Walmart (WMT.US) rallies over 6% today, following release of fiscal-Q1 2025 earnings report (calendar February - April 2024). US retailer reported results that were much better than expected, as well as decided to boost a full-year outlook.

Walmart reported a 6.1% YoY jump in total revenue, with net sales increasing 5.9% YoY and almost reaching $160 billion. Growth in cost of revenue was slower than revenue growth, allowing for an improvement in gross margin. Company also managed to improve operating margin compared to a year ago, while EBITDA margin remained unchanged. An over-200% spike in net income can be attributed to a $794 million in 'other interest gains'. Walmart reported almost $3 billion in 'other interest losses' a year ago.

However, while fiscal-Q1 results were better than expected, the move higher today is driven primarily by forecasts, especially full-year forecast. Walmart boosted its full-year 2025 net sales growth forecast and now expects it to be near the upper-end or slightly above previous guidance of 3-4% guidance. It is rather unusual for the company to adjusted its full-year outlook as soon as in fiscal-Q1 and analysts hint that such a move reflect company's confidence.

Walmart (WMT.US) rallies over 6% today and exceed $500 billion in market capitalization for the first time in history.

Fiscal-Q1 2025 earnings

- Revenue: $161.51 billion vs $159.58 billion expected (+6.1% YoY)

- Net sales: $159.94 billion vs $158.13 billion expected (+5.9% YoY)

- Membership & Other Income: $1.57 billion vs $1.37 billion expected (+21% YoY)

- Cost of revenue: $121.43 billion vs $120.56 billion expected (+5.3% YoY)

- Gross profit: $40.08 billion vs $38.74 billion expected (+8.3% YoY)

- Gross margin: 24.8% vs 23.8% expected (23.7% a year ago)

- Operating income: $6.84 billion vs $6.56 billion expected (+9.6% YoY)

- Operating margin: 4.2% vs 4.1% expected (4.1% a year ago)

- EBITDA: $9.97 billion vs $9.56 billion expected (+9.7% YoY)

- EBITDA margin: 6.2% vs 5.7% expected (6.2% a year ago)

- Net income: $5.10 billion vs $4.21 billion expected (+205.8% YoY)

- Net margin: 3.2% vs 2.7% expected (1.1% a year ago)

- Diluted EPS: $0.63 vs $0.52 expected ($0.21 a year ago)

- US same store sales excluding fuel: 3.9% vs 3.4% expected

- Walmart US Stores: 3.8% vs 3.5% expected

- Traffic: 3.8% vs 3.2% expected

- Ticket: 0.0% vs 1.3% expected

- E-Commerce Contribution: 2.8% vs 1.5% expected

- Sam's Club: 4.4% vs 3.3% expected

- Traffic: 5.4% vs 0.8% expected

- Ticket: -1.0% vs 2.3% expected

- E-Commerce Contribution: 1.8% vs 1.6% expected

- Walmart US Stores: 3.8% vs 3.5% expected

Fiscal-Q2 2025 forecast

- Net sales growth: 3.5-4.5% YoY

- Operating income growth: 3.0-4.5% YoY

- Adjusted EPS: $0.62-0.65

Full-year fiscal-2025 forecast

- Net sales growth: at high-end or slightly above previous 3-4% guidance

- Adjusted EPS: at high-end or slightly above previous $2.23-2.37 guidance

- Capital expenditures: still expected at 3.0-3.5% of net sales

Walmart (WMT.US) gains around 6% today and trades at fresh all-time highs. Company's market capitalization exceeded $500 billion for the first time in history. Source: xStation5

Walmart (WMT.US) gains around 6% today and trades at fresh all-time highs. Company's market capitalization exceeded $500 billion for the first time in history. Source: xStation5

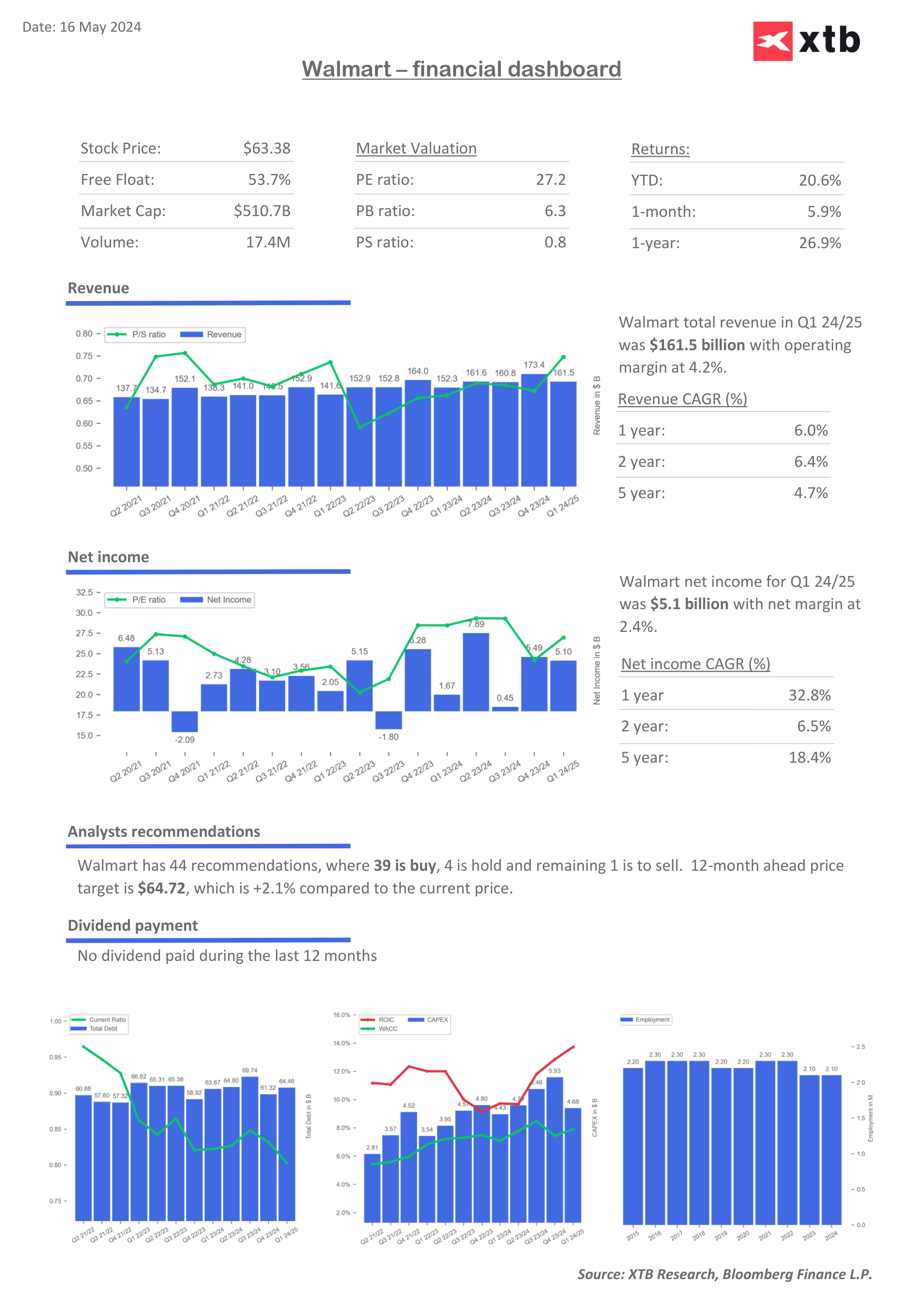

Financial dashboard for Walmart. Source: Bloomberg Finance LP, XTB

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street