turns to Powell's presser at 7:30 pm GMT. Source: xStation5

US100 tested 14,600 pts area after FOMC decision that is marked with the downward trendline. The inital downward move was partially erased. Markets' attention turns to Powell's presser at 7:30 pm GMT. Source: xStation5

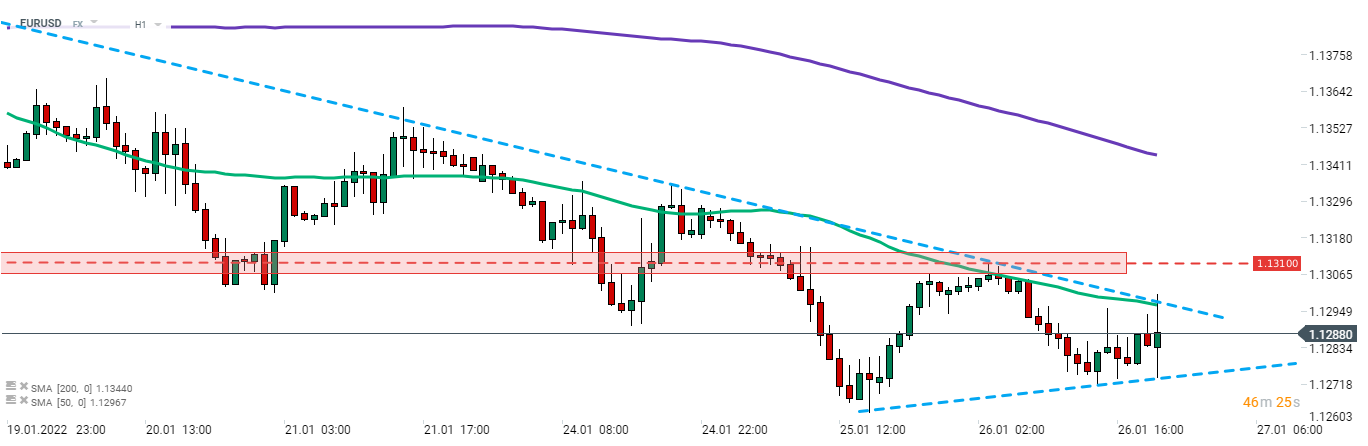

EURUSD erased daily gains following the FOMC decision announcement and now trades little changed on the day near both limits of the triangle pattern. Source: xStation5

EURUSD erased daily gains following the FOMC decision announcement and now trades little changed on the day near both limits of the triangle pattern. Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)