Virgin Galactic (SPCE.US) stocks experience increased volatility during today's session. Shares rose more than 10 % in premarket after the space travel company conducted its first fully crewed flight on Sunday, sending Richard Branson into space. According to The Wall Street Journal, the company has collected $80 million in deposits from sale of tickets for a space ride. Each ticket costs between $ 200,000 and $ 250,000, according to various reports. Company plans to start commercial service in early 2022.

However, the stock price fell 14% in the afternoon on news that the company informed the SEC of plans to sell off $500 million worth of new stocks. Trading in Virgin Galactic was briefly halted due to volatility.

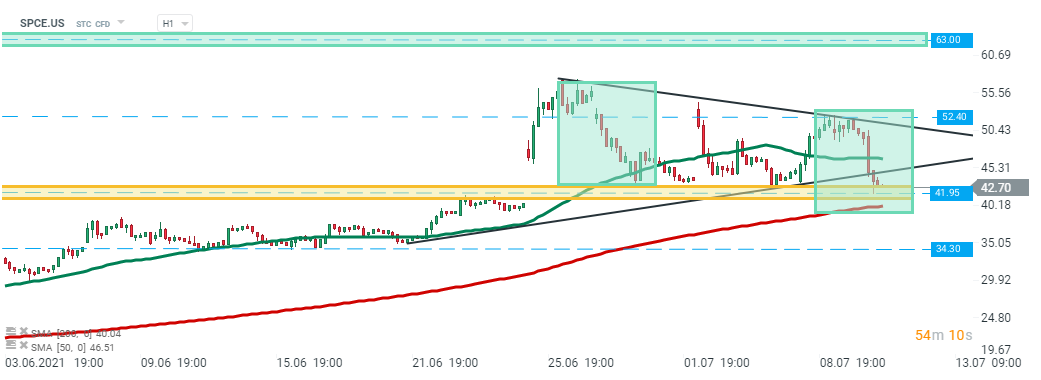

Virgin Galactic (SPCE.US) stock fell sharply after the US open and price broke below the lower limit of the triangle formation. Currently the price is testing a major support zone around $41.95 which is marked with a lower limit of the 1:1 structure and 200 SMA (red line). Source: xStation5

Virgin Galactic (SPCE.US) stock fell sharply after the US open and price broke below the lower limit of the triangle formation. Currently the price is testing a major support zone around $41.95 which is marked with a lower limit of the 1:1 structure and 200 SMA (red line). Source: xStation5

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Market wrap: European and US stocks try to rebound rebound 📈

Paramount Skydance shares under pressure after S&P warning