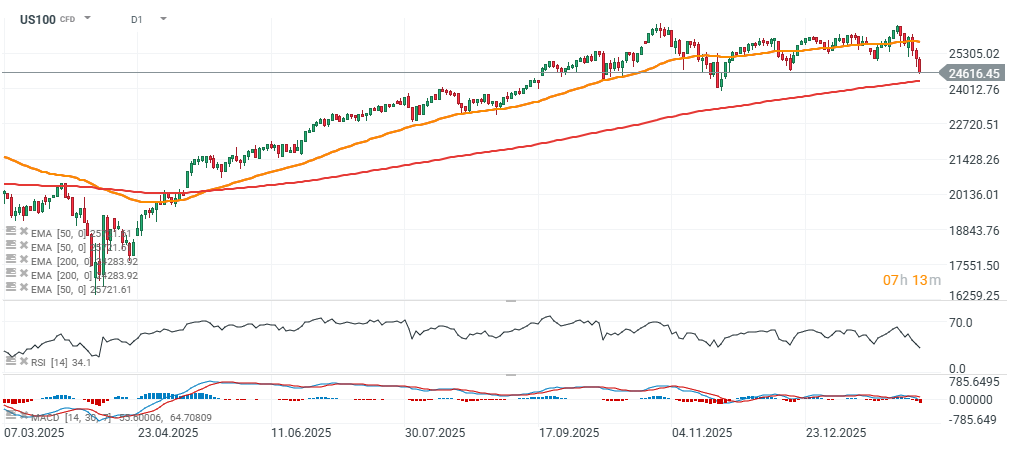

Nasdaq 100 (US100) futures are extending the early-week sell-off and are down more than 2% today. Weak sentiment in the technology sector has been further intensified by weaker-than-expected labor market data. Jobless claims rose more than forecast, while Challenger-reported layoffs surged by over 200% year-on-year in January. As a result, US100 is now trading only about 300 points above the 200-session exponential moving average (EMA200), marked by the red line. Cash indices are also under pressure: the DJIA and S&P 500 are down around 1.2%, while the small- and mid-cap Russell 2000 is down more than 1.3%.

Key US labor-market figures

• Initial jobless claims: 231k vs 212k expected and 209k prior week

• JOLTS (December): 6.54m vs 7.25m expected and 7.14m prior

• Challenger (January): 108.4k vs 35.5k in December

US100 (D1 timeframe)

The daily RSI for Nasdaq 100 futures is falling to around 34 today, a level not seen since the autumn correction. The EMA50 is located near 25,700 points.

Source: xStation5

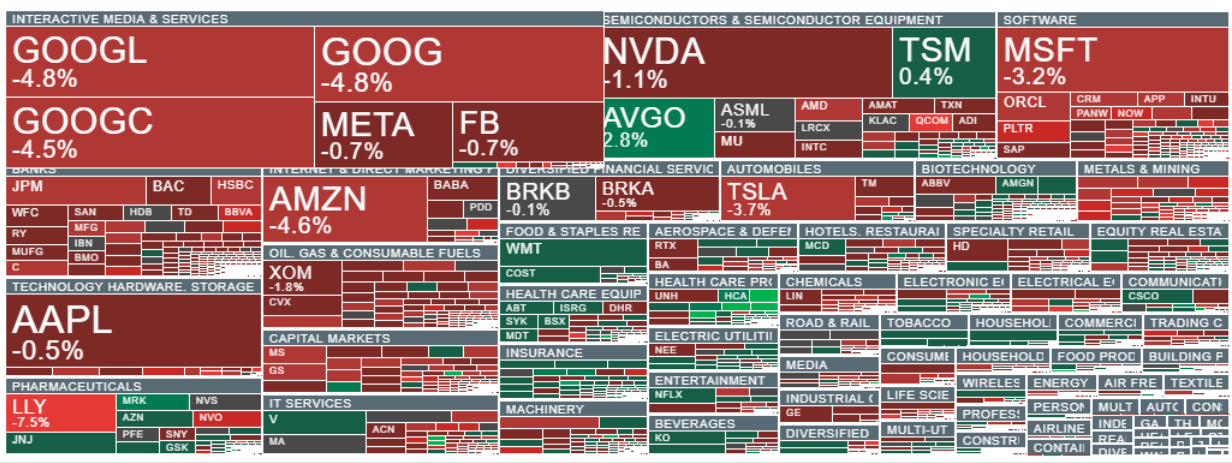

Negative sentiment in the software space has now spread across the broader tech sector, and the pullback is visible across almost all sub-sectors. Semiconductors are also declining, with Broadcom (AVGO.US) and TSMC (TSM.US) standing out as the only notable gainers. Heavy losses are seen in major names: Amazon and Alphabet (down nearly 5%), Microsoft (down more than 3%), and Tesla (down nearly 4%). Sentiment is also weak in financials and banking, where concerns over loan exposure to the software sector and a broader deterioration in market mood have triggered profit-taking. Recent gains are reversing in obesity drug maker Eli Lilly (LLY.US) as well, with the stock down more than 7%.

Source: xStation5

Oil surges almost 2% amid US - Iran tensions 📈

📉US100 loses 2%

US100 loses 1% amid Nvidia weakness 📉Heico crashes 13%

D‑Wave Quantum: Concrete Results Today, Big Dreams Tomorrow