- US GDP report for Q1 2023 is expected to show annualized growth at 2%, down from 2.6% in Q4 2022

- Core PCE inflation is expected to come in at 4.7% QoQ, up from 4.4% QoQ in Q4 2022

- Banking turmoil and recent data for March suggests that economic growth may be slowed. Atlanta Fed GDP model also suggests it

US economy is slowing but a number of parts of the economy are still showing solid data. This is especially true for jobs market as well as the services sector. However, recent data releases (for Q2 2023) suggest that the US economy is slowing down more and more. Nevertheless, data for Q1 2023 should remain solid. Moreover, expectations for core PCE suggest that Fed should have less concerns over another, and possibly final, rate hike. On the other hand, today's data should confirm earlier expectations that recession risk in the United States decreased significantly (although it is still relatively high).

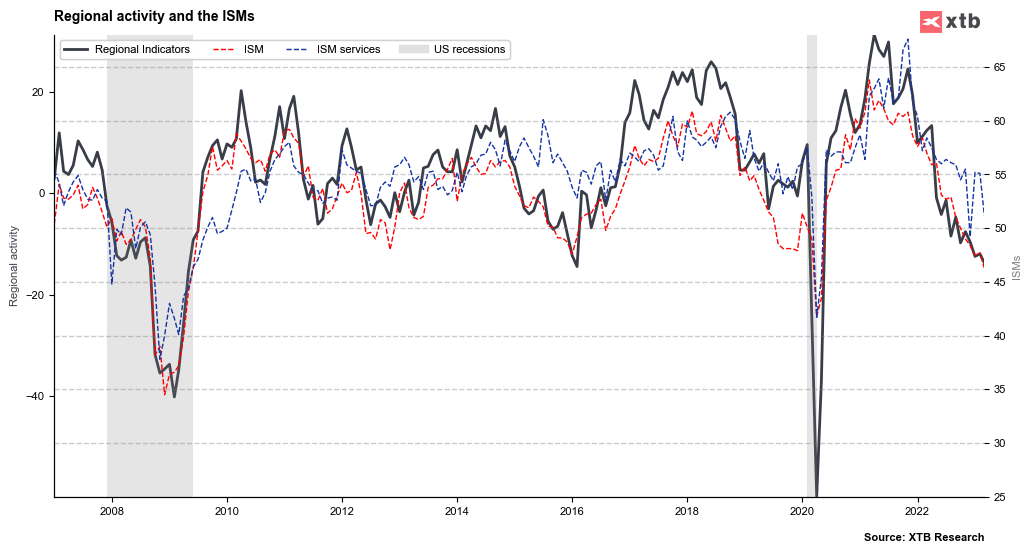

Regional Fed indices as well as manufacturing ISM index have been suggesting a noticeable economic slowdown for a long time. On the other hand, one should keep in mind that the majority of the US economy is made up of the services sector, which fared quite well in Q1 2023 and has just recently begun to show signs of slowdown. Source: Macrobond, XTB

Regional Fed indices as well as manufacturing ISM index have been suggesting a noticeable economic slowdown for a long time. On the other hand, one should keep in mind that the majority of the US economy is made up of the services sector, which fared quite well in Q1 2023 and has just recently begun to show signs of slowdown. Source: Macrobond, XTB

GDP model from Atlanta Fed has been pointing to a 2.5% annualized growth not long ago, but now it is showing just 1.1%. This is driven by lower impact of real spending and increased negative impact of real private investments. On the other hand, model suggests a slightly higher contribution from net exports.

GDPNow model suggests GDP growth below market consensus. Median estimate from Blue Chip survey (survey of 10 top-tier research companies) points to 1.5% GDP growth in Q1 2023. Source: Fed Atlanta

GDPNow model suggests GDP growth below market consensus. Median estimate from Blue Chip survey (survey of 10 top-tier research companies) points to 1.5% GDP growth in Q1 2023. Source: Fed Atlanta

What today's data may mean for the markets?

Reading close to market estimates could be a positive for Wall Street and may help alleviate concerns around banking sectors. Simultaneously, it should be neutral for USD as it will be more reactive to Fed. A strong GDP reading could provide fuel for USD gains as it would boost odds for more hikes from Fed. This, in turn, could be negative for Wall Street. Weak GDP report may have mixed impact on Wall Street but would most likely be negative for USD.

US100 is trading in the 13,000 pts area. Yields resumed climb (drop on TNOTE) and suggest a pullback. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Strong Service ISM Reading as activity expanded most since 2022