Summary:

-

USD dropping against most of its peers

-

GDT and Philly Fed non-manufacturing miss

-

GBPUSD and NZDUSD both move higher

The USD has come under some selling pressure in the past hour after remarks from Donald Trump threaten to impart some sustained downside on the buck. The US president repeated his oft cited accusations that other countries, notably China and the US, were manipulating their respective currencies weaker but perhaps the biggest revelation related to his displeasure at the Fed’s current sustained hiking path.

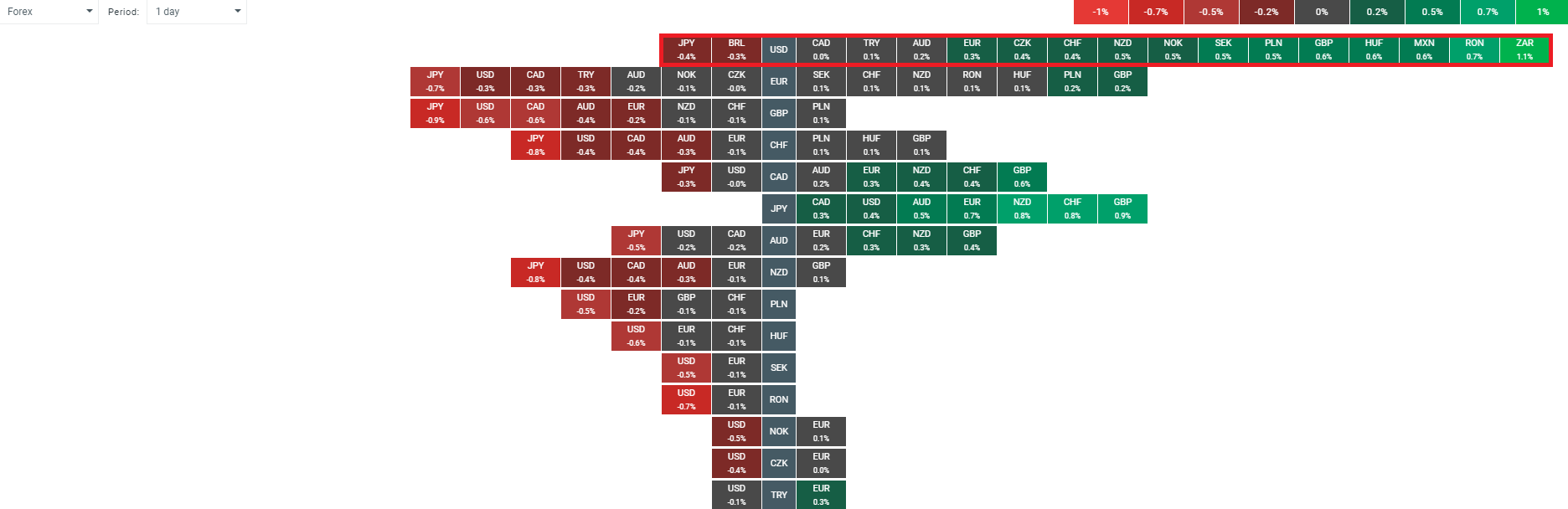

The USD is trading lower on the day against all its peers barring the JPY and BRL. EM currencies are the best performers with the USDZAR lower by more than 1% on the day. Source: xStation

Today is an uneventful one on the economic calendar for North America with very little to go off for the European and US sessions. The only real data of note is the Philly Fed August non-manufacturing index which has fallen to 41.7 from 44.3 previously. The new orders were also worse than before with the metric dropping to 29.0 from 31.5 previously. On the plus side the employment component did rise however, coming in at 32.2 from a prior print of 29.5.

GBPUSD has moved firmly higher today and the market is now retesting the 21 EMA on a D1 chart. The market remains in a longer term downtrend as shown by the orientation of the 8 and 21 EMAs. Source: xStation

Despite a pretty low result in the latest Global Dairy Trade (GDT) auction the New Zealand dollar is enjoying a pretty good day. The Kiwi is rising strongly against both the JPY and USD and against the latter in particular the market could be approaching a key level. First, let’s look at the GDT results themselves which showed the second largest decline in the fortnightly result since early March. A drop of 3.6% was large compared to recent weeks, with the prior reading coming in flat at 0.0%. This equates to a decline of more than 10% since May and with whole milk powder also dropping, in its case by 2.1%, it is a pretty bad data point on the whole.

The latest GDT results showed a decline of 3.6% in the past fortnight - the second largest drop since March - which means this metric has fallen by more than 10% since May. Source: Globaldairytrade.info

The latest GDT results showed a decline of 3.6% in the past fortnight - the second largest drop since March - which means this metric has fallen by more than 10% since May. Source: Globaldairytrade.info

The NZDUSD is extending its recent recovery today with the market moving back near the 0.6710 level. This is the prior support that price broke lower form earlier this month and this could now be seen to offer potential resistance. Source: xStation

The NZDUSD is extending its recent recovery today with the market moving back near the 0.6710 level. This is the prior support that price broke lower form earlier this month and this could now be seen to offer potential resistance. Source: xStation