The US100 is up 0.4% today, approaching the 25,000 mark and sitting just 0.3% shy of its all-time high. The contract has fully reversed the decline that began yesterday evening and lasted until the start of the European session. Furthermore, gains on the Nasdaq 100 futures accelerated sharply upon the opening of Wall Street today.

The rally is occurring despite the ongoing government shutdown. While the shutdown may have limited immediate impact on the operations of key technology companies, Wall Street indices have historically tended to gain during government closures—an outcome that often appears counter-intuitive. Nevertheless, the shutdown increases the likelihood of a deterioration in the labour market, which could compel the Federal Reserve to cut interest rates.

Today's ADP report showed a loss of 32,000 private-sector jobs. This is the worst reading for private employment since January 2021. Furthermore, previous data was revised downwards.

The main drivers today are biotechnology and pharmaceutical stocks, even though the government shutdown may cause a slowdown in areas like new drug approvals. Chip manufacturers form the second strongest cohort of gaining stocks today.

Stocks within the Nasdaq 100 are split almost fifty-fifty in terms of gains and losses today. Source: Bloomberg Finance LP

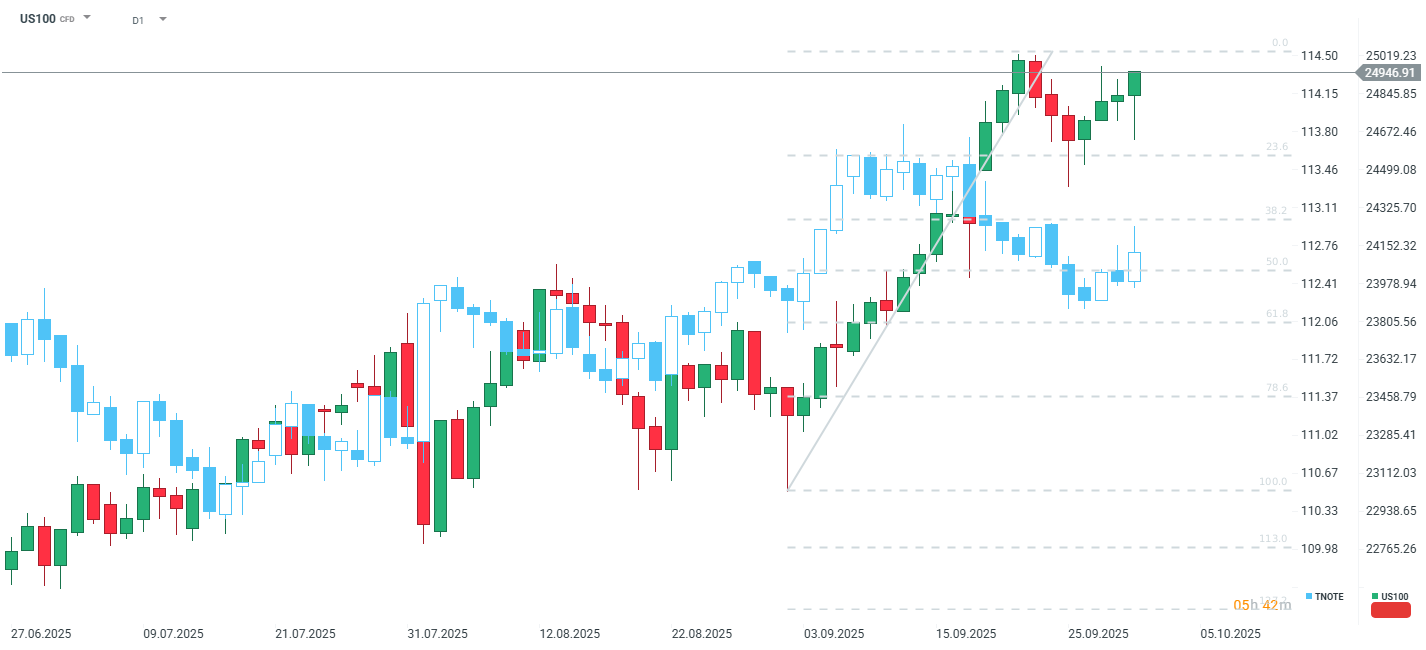

Stocks within the Nasdaq 100 are split almost fifty-fifty in terms of gains and losses today. Source: Bloomberg Finance LP The US100 has rebounded by approximately 1% (around 300 points) from its session low today. Source: xStation5

The US100 has rebounded by approximately 1% (around 300 points) from its session low today. Source: xStation5

Daily Summary: Euphoria on Wall Street; SILVER rebounds 10% 📱

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?