FOMC rate decision turned out to be in-line with market expectations - US central bank delivered a 50 bp rate hike to 4.25-4.50% range. Decision to hike rates by 50 bp was unanimous, signaling that none of Fed members saw a need for an even smaller 25 bp rate hike after yesterday's CPI print. This can be seen as somewhat hawkish.

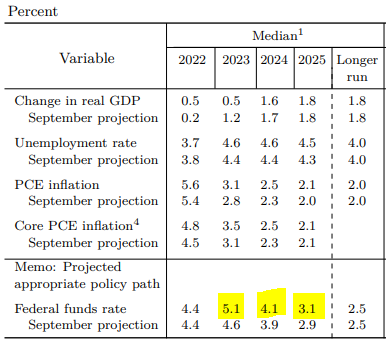

Details of the statement as well as revisions of economic projections are hawkish as well - median forecast for end-2023 level of rates moved from 4.6% in September projections to 5.1% in December projection. Median for end-2024 moved from 3.9% in September to 4.1% now. Also headline and core PCE inflation forecasts were revised higher for 2023 and 2024, signaling that Fed may need to keep tight policy for longer. There was also a massive revision to 2023 GDP forecasts - down from 1.2% growth to just 0.5% growth.

FOMC members see rates peaking above 5% in 2023. A major downward revision to the 2023 GDP forecast is also noteworthy. Source: Federal Reserve

FOMC members see rates peaking above 5% in 2023. A major downward revision to the 2023 GDP forecast is also noteworthy. Source: Federal Reserve

Reaction of the market also shows that decision was seen as hawkish - US dollar gained and equities dropped. S&P 500 (US500) erased daily gains and is now trading 0.6% lower on the day. The index tested psychological 4,000 pts area but bulls did not manage to break below, at least not yet. EURUSD dropped to a 1.0630, erasing most of today's gains. Gold pulled back and tested $1,800 per ounce area but no break below occurred. Upcoming Powell's presser (start - 7:30 pm GMT) is likely to be a source of additional volatility on the markets.

US500 plunged following the FOMC decision, erasing daily gains and testing 4,000 pts area. While bulls managed to defend the area for now, volatility on the markets is elevated and is expected to remain so throughout Powell's presser. Source: xStation5

US500 plunged following the FOMC decision, erasing daily gains and testing 4,000 pts area. While bulls managed to defend the area for now, volatility on the markets is elevated and is expected to remain so throughout Powell's presser. Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments