Such key events like FOMC or ECB decisions are already behind us and they failed to spur optimism on the markets. Moreover, banking sector issues continue to weigh on the risk appetite. Now the time has come for the final top-tier event of the week - release of US jobs market data for April!

Expectations

- Non-farm payrolls: 180k expected vs 236k previously (ADP: +296k)

- Private NFP: +160k expected vs 189k previously

- Unemployment rate: 3.6% expected vs 3.5% previously

- Wage growth (annual): 4.2% YoY expected vs 4.2% YoY previously

- Wage growth (monthly): 0.3% MoM expected vs 0.3% MoM previously

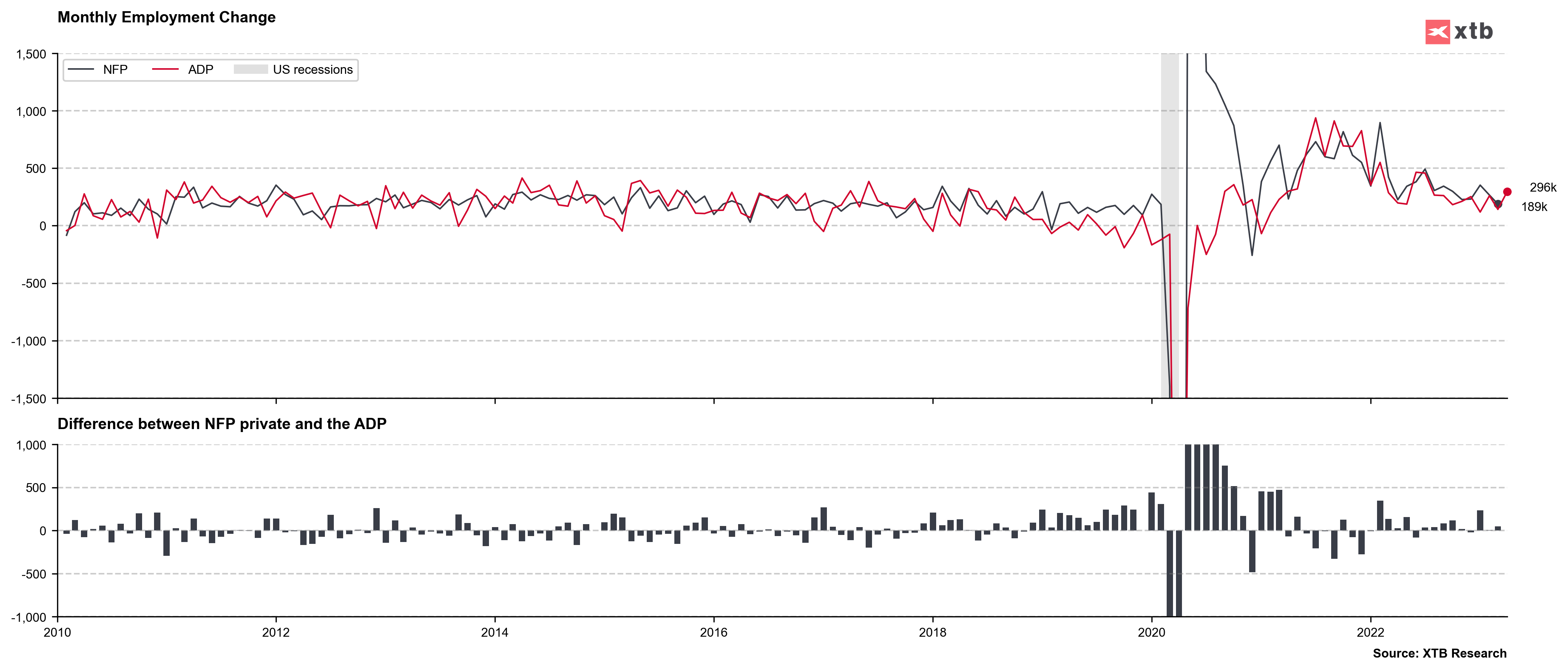

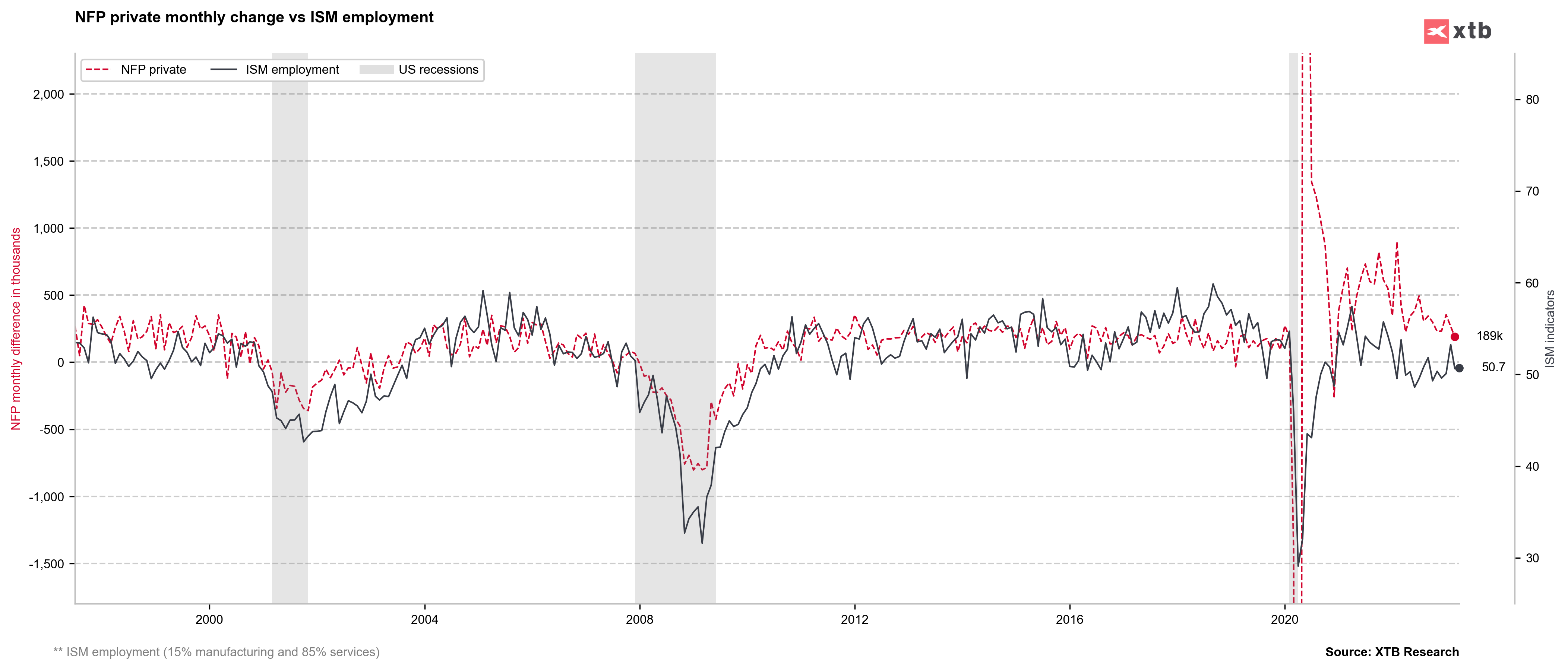

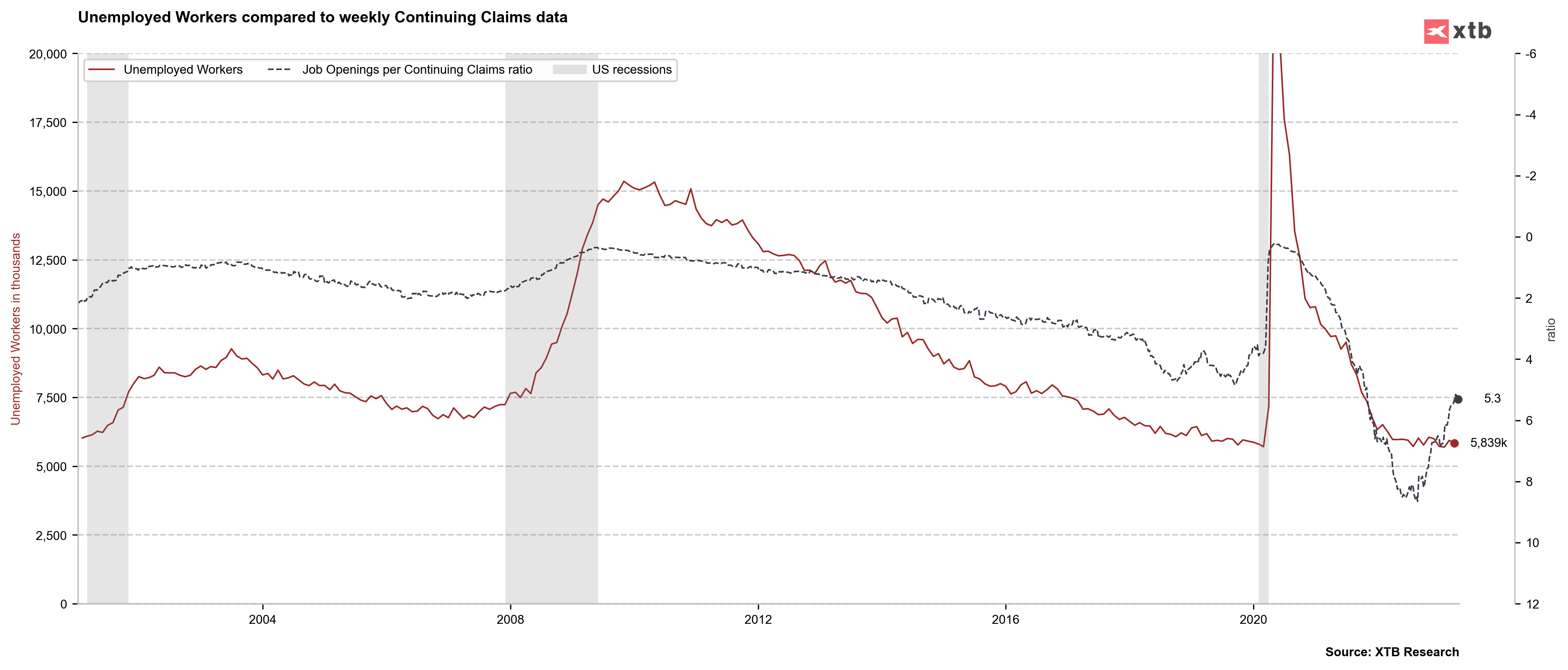

It should be noted that some worrying data from the US labor market has been released recently. Initial jobless claims climb towards 240k, JOLTS dropped significantly below 10 million while planned lay-offs are on the rise. ISM employment subindices have been struggling as of late but composite for both services and manufacturing sectors remains above 50 points threshold, signaling expansion. An expectations for the slowdown in US jobs market were distorted by ADP report released earlier this week as it came significantly above expectations, signaling a jobs gain of almost-300k. Moreover, it should be noted that ADP has been printing lower readings than NFP in recent months.

ADP employment gain has seldom exceeded the one signaled by NFP report since the beginning of 2022. Source: Macrobond, XTB

ADP employment gain has seldom exceeded the one signaled by NFP report since the beginning of 2022. Source: Macrobond, XTB

Composite ISM employment subindices remains above 50 points but does not point to any major expansion. Source: Macrobond, XTB

Composite ISM employment subindices remains above 50 points but does not point to any major expansion. Source: Macrobond, XTB

Ratio of job openings to initial jobless claims have been dropping recently. Interestingly, the overall number of unemployed remains relatively stable. Source: Macrobond, XTB

Ratio of job openings to initial jobless claims have been dropping recently. Interestingly, the overall number of unemployed remains relatively stable. Source: Macrobond, XTB

How will market react?

EURUSD continues to trade without a clear direction but at elevated levels. Meanwhile, US indices have been selling off hard in recent days. Strong jobs gain as well as lower wage growth would be positive for equity markets, especially US500, where the share of the financial sector is quite large. On the other hand, excessive employment gain and acceleration in wage growth could boost market odds for one more rate hike from the Fed. A miss in employment data could, however, have a negative impact on equities as it would hint at rising recession risk. Data released earlier suggests the first scenario but the other 2 cannot be ruled out.

US500 dropped to the lowest level since late-March. Should current recovery turn out to be short-lived and US500 drops below 4,000 pts, bears may attempt to realize the range of a double (triple) top pattern. Source: xStation5

US500 dropped to the lowest level since late-March. Should current recovery turn out to be short-lived and US500 drops below 4,000 pts, bears may attempt to realize the range of a double (triple) top pattern. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report