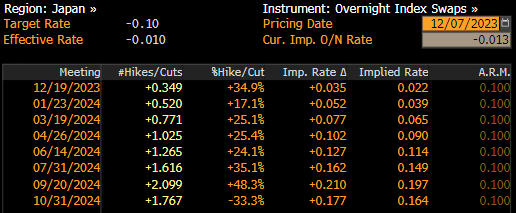

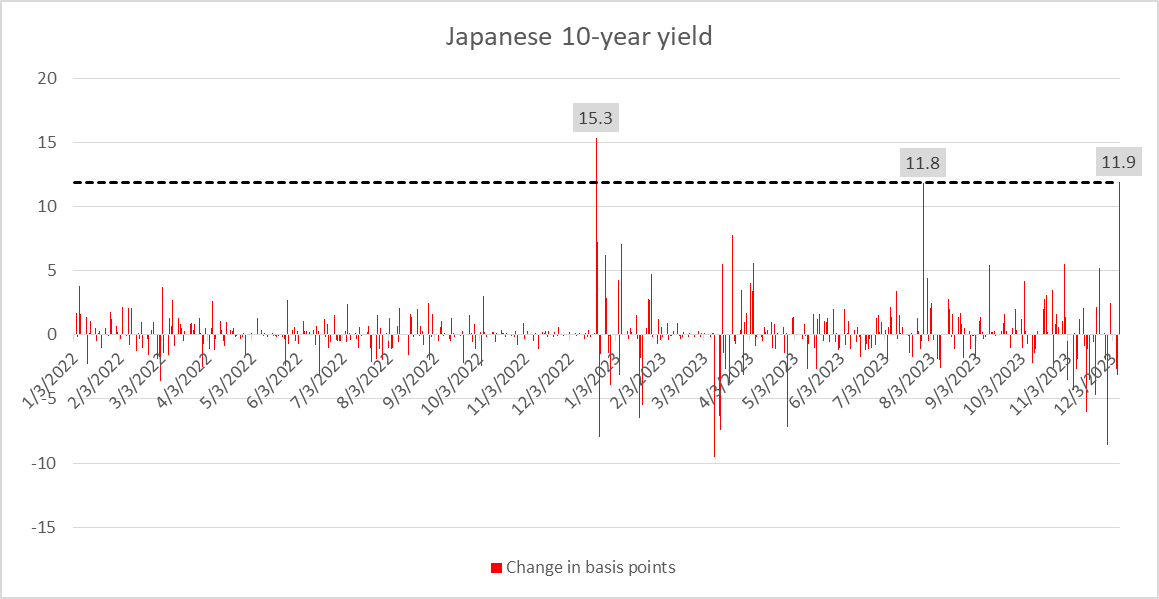

Japanese yen is a clear outperformer among G10 currencies today. JPY gains as traders are positioning for Bank of Japan exiting an ultra-loose monetary policy and hiking rates out of the negative territory. Comments from BoJ governor Ueda are seen as a driver behind the move. Ueda told Japanese lawmakers that handling of the monetary policy will become more challenging from the year-end, what fuelled speculation that the Bank is readying to exit negative rates. However, hints started arriving yesterday, with BoJ Deputy Governor Himino playing down adverse effects of rate hikes in his comments on Wednesday. As a result, market pricing for BoJ rate hikes increased and now money markets see a 35% chance of 10 basis point rate hike at December 19, 2023 meeting, up from around 26% yesterday. Increase in hawkish bets is also driving the biggest jump in Japanese yields in almost a year!

Money markets see around 35% chance of Bank of Japan delivering a 10 basis point rate hike at December meeting. Source: Bloomberg Finance LP

10-year Japanese yield experiences the biggest single-day jump since December 20, 2022. Source: Bloomberg Finance LP, XTB

10-year Japanese yield experiences the biggest single-day jump since December 20, 2022. Source: Bloomberg Finance LP, XTB

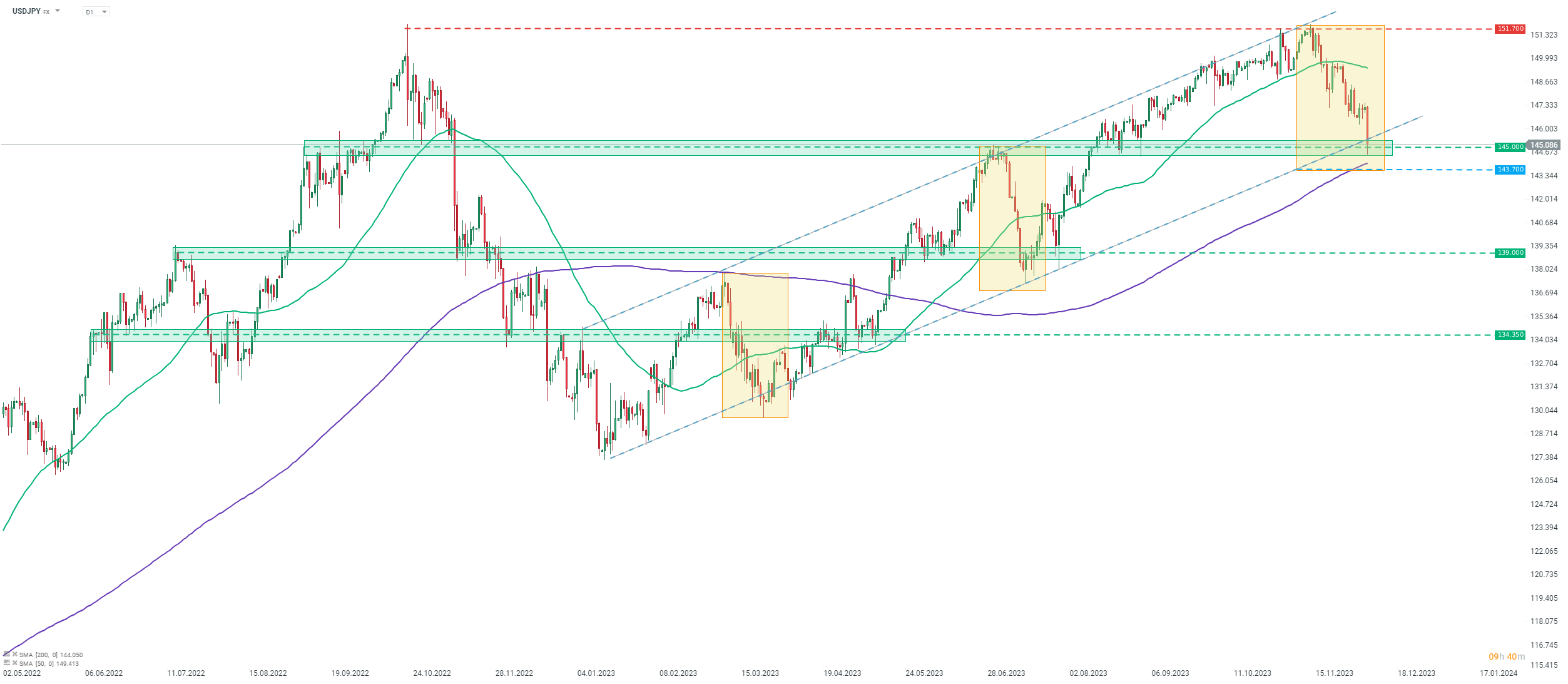

An expected hawkish turn by the Bank of Japan is pushing USDJPY 1.5% lower today. This is the biggest single-day drop for the pair since January 12, 2023 when the pair plunged 2.4%. Taking a look at USDJPY chart at D1 interval, we can see that the pair is making a drop below the lower limit of the bullish channel today and is testing the 145.00 support zone. A break below this area may be followed by a drop towards 143.70 zone, where a key support can be found. The 143.70 area is marked with the lower limit of the Overbalance structure as well as 200-session moving average and a move below this zone could hint at trend reversal.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)