European trading session has been rather calm so far. Major European indices post small gains while US futures hold near all-time highs. USD is the strongest G10 currency today. Things are about to get interesting in less than an hour as the US NFP report for July will be released at 1:30 pm BST. Market expects that 900k jobs have been added by the US economy last month. However, ADP data released on Wednesday disappointed and showed a mere 330k addition. Nevertheless, markets were rather unimpressed by NFP misses in recent months and tended to move higher regardless of beat or miss. Meanwhile, USD moved lower following most of the past 12 NFP releases and gold benefitted.

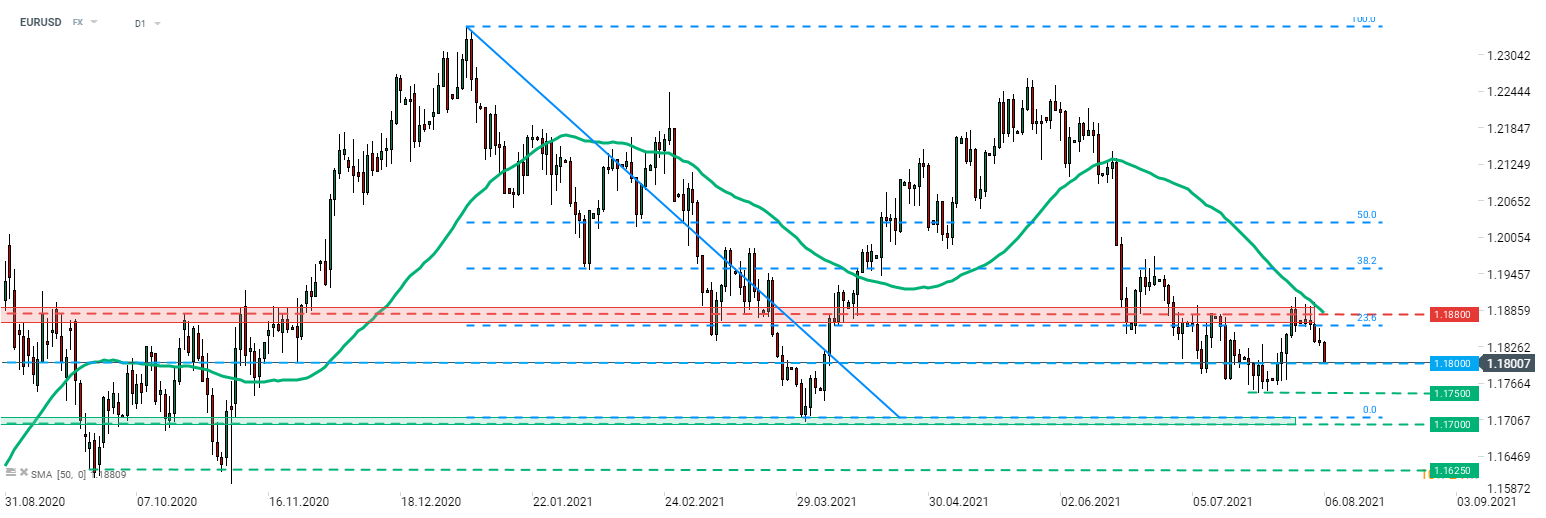

Will it be the same this time? We shall see at 1:30 pm BST. US dollar has been on the rise this week and EURUSD pulled back from the 1.1880 resistance zone. The main currency pair is currently testing the psychological 1.18 mark and breaking below would pave the way for a retest of recent local lows of 1.1750.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)