Release of the official US jobs report for February - NFP report - is a key macro event of the day. Data will be released at 1:30 pm GMT and is expected to show a strong employment gain in February, but weaker than a massive surge reported for January. What to focus on in today's release?

What market expects?

- Non-farm payrolls are expected to increase 200k, following a massive 353k surge in January

- Private payrolls are seen climbing 160k, following 317k spike in January

- Unemployment rate is seen staying unchanged at 3.7%

- Annual wage growth is seen slowing from 4.5 to 4.4% YoY, with wages seen rising 0.3% month-over-month

February's jobs-related data released so far

- ADP report showed an employment gain of 140k, slightly lower than 150k expected. Employment gain was driven by 110k increase in services-providing jobs

- Manufacturing ISM employment subindex dropped from 47.1 to 45.9 in February

- Services ISM employment subindex dropped from 50.5 to 48.0 in February

- Challenger report showed announced lay-offs at 84.64k in February, marking an 8.8% year-over-year increase

ADP reading for February showed a lower-than-expected jobs growth of 140k. Source: Bloomberg Finance LP, XTB Research

What to focus on?

There is a strong expectation that February may be another month of a very strong jobs growth in the United States, mostly thanks to a warmer-than-average weather. However, this also hints that job growth may be limited to a few sectors. Nevertheless, US labour market remains tight given that Fed Chair Powell said some time ago that he see neutral job growth as being around 100k per month.

A massive deterioration would be need in jobs data to justify imminent rate cuts, and this deterioration would need to be present over multiple periods rather than a single month. While jobs growth in February is expected to remain strong, headline reading may not be the most important in the release. January's surge is likely to be revised lower. Given that response rate to BLS survey in January was very low at 56% and January's reading are often marred with seasonal adjustments, a very high reading for the first month of the year should be taken with a grain of salt and may not be reflective of the situation in US jobs market.

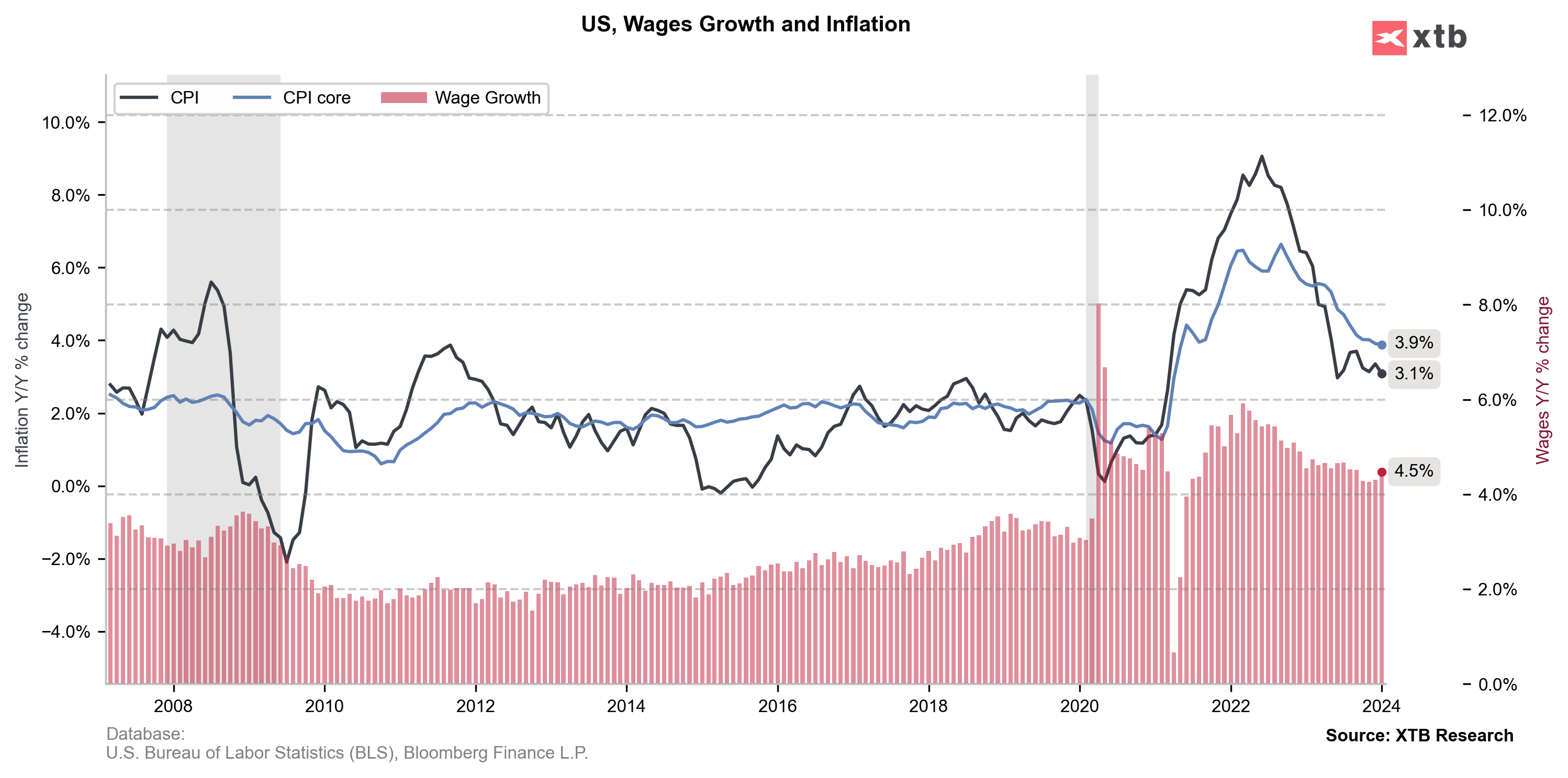

Wage growth data will be on watch as there is a strong correlation between growth in wages and prices, with the former often fuelling the latter.

There is a strong correlation between inflation and wage growth. Source: Bloomberg Finance LP, XTB Research

There is a strong correlation between inflation and wage growth. Source: Bloomberg Finance LP, XTB Research

A look at the markets

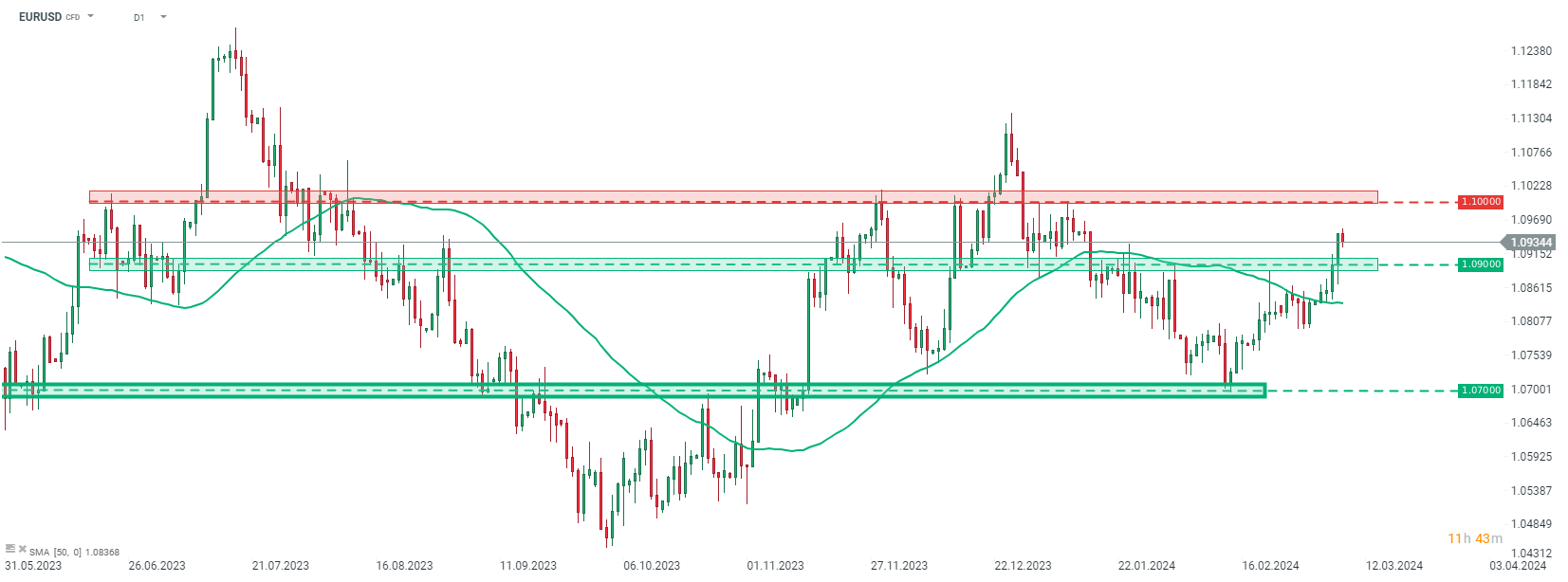

EURUSD

Recent USD weakening supported the main currency pair, allowing EURUSD to climb above 1.0900. The pair climbed to the highest level since mid-January this week as Fed Chair Powell did not rule out a possibility of May rate cut. Source: xStation5

GOLD

USD weakness provided support for precious metals, allowing GOLD to break to fresh all-time highs. Lower-than-expected wage growth or disappointing jobs growth could provide more fuel for the rally. Source: xStation5

US100

US100 has fully recovered from Tuesday's sell-off and returned to an all-time highs in the 18,360 pts area. Dovish NFP print, with lower wage growth or weak jobs growth, could help the index set new records. Source: xStation5

Market wrap: European stocks attempt to stabilize despite the surge in oil prices 🔍

Chart of the Day: EURUSD – Why is the Euro Losing to the Dollar?

Cattle futures fall amid JBS plant strike, rising corn and Middle East 📌

Economic Calendar: U.S. Unemployment Claims in spotlight (12.03.2025)