Retail giant Walmart released its fiscal year 2024 Q4 financial results, exceeding analyst expectations and prompting the company to raise its full-year 2025 forecast. The stock is gaining more than 2% in pre-market session.

-

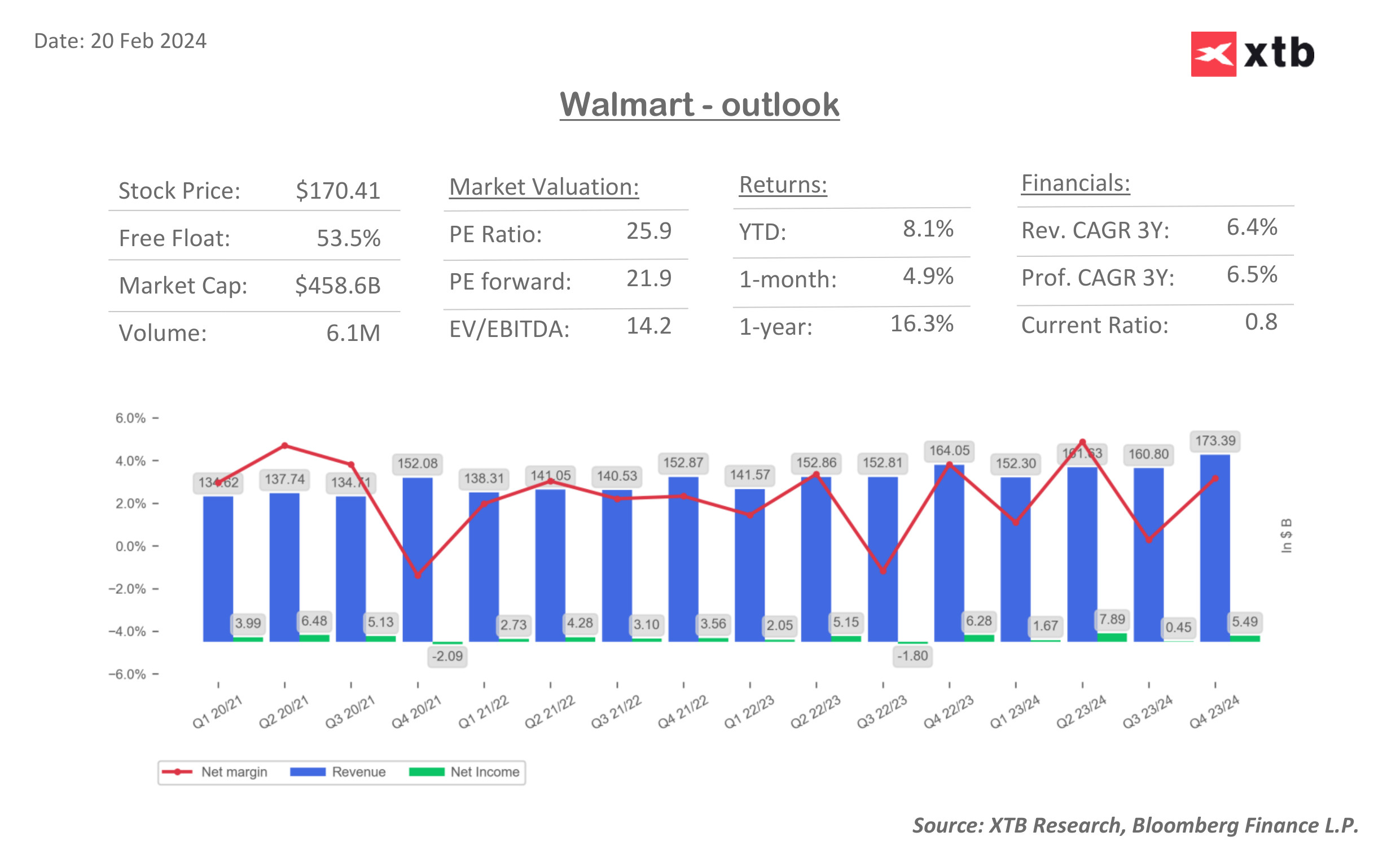

Q4 revenue reached $173.39 billion, growing 5.7% year-over-year and surpassing analyst estimates of $170.66 billion.

-

Comparable sales in US stores (excluding gas) jumped 3.9%, exceeding expectations of 3.2%.

-

Adjusted earnings per share (EPS) came in at $1.80 compared to $1.71 a year ago and analyst predictions of $1.65.

-

E-commerce sales surged 17%, exceeding projections of 15.5%.

-

Walmart lifted its full-year 2025 EPS guidance to $6.70-$7.12 from the previous range of $6.20-$6.75.

-

The company also anticipates net sales growth of 3-4% in 2025.

-

Additionally, Walmart declared a 9% increase in its dividend.

CEO Doug McMillon expressed optimism about the results, highlighting surpassing the $100 billion mark in e-commerce sales and gaining market share due to improved customer experience metrics. Market analysts responded positively, raising their recommendations for Walmart shares. Bloomberg said that Walmart results were good and raised forecast for the fiscal year 2025 expresses strong position for the company on the market. It's crucial to note that these results were achieved during a period of high inflation and rising interest rates. This demonstrates Walmart's business resilience and its ability to adapt to changing market conditions. Investors should closely monitor Walmart's further actions, including its progress in e-commerce and its international expansion plans.

Walmart is up more than 2% in pre-market session and it will probably reach new all-time high in the first trading session in the week. Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈