US non-farm payrolls report at 1:30 pm GMT is a key macro event of the day. Market expects another month of solid above-500k jobs growth. Continuation of a strong recovery on the labour market may encourage the Fed to start focusing more on rampant price growth. Fed's Powell said recently that inflation should no longer be seen as transitory. Jobs data will play a big role for the Fed when it makes the next monetary policy decision on December 15, 2021. Solid reading, preferably a beat, could boost already high odds for a hawkish move in mid-December.

US NFP expectations

-

Non-farm payrolls. Expected: 550k. Previous: 604k

-

Unemployment rate. Expected: 4.5%. Previous: 4.6%

-

Wage growth. Expected: 5.0% YoY. Previous: 4.9% YoY

USD is trading higher against most major peers around an hour ahead of data release. Gold trades slightly higher while silver posts a small drop. Platinum gains. US equity trade around 0.3% off overnight highs.

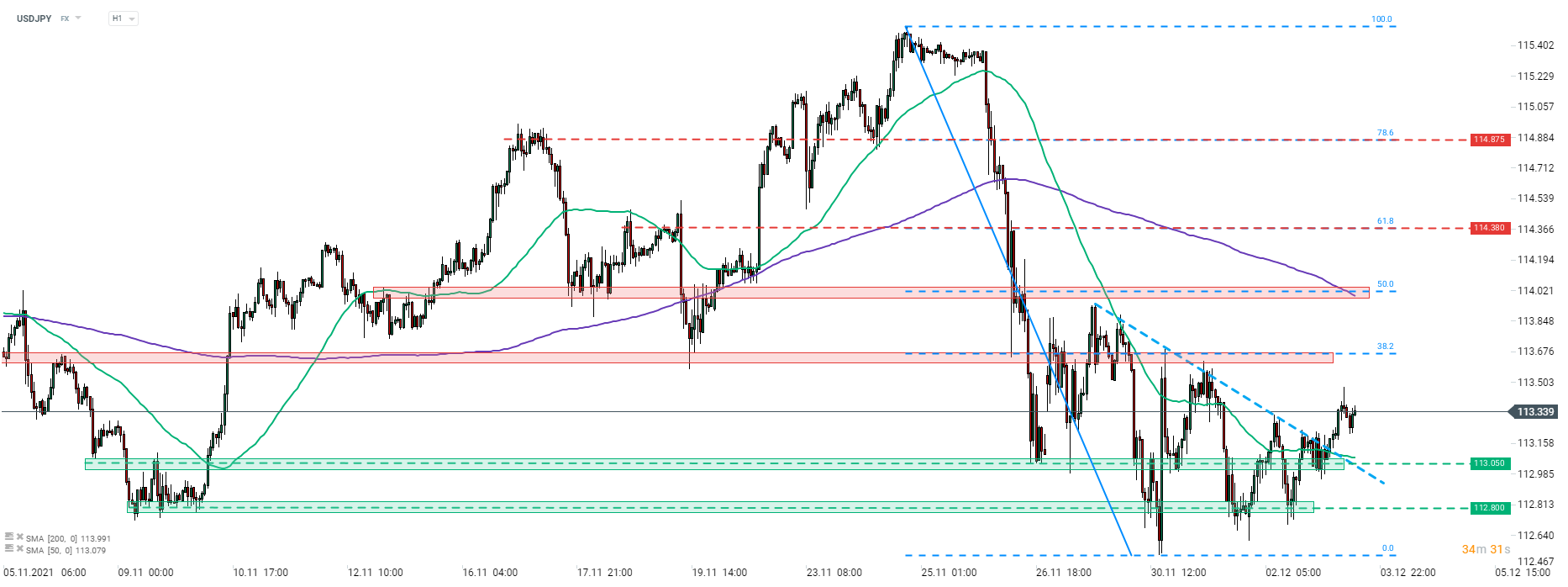

USDJPY broke above the short-term downward trendline overnight and continues the upward move. This pair, just like others tied to USD, are expected to become more volatile around the NFP release time (1:30 pm GMT). Source: xStation5

USDJPY broke above the short-term downward trendline overnight and continues the upward move. This pair, just like others tied to USD, are expected to become more volatile around the NFP release time (1:30 pm GMT). Source: xStation5

🚨 EURUSD deepens decline, falls to key support zone

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Three markets to watch next week (27.02.2026)

BREAKING: GDP collapse in Canada; US producer inflation accelerates🚨