Release of US data pack for February, including PCE inflation, is a key macro event in the afternoon today. Even though it will be a report for February, somewhat outdated given that we are entering April next week, it is the Fed's preferred measure of inflation and will therefore be watched closely.

However, it may not have too much impact on the next FOMC rate decision. This is because traders will be offered data for March prior to the next FOMC meeting (both CPI and PCE). Nevertheless, today's reading is likely to impact market expectations regarding Fed's rate path and it may trigger some moves on the market.

1:30 pm BST - US, data pack for February.

- Headline PCE. Expected: 5.1% YoY. Previous: 5.4% YoY

- Core PCE. Expected: 4.7% YoY. Previous: 4.7% YoY

- Personal Income. Expected: 0.2% MoM. Previous: 0.6% MoM

- Personal Spending. Expected: 0.3% MoM. Previous: 1.8% MoM

CPI data for February, which was already released, pointed to another slowdown in the headline measure and a similar outcome is expected from headline PCE data today. However, the question is what comes next as some price growth proxies, like for example Manheim index for used vehicles, points to a possibility of CPI re-accelerating in Q2 2023.

Manheim used vehicles index (green line, 3-month lead) suggests that inflation slowdown may take a halt and reverse in the coming months. Source: XTB, Bloomberg

Manheim used vehicles index (green line, 3-month lead) suggests that inflation slowdown may take a halt and reverse in the coming months. Source: XTB, Bloomberg

A look at the markets

EURUSD

EURUSD bulls failed to break above the resistance zone ranging above 1.0920 mark. As a result, a double top was painted in the area. This is a bearish pattern but a strong signal would be generated only once the pair drops below the neckline of the pattern, which can be found near 38.2% retracement in the 1.0710 area.

EURUSD at H1 interval. Source: xStation5

EURUSD at H1 interval. Source: xStation5

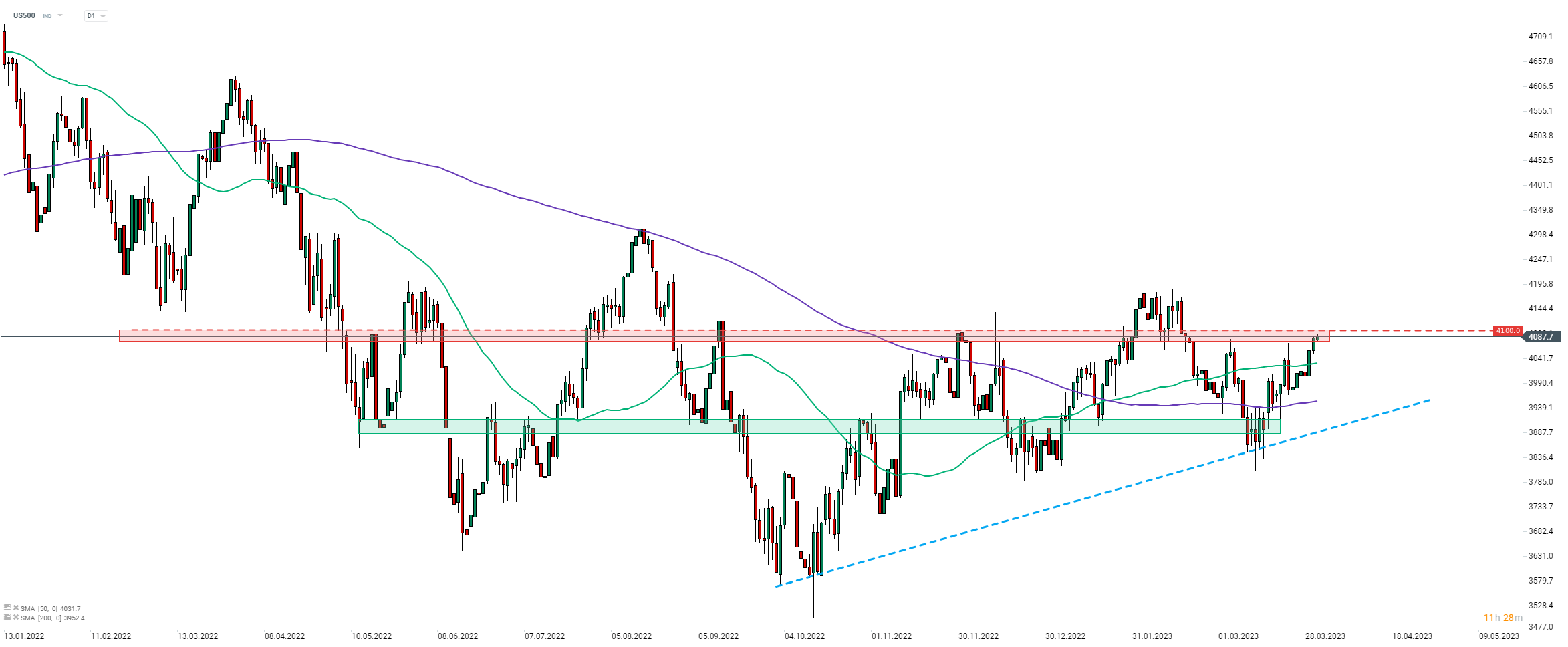

US500

S&P 500 futures (US500) traded higher in the early afternoon ahead of the US PCE report release and ahead of the Wall Street cash session open. The index reached 4,100 pts resistance zone and a softer PCE reading could provide fuel for another attempt at breaking above it.

US500 at D1 interval. Source: xStaiton5

US500 at D1 interval. Source: xStaiton5

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Market Wrap: Capital Flees Europe 🇪🇺 📉

🚩US500 loses ahead of the US open, VIX surges 6%

Economic Calendar - All Eyes on NFP (06.03.2026)