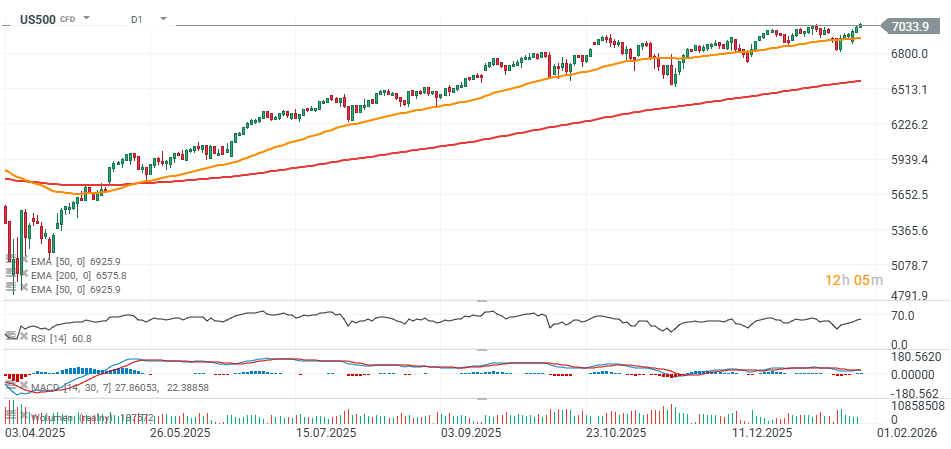

The S&P 500 contract (US500) hit a record high today around the 7,040 mark as markets brace for the Fed decision scheduled for 6 PM GMT. This week, four “Magnificent 7” companies are set to report Q4 results: Meta Platforms and Microsoft (both after the US session today), as well as Apple and Tesla. That setup suggests US500 could see elevated volatility - in both directions.

Source: xStation5

What about Big Tech earnings?

After today’s US close, two leading US tech giants — Microsoft and Meta Platforms — will report earnings. Market expectations are high.

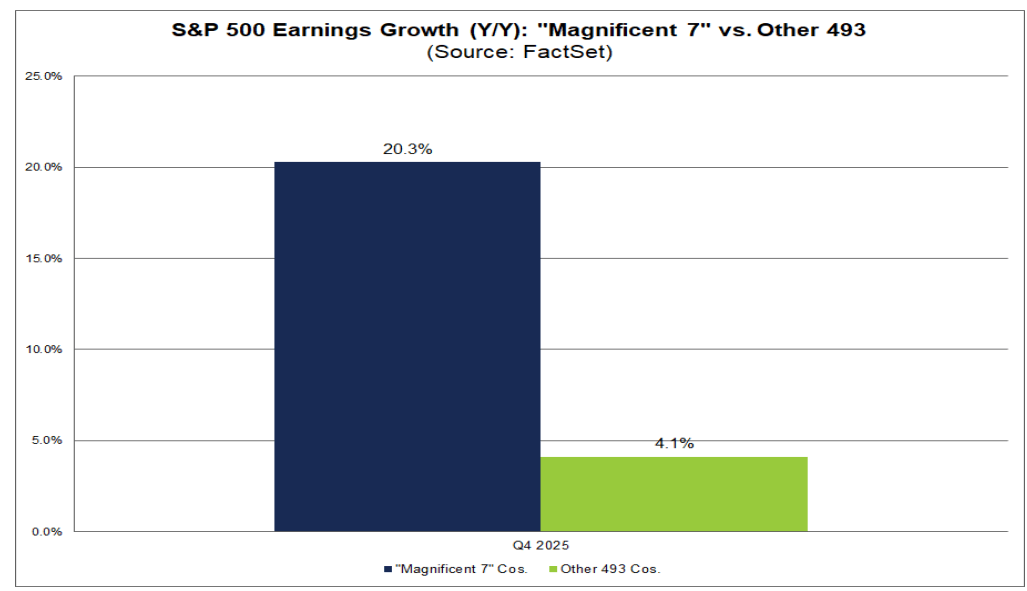

- In recent quarters, the so-called “Magnificent 7” have often been among the strongest drivers of year-over-year earnings growth for the entire S&P 500. The question is: how many of them are expected to rank among the top five contributors to earnings growth in Q4 2025?

- Consensus for the full S&P 500 points to +8.2% y/y blended earnings growth in Q4 2025. If this figure holds, it would mark the 10th consecutive quarter of earnings growth for the index.

- At present, the top five companies contributing the most to year-over-year earnings growth for the index in Q4 (ranked by contribution) are: Nvidia, Boeing, Alphabet (Google), Micron Technology, and Microsoft.

- This means three out of the five largest contributors to Q4 earnings growth are expected to be “Magnificent 7” names: Nvidia, Alphabet, and Microsoft, which reports today.

- Boeing (outside the “Magnificent 7”) is benefiting mainly from an easy base effect: a year ago the company posted a large loss (including charges and other expenses reflected in non-GAAP EPS).

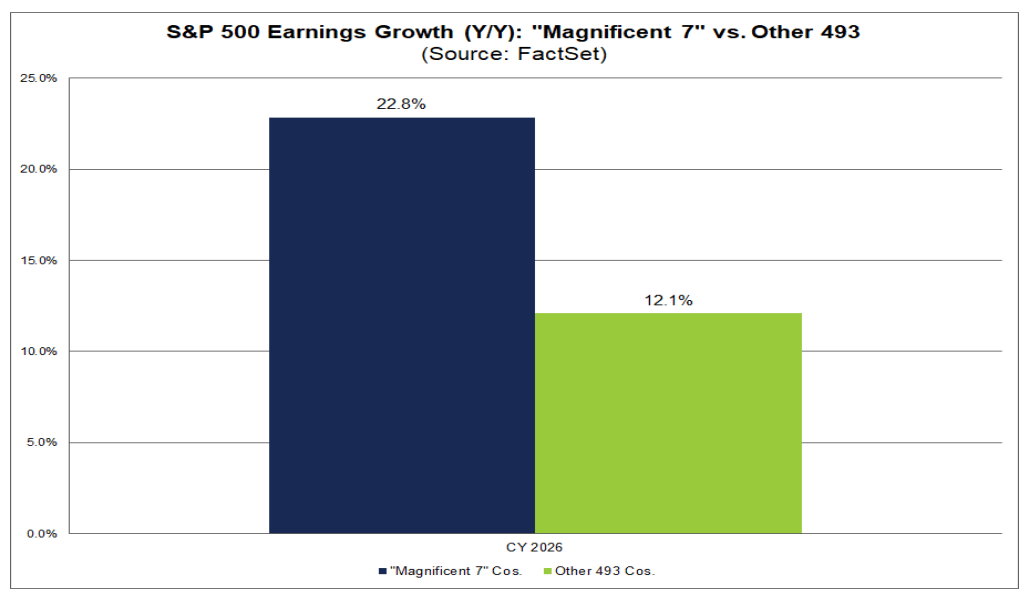

- Looking ahead, analysts expect double-digit earnings growth in 2026 for both the “Magnificent 7” and the rest of the index. Moreover, growth for the Mag7 is projected to accelerate to nearly +23% y/y, versus +12.1% for the remaining S&P 500 companies. If these estimates prove accurate — or even slightly conservative — the index could deliver solid performance this year.

The market is pricing in at least ~20% EPS growth for the Mag7 in Q4 2025, compared with only ~4% for the other 493 S&P 500 companies.

Source: FactSet Research

According to FactSet data as of January 23, about 13% of S&P 500 companies have reported results so far. 75% beat EPS expectations (positive surprise), while 69% beat revenue expectations.

- Estimate revisions: as of December 31, the market expected +8.3% y/y earnings growth for Q4; it is now marginally lower at +8.2%.

- Four sectors currently have lower earnings expectations than at the end of December, due to downward EPS revisions and negative earnings surprises.

- Guidance (Q1 2026): so far, six S&P 500 companies have issued negative EPS guidance for Q1, while four have issued positive guidance.

- Valuation: the S&P 500’s forward 12-month P/E stands at 22.1. That is above both the 5-year average (20.0) and the 10-year average (18.8). The market is relatively expensive versus history, but double-digit y/y earnings growth expected in 2026 provides a meaningful argument for an earnings “premium” in valuations.

Source: FactSet Research

Microsoft Preview: Azure, AI, and a Test of Growth Quality

Gold surges 2% testing $5300 level amid weakening US dollar 📈

AUDUSD: Will the RBA be the next central bank to return to rate hikes?

Daily summary: Wall Street and EURUSD rise ahead of tomorrow’s Fed decision 🗽 Oil gains