The Federal Reserve left fed funds rate at 0-0.25% and bond-buying at a $120 billion monthly pace. Still, the central bank said the economy has made progress toward employment and inflation goals and that if progress continues broadly as expected, a moderation in the pace of asset purchases may soon be warranted. The Fed also signalled interest rate increases may follow more quickly than expected, with 9 of 18 policymakers projecting borrowing costs will need to rise in 2022.

We will hear more from Powell at 7:30 pm BST during his press conference.

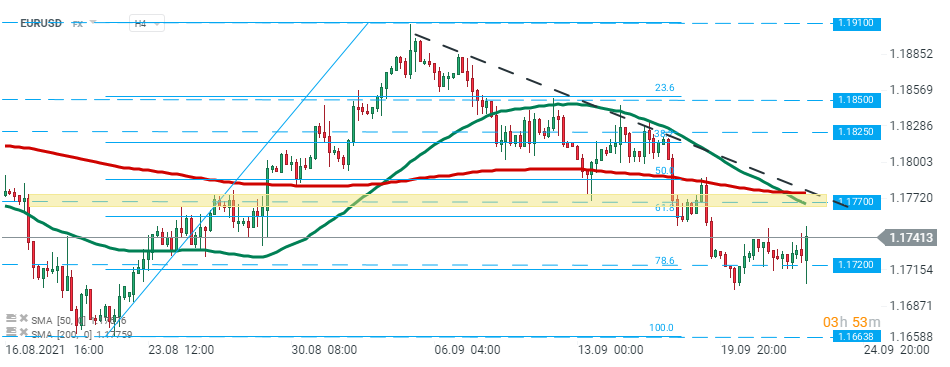

EURUSD bounced off the 1.1720 support after Fed decision and is heading towards major resistance level at 1.1770. Source:xStation5

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Economic calendar: ADP Labor market report and ISM services 🔎